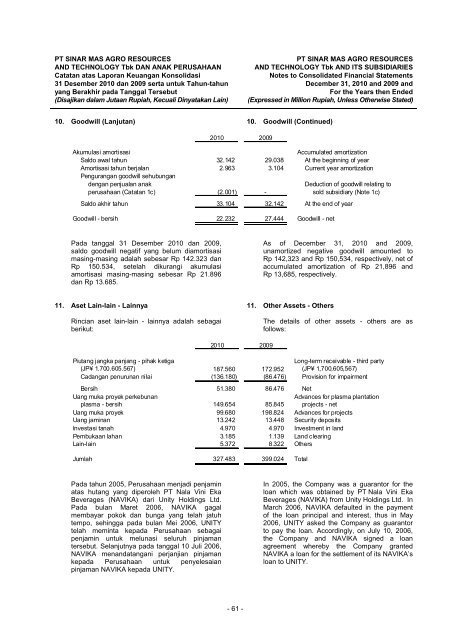

<strong>PT</strong> SINAR MAS AGRO RESOURCESAND TECHNOLOGY <strong>Tbk</strong> DAN ANAK PERUSAHAANCatatan atas Laporan Keuangan Konsolidasi31 Desember 2010 dan 2009 serta untuk Tahun-tahunyang Berakhir pada Tanggal Tersebut(Disajikan dalam Jutaan Rupiah, Kecuali Dinyatakan Lain)<strong>PT</strong> SINAR MAS AGRO RESOURCESAND TECHNOLOGY <strong>Tbk</strong> AND ITS SUBSIDIARIESNotes to Consolidated Financial StatementsDecember 31, 2010 and 2009 andFor the Years then Ended(Expressed in Million Rupiah, Unless Otherwise Stated)9. Aset Tetap (Lanjutan) 9. Property, Plant and Equipment (Continued)Nilai tercatat hak atas tanah termasuk tanamanperkebunan (Catatan 8), bangunan, prasaranajalan dan jembatan, mesin dan peralatan,perabot dan peralatan kantor dan kendaraanGrup yang digunakan sebagai jaminan pinjamanhutang bank jangka pendek dan hutang jangkapanjang Grup pada tanggal 31 Desember 2010dan 2009 masing-masing adalahsebesar Rp 2.442.055 dan Rp 2.577.670.Tangki, bangunan, mesin dan peralatan, perabotdan peralatan kantor serta kendaraandiasuransikan kepada <strong>PT</strong> Asuransi Sinar Mas,pihak yang mempunyai hubungan istimewa(Catatan 28c), terhadap risiko kebakaran danrisiko lainnya berdasarkan suatu paket polisdengan jumlah pertanggungan masing-masingsebesar Rp 3.636.776, US$ 66.445.565,GBP 239.850 dan EUR 344.689 pada tanggal31 Desember 2010 dan Rp 3.766.942,US$ 68.883.503 dan GBP 135.660 pada tanggal31 Desember 2009. Manajemen berpendapatbahwa nilai pertanggungan tersebut cukup untukmenutup kemungkinan kerugian atas aset yangdipertanggungkan.Manajemen berpendapat bahwa nilai tercatatsemua aset Grup dapat terealisasi seluruhnyadan oleh karena itu, tidak diperlukan cadanganpenurunan nilai aset.The carrying value of landrights and plantations(Note 8), buildings, land improvementsand bridges, machinery and equipment, officefurniture and fixtures and transportationequipment of the Group, which are pledgedas collateral on the Group’s short-termbank loans and long-term loans amountedto Rp 2,442,055 and Rp 2,577,670 as ofDecember 31, 2010 and 2009, respectively.Storage tanks, buildings, machinery andequipment, office furniture and fixtures andtransportation equipment are insured with<strong>PT</strong> Asuransi Sinar Mas, a related party(Note 28c), against losses from fire and otherrisks under blanket policies with insurancecoverage totaling to Rp 3,636,776,US$ 66,445,565, GBP 239,850 andEUR 344,689 as of December 31, 2010 andRp 3,766,942, US$ 68,883,503, andGBP 135,660 as of December 31, 2009, which inmanagement’s opinion is adequate to coverpossible losses from such risks.Management is of the opinion that the carryingvalues of all assets of the Group are fullyrecoverable, thus, no write-down for impairmentin asset value is necessary.10. Goodwill 10. GoodwillAkun ini merupakan selisih lebih yang tidakteridentifikasi antara biaya perolehan dan bagianPerusahaan atau anak perusahaan atas nilaiwajar aset bersih anak perusahaan yangdiakuisisi dengan menggunakan metodepembelian dengan rincian sebagai berikut:This account represents the excess of thepurchase price over the Company’s orsubsidiaries’ proportionate share in theunderlying fair values of the net assets of theacquired subsidiaries accounted for under thepurchase method, with details as follows:2010 2009Selisih lebih antara biaya perolehanExcess of the purchase price over thedan bagian nilai wajar aset bersihunderlying fair values of the netanak perusahaanassets of the acquired subsidiariesSaldo awal tahun 59.586 59.586 At the beginning of yearPengurangan goodwill sehubungandengan penjualan anakDeduction of goodwill relating toperusahaan (Catatan 1c) (4.250) - sold subsidiary (Note 1c)Saldo akhir tahun 55.336 59.586 At the end of year- 60 -

