Annual report 2005 - Sava dd

Annual report 2005 - Sava dd

Annual report 2005 - Sava dd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

a n n u a l r e p o r t | 2 0 0 5<br />

11. The <strong>Sava</strong> Share and<br />

Ownership Structure<br />

11.1<br />

4 8 |<br />

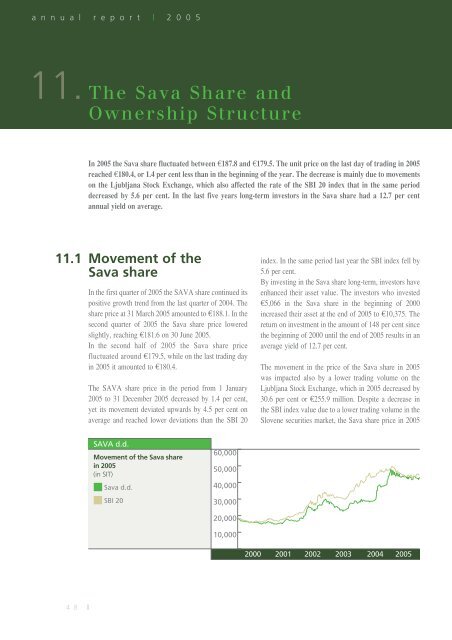

In <strong>2005</strong> the <strong>Sava</strong> share fluctuated between €187.8 and €179.5. The unit price on the last day of trading in <strong>2005</strong><br />

reached €180.4, or 1.4 per cent less than in the beginning of the year. The decrease is mainly due to movements<br />

on the Ljubljana Stock Exchange, which also affected the rate of the SBI 20 index that in the same period<br />

decreased by 5.6 per cent. In the last five years long-term investors in the <strong>Sava</strong> share had a 12.7 per cent<br />

annual yield on average.<br />

Movement of the<br />

<strong>Sava</strong> share<br />

In the first quarter of <strong>2005</strong> the SAVA share continued its<br />

positive growth trend from the last quarter of 2004. The<br />

share price at 31 March <strong>2005</strong> amounted to €188.1. In the<br />

second quarter of <strong>2005</strong> the <strong>Sava</strong> share price lowered<br />

slightly, reaching €181.6 on 30 June <strong>2005</strong>.<br />

In the second half of <strong>2005</strong> the <strong>Sava</strong> share price<br />

fluctuated around €179.5, while on the last trading day<br />

in <strong>2005</strong> it amounted to €180.4.<br />

The SAVA share price in the period from 1 January<br />

<strong>2005</strong> to 31 December <strong>2005</strong> decreased by 1.4 per cent,<br />

yet its movement deviated upwards by 4.5 per cent on<br />

average and reached lower deviations than the SBI 20<br />

SAVA d.d.<br />

Movement of the <strong>Sava</strong> share<br />

in <strong>2005</strong><br />

(in SIT)<br />

<strong>Sava</strong> d.d.<br />

SBI 20<br />

60,000<br />

50,000<br />

40,000<br />

30,000<br />

20,000<br />

10,000<br />

2000<br />

index. In the same period last year the SBI index fell by<br />

5.6 per cent.<br />

By investing in the <strong>Sava</strong> share long-term, investors have<br />

enhanced their asset value. The investors who invested<br />

€5,066 in the <strong>Sava</strong> share in the beginning of 2000<br />

increased their asset at the end of <strong>2005</strong> to €10,375. The<br />

return on investment in the amount of 148 per cent since<br />

the beginning of 2000 until the end of <strong>2005</strong> results in an<br />

average yield of 12.7 per cent.<br />

The movement in the price of the <strong>Sava</strong> share in <strong>2005</strong><br />

was impacted also by a lower trading volume on the<br />

Ljubljana Stock Exchange, which in <strong>2005</strong> decreased by<br />

30.6 per cent or €255.9 million. Despite a decrease in<br />

the SBI index value due to a lower trading volume in the<br />

Slovene securities market, the <strong>Sava</strong> share price in <strong>2005</strong><br />

2001 2002 2003 2004 <strong>2005</strong>