Correction des exercices du livre La Gestion des Risques Financiers

Correction des exercices du livre La Gestion des Risques Financiers

Correction des exercices du livre La Gestion des Risques Financiers

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

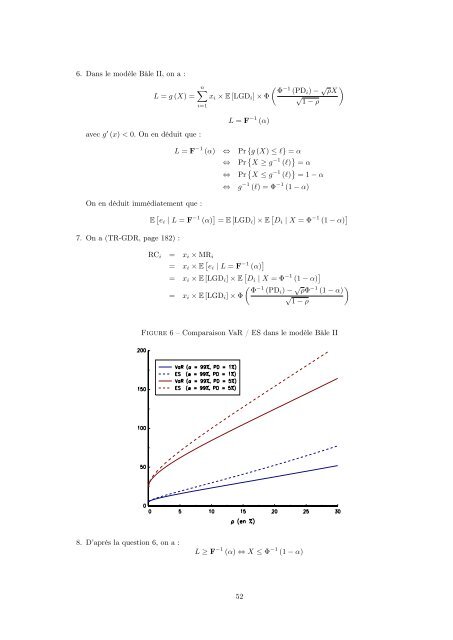

6. Dans le modèle Bâle II, on a :L = g (X) =n∑i=1( Φ −1 (PD i ) − √ )ρXx i × E [LGD i ] × Φ √ 1 − ρavec g ′ (x) < 0. On en dé<strong>du</strong>it que :L = F −1 (α)On en dé<strong>du</strong>it immédiatement que :7. On a (TR-GDR, page 182) :L = F −1 (α) ⇔ Pr {g (X) ≤ l} = α⇔⇔Pr { X ≥ g −1 (l) } = αPr { X ≤ g −1 (l) } = 1 − α⇔ g −1 (l) = Φ −1 (1 − α)E [ e i | L = F −1 (α) ] = E [LGD i ] × E [ D i | X = Φ −1 (1 − α) ]RC i = x i × MR i= x i × E [ e i | L = F −1 (α) ]= x i × E [LGD i ] × E [ D i | X = Φ −1 (1 − α) ]( Φ −1 (PD i ) − √ ρΦ −1 )(1 − α)= x i × E [LGD i ] × Φ√ 1 − ρFigure 6 – Comparaison VaR / ES dans le modèle Bâle II8. D’après la question 6, on a :L ≥ F −1 (α) ⇔ X ≤ Φ −1 (1 − α)52