<strong>PT</strong> SINAR MAS AGRO RESOURCESAND TECHNOLOGY <strong>Tbk</strong> DAN ANAK PERUSAHAANCatatan atas Laporan Keuangan Konsolidasi31 Desember 2010 dan 2009 serta untuk Tahun-tahunyang Berakhir pada Tanggal Tersebut(Disajikan dalam Jutaan Rupiah, Kecuali Dinyatakan Lain)<strong>PT</strong> SINAR MAS AGRO RESOURCESAND TECHNOLOGY <strong>Tbk</strong> AND ITS SUBSIDIARIESNotes to Consolidated Financial StatementsDecember 31, 2010 and 2009 andFor the Years then Ended(Expressed in Million Rupiah, Unless Otherwise Stated)10. Goodwill (Lanjutan) 10. Goodwill (Continued)2010 2009Akumulasi amortisasiAccumulated amortizationSaldo awal tahun 32.142 29.038 At the beginning of yearAmortisasi tahun berjalan 2.963 3.104 Current year amortizationPengurangan goodwill sehubungandengan penjualan anakDeduction of goodwill relating toperusahaan (Catatan 1c) (2.001) - sold subsidiary (Note 1c)Saldo akhir tahun 33.104 32.142 At the end of yearGoodwill - bersih 22.232 27.444 Goodwill - netPada tanggal 31 Desember 2010 dan 2009,saldo goodwill negatif yang belum diamortisasimasing-masing adalah sebesar Rp 142.323 danRp 150.534, setelah dikurangi akumulasiamortisasi masing-masing sebesar Rp 21.896dan Rp 13.685.As of December 31, 2010 and 2009,unamortized negative goodwill amounted toRp 142,323 and Rp 150,534, respectively, net ofaccumulated amortization of Rp 21,896 andRp 13,685, respectively.11. Aset Lain-lain - Lainnya 11. Other Assets - OthersRincian aset lain-lain - lainnya adalah sebagaiberikut:The details of other assets - others are asfollows:2010 2009Piutang jangka panjang - pihak ketigaLong-term receivable - third party(JP¥ 1.700.605.567) 187.560 172.952 (JP¥ 1,700,605,567)Cadangan penurunan nilai (136.180) (86.476) Provision for impairmentBersih 51.380 86.476 NetUang muka proyek perkebunanAdvances for plasma plantationplasma - bersih 149.654 85.845 projects - netUang muka proyek 99.680 198.824 Advances for projectsUang jaminan 13.242 13.448 Security depositsInvestasi tanah 4.970 4.970 Investment in landPembukaan lahan 3.185 1.139 Land clearingLain-lain 5.372 8.322 OthersJumlah 327.483 399.024 TotalPada tahun 2005, Perusahaan menjadi penjaminatas hutang yang diperoleh <strong>PT</strong> Nala Vini EkaBeverages (NAVIKA) dari Unity Holdings Ltd.Pada bulan Maret 2006, NAVIKA gagalmembayar pokok dan bunga yang telah jatuhtempo, sehingga pada bulan Mei 2006, UNITYtelah meminta kepada Perusahaan sebagaipenjamin untuk melunasi seluruh pinjamantersebut. Selanjutnya pada tanggal 10 Juli 2006,NAVIKA menandatangani perjanjian pinjamankepada Perusahaan untuk penyelesaianpinjaman NAVIKA kepada UNITY.In 2005, the Company was a guarantor for theloan which was obtained by <strong>PT</strong> Nala Vini EkaBeverages (NAVIKA) from Unity Holdings Ltd. InMarch 2006, NAVIKA defaulted in the paymentof the loan principal and interest, thus in May2006, UNITY asked the Company as guarantorto pay the loan. Accordingly, on July 10, 2006,the Company and NAVIKA signed a loanagreement whereby the Company grantedNAVIKA a loan for the settlement of its NAVIKA’sloan to UNITY.- 61 -