Annual Report - PT SMART Tbk

Annual Report - PT SMART Tbk

Annual Report - PT SMART Tbk

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

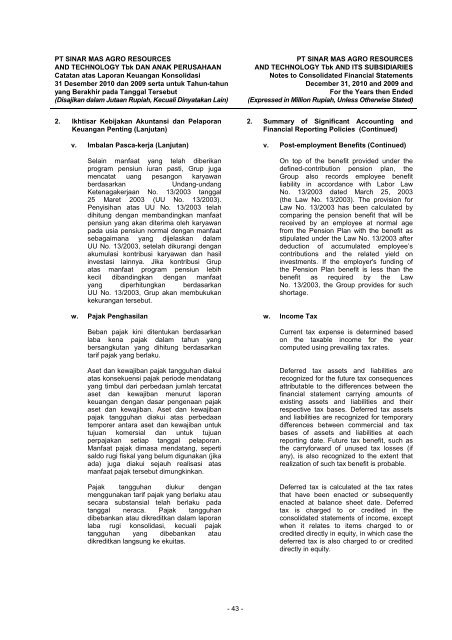

<strong>PT</strong> SINAR MAS AGRO RESOURCESAND TECHNOLOGY <strong>Tbk</strong> DAN ANAK PERUSAHAANCatatan atas Laporan Keuangan Konsolidasi31 Desember 2010 dan 2009 serta untuk Tahun-tahunyang Berakhir pada Tanggal Tersebut(Disajikan dalam Jutaan Rupiah, Kecuali Dinyatakan Lain)<strong>PT</strong> SINAR MAS AGRO RESOURCESAND TECHNOLOGY <strong>Tbk</strong> AND ITS SUBSIDIARIESNotes to Consolidated Financial StatementsDecember 31, 2010 and 2009 andFor the Years then Ended(Expressed in Million Rupiah, Unless Otherwise Stated)2. Ikhtisar Kebijakan Akuntansi dan PelaporanKeuangan Penting (Lanjutan)2. Summary of Significant Accounting andFinancial <strong>Report</strong>ing Policies (Continued)v. Imbalan Pasca-kerja (Lanjutan) v. Post-employment Benefits (Continued)Selain manfaat yang telah diberikanprogram pensiun iuran pasti, Grup jugamencatat uang pesangon karyawanberdasarkanUndang-undangKetenagakerjaan No. 13/2003 tanggal25 Maret 2003 (UU No. 13/2003).Penyisihan atas UU No. 13/2003 telahdihitung dengan membandingkan manfaatpensiun yang akan diterima oleh karyawanpada usia pensiun normal dengan manfaatsebagaimana yang dijelaskan dalamUU No. 13/2003, setelah dikurangi denganakumulasi kontribusi karyawan dan hasilinvestasi lainnya. Jika kontribusi Grupatas manfaat program pensiun lebihkecil dibandingkan dengan manfaatyang diperhitungkan berdasarkanUU No. 13/2003, Grup akan membukukankekurangan tersebut.On top of the benefit provided under thedefined-contribution pension plan, theGroup also records employee benefitliability in accordance with Labor LawNo. 13/2003 dated March 25, 2003(the Law No. 13/2003). The provision forLaw No. 13/2003 has been calculated bycomparing the pension benefit that will bereceived by an employee at normal agefrom the Pension Plan with the benefit asstipulated under the Law No. 13/2003 afterdeduction of accumulated employee’scontributions and the related yield oninvestments. If the employer's funding ofthe Pension Plan benefit is less than thebenefit as required by the LawNo. 13/2003, the Group provides for suchshortage.w. Pajak Penghasilan w. Income TaxBeban pajak kini ditentukan berdasarkanlaba kena pajak dalam tahun yangbersangkutan yang dihitung berdasarkantarif pajak yang berlaku.Aset dan kewajiban pajak tangguhan diakuiatas konsekuensi pajak periode mendatangyang timbul dari perbedaan jumlah tercatataset dan kewajiban menurut laporankeuangan dengan dasar pengenaan pajakaset dan kewajiban. Aset dan kewajibanpajak tangguhan diakui atas perbedaantemporer antara aset dan kewajiban untuktujuan komersial dan untuk tujuanperpajakan setiap tanggal pelaporan.Manfaat pajak dimasa mendatang, sepertisaldo rugi fiskal yang belum digunakan (jikaada) juga diakui sejauh realisasi atasmanfaat pajak tersebut dimungkinkan.Pajak tangguhan diukur denganmenggunakan tarif pajak yang berlaku atausecara substansial telah berlaku padatanggal neraca. Pajak tangguhandibebankan atau dikreditkan dalam laporanlaba rugi konsolidasi, kecuali pajaktangguhan yang dibebankan ataudikreditkan langsung ke ekuitas.Current tax expense is determined basedon the taxable income for the yearcomputed using prevailing tax rates.Deferred tax assets and liabilities arerecognized for the future tax consequencesattributable to the differences between thefinancial statement carrying amounts ofexisting assets and liabilities and theirrespective tax bases. Deferred tax assetsand liabilities are recognized for temporarydifferences between commercial and taxbases of assets and liabilities at eachreporting date. Future tax benefit, such asthe carryforward of unused tax losses (ifany), is also recognized to the extent thatrealization of such tax benefit is probable.Deferred tax is calculated at the tax ratesthat have been enacted or subsequentlyenacted at balance sheet date. Deferredtax is charged to or credited in theconsolidated statements of income, exceptwhen it relates to items charged to orcredited directly in equity, in which case thedeferred tax is also charged to or crediteddirectly in equity.- 43 -