Annual report 2005 - Sava dd

Annual report 2005 - Sava dd

Annual report 2005 - Sava dd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

10.Financial<br />

Management<br />

4 3 |<br />

After <strong>Sava</strong> d.d. had been restructured into a holding company for managing and financing, the role of<br />

financial management has become one of performing essential business functions. The policy is defined at the<br />

level of the parent company, and the co-ordinated presence of Group companies is the domain of the<br />

competence centre Finance.<br />

<strong>Sava</strong> d.d. does not appear as a direct lessee of required<br />

credit sources. As a rule, the companies themselves hire<br />

loans, which depends on the agreement and planned<br />

indebtedness requirements that are planned annually.<br />

Outside the Group the companies are not able to<br />

contract debts without approval from the Strategic<br />

Finance Department, which agrees upon the terms and<br />

conditions with a selected bank. The balancing of cash<br />

flows, which guarantees financial solvency and using<br />

lines of credit to do so, is agreed upon and co-ordinated<br />

in the same manner.<br />

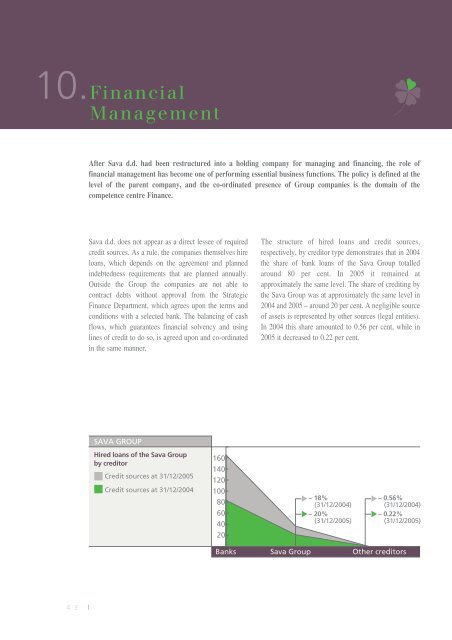

SAVA GROUP<br />

Hired loans of the <strong>Sava</strong> Group<br />

by creditor<br />

Credit sources at 31/12/<strong>2005</strong><br />

Credit sources at 31/12/2004<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

The structure of hired loans and credit sources,<br />

respectively, by creditor type demonstrates that in 2004<br />

the share of bank loans of the <strong>Sava</strong> Group totalled<br />

around 80 per cent. In <strong>2005</strong> it remained at<br />

approximately the same level. The share of crediting by<br />

the <strong>Sava</strong> Group was at approximately the same level in<br />

2004 and <strong>2005</strong> – around 20 per cent. A negligible source<br />

of assets is represented by other sources (legal entities).<br />

In 2004 this share amounted to 0.56 per cent, while in<br />

<strong>2005</strong> it decreased to 0.22 per cent.<br />

Banks <strong>Sava</strong> Group<br />

~ 18%<br />

(31/12/2004)<br />

~ 20%<br />

(31/12/<strong>2005</strong>)<br />

~ 0.56%<br />

(31/12/2004)<br />

~ 0.22%<br />

(31/12/<strong>2005</strong>)<br />

Other creditors