Annual Report - PT SMART Tbk

Annual Report - PT SMART Tbk

Annual Report - PT SMART Tbk

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

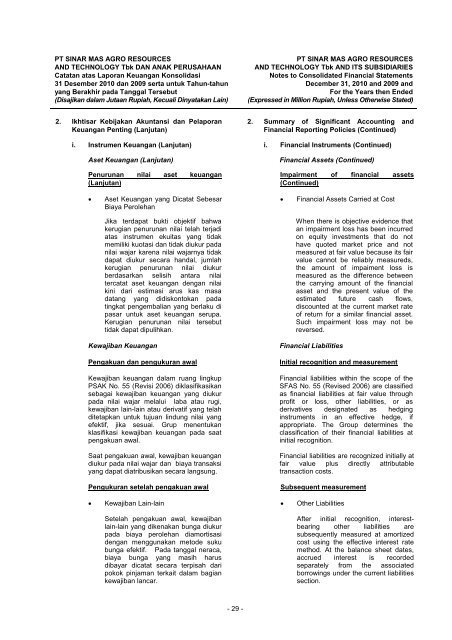

<strong>PT</strong> SINAR MAS AGRO RESOURCESAND TECHNOLOGY <strong>Tbk</strong> DAN ANAK PERUSAHAANCatatan atas Laporan Keuangan Konsolidasi31 Desember 2010 dan 2009 serta untuk Tahun-tahunyang Berakhir pada Tanggal Tersebut(Disajikan dalam Jutaan Rupiah, Kecuali Dinyatakan Lain)<strong>PT</strong> SINAR MAS AGRO RESOURCESAND TECHNOLOGY <strong>Tbk</strong> AND ITS SUBSIDIARIESNotes to Consolidated Financial StatementsDecember 31, 2010 and 2009 andFor the Years then Ended(Expressed in Million Rupiah, Unless Otherwise Stated)2. Ikhtisar Kebijakan Akuntansi dan PelaporanKeuangan Penting (Lanjutan)2. Summary of Significant Accounting andFinancial <strong>Report</strong>ing Policies (Continued)i. Instrumen Keuangan (Lanjutan) i. Financial Instruments (Continued)Aset Keuangan (Lanjutan)Penurunan nilai aset keuangan(Lanjutan)• Aset Keuangan yang Dicatat SebesarBiaya PerolehanJika terdapat bukti objektif bahwakerugian penurunan nilai telah terjadiatas instrumen ekuitas yang tidakmemiliki kuotasi dan tidak diukur padanilai wajar karena nilai wajarnya tidakdapat diukur secara handal, jumlahkerugian penurunan nilai diukurberdasarkan selisih antara nilaitercatat aset keuangan dengan nilaikini dari estimasi arus kas masadatang yang didiskontokan padatingkat pengembalian yang berlaku dipasar untuk aset keuangan serupa.Kerugian penurunan nilai tersebuttidak dapat dipulihkan.Kewajiban KeuanganPengakuan dan pengukuran awalKewajiban keuangan dalam ruang lingkupPSAK No. 55 (Revisi 2006) diklasifikasikansebagai kewajiban keuangan yang diukurpada nilai wajar melalui laba atau rugi,kewajiban lain-lain atau derivatif yang telahditetapkan untuk tujuan lindung nilai yangefektif, jika sesuai. Grup menentukanklasifikasi kewajiban keuangan pada saatpengakuan awal.Saat pengakuan awal, kewajiban keuangandiukur pada nilai wajar dan biaya transaksiyang dapat diatribusikan secara langsung.Pengukuran setelah pengakuan awalFinancial Assets (Continued)Impairment of financial assets(Continued)• Financial Assets Carried at CostWhen there is objective evidence thatan impairment loss has been incurredon equity investments that do nothave quoted market price and notmeasured at fair value because its fairvalue cannot be reliably measureds,the amount of impaiment loss ismeasured as the difference betweenthe carrying amount of the financialasset and the present value of theestimated future cash flows,discounted at the current market rateof return for a similar financial asset.Such impairment loss may not bereversed.Financial LiabilitiesInitial recognition and measurementFinancial liabilities within the scope of theSFAS No. 55 (Revised 2006) are classifiedas financial liabilities at fair value throughprofit or loss, other liabilities, or asderivatives designated as hedginginstruments in an effective hedge, ifappropriate. The Group determines theclassification of their financial liabilities atinitial recognition.Financial liabilities are recognized initially atfair value plus directly attributabletransaction costs.Subsequent measurement• Kewajiban Lain-lain • Other LiabilitiesSetelah pengakuan awal, kewajibanlain-lain yang dikenakan bunga diukurpada biaya perolehan diamortisasidengan menggunakan metode sukubunga efektif. Pada tanggal neraca,biaya bunga yang masih harusdibayar dicatat secara terpisah daripokok pinjaman terkait dalam bagiankewajiban lancar.After initial recognition, interestbearingother liabilities aresubsequently measured at amortizedcost using the effective interest ratemethod. At the balance sheet dates,accrued interest is recordedseparately from the associatedborrowings under the current liabilitiessection.- 29 -