Annual Report - PT SMART Tbk

Annual Report - PT SMART Tbk

Annual Report - PT SMART Tbk

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

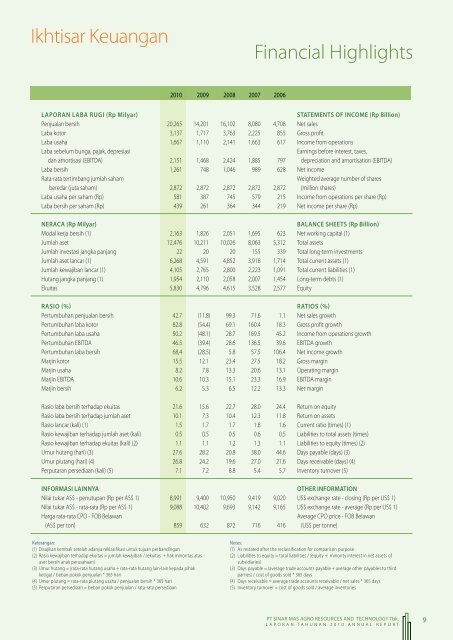

Ikhtisar KeuanganFinancial Highlights2010 2009 2008 2007 2006Laporan Laba Rugi (Rp Milyar)Statements of Income (Rp Billion)Penjualan bersih 20,265 14,201 16,102 8,080 4,708 Net salesLaba kotor 3,137 1,717 3,763 2,225 855 Gross profitLaba usaha 1,667 1,110 2,141 1,663 617 Income from operationsLaba sebelum bunga, pajak, depresiasiearnings before interest, taxes,dan amortisasi (EBITDA) 2,151 1,468 2,424 1,885 797 depreciation and amortisation (EBITDA)Laba bersih 1,261 748 1,046 989 628 Net incomeRata-rata tertimbang jumlah sahamWeighted average number of sharesberedar (juta saham) 2,872 2,872 2,872 2,872 2,872 (million shares)Laba usaha per saham (Rp) 581 387 745 579 215 Income from operations per share (Rp)Laba bersih per saham (Rp) 439 261 364 344 219 Net income per share (Rp)Neraca (Rp Milyar)balance Sheets (Rp Billion)Modal kerja bersih (1) 2,163 1,826 2,051 1,695 623 Net working capital (1)Jumlah aset 12,476 10,211 10,026 8,063 5,312 Total assetsJumlah investasi jangka panjang 22 20 20 155 339 Total long-term investmentsJumlah aset lancar (1) 6,268 4,591 4,852 3,918 1,714 Total current assets (1)Jumlah kewajiban lancar (1) 4,105 2,765 2,800 2,223 1,091 Total current liabilities (1)Hutang jangka panjang (1) 1,954 2,110 2,058 2,007 1,454 Long-term debts (1)Ekuitas 5,830 4,796 4,615 3,528 2,577 EquityRasio (%) ratios (%)Pertumbuhan penjualan bersih 42.7 (11.8) 99.3 71.6 1.1 Net sales growthPertumbuhan laba kotor 82.8 (54.4) 69.1 160.4 18.3 Gross profit growthPertumbuhan laba usaha 50.2 (48.1) 28.7 169.5 45.2 Income from operations growthPertumbuhan EBITDA 46.5 (39.4) 28.6 136.5 39.6 EBITDA growthPertumbuhan laba bersih 68,4 (28.5) 5.8 57.5 106.4 Net income growthMarjin kotor 15.5 12.1 23.4 27.5 18.2 Gross marginMarjin usaha 8.2 7.8 13.3 20.6 13.1 Operating marginMarjin EBITDA 10.6 10.3 15.1 23.3 16.9 EBITDA marginMarjin bersih 6.2 5.3 6.5 12.2 13.3 Net marginRasio laba bersih terhadap ekuitas 21.6 15.6 22.7 28.0 24.4 Return on equityRasio laba bersih terhadap jumlah aset 10.1 7.3 10.4 12.3 11.8 Return on assetsRasio lancar (kali) (1) 1.5 1.7 1.7 1.8 1.6 Current ratio (times) (1)Rasio kewajiban terhadap jumlah aset (kali) 0.5 0.5 0.5 0.6 0.5 Liabilities to total assets (times)Rasio kewajiban terhadap ekuitas (kali) (2) 1.1 1.1 1.2 1.3 1.1 Liabilities to equity (times) (2)Umur hutang (hari) (3) 27.6 28.2 20.8 38.0 44.6 Days payable (days) (3)Umur piutang (hari) (4) 26.8 24.2 19.6 27.0 21.6 Days receivable (days) (4)Perputaran persediaan (kali) (5) 7.1 7.2 8.8 5.4 5.7 Inventory turnover (5)Informasi LainnyaOther InformationNilai tukar AS$ - penutupan (Rp per AS$ 1) 8,991 9,400 10,950 9,419 9,020 US$ exchange rate - closing (Rp per US$ 1)Nilai tukar AS$ - rata-rata (Rp per AS$ 1) 9,088 10,402 9,693 9,142 9,165 US$ exchange rate - average (Rp per US$ 1)Harga rata-rata CPO - FOB Belawanaverage CPO price - FOB Belawan(AS$ per ton) 859 632 872 716 416 (US$ per tonne)Keterangan:(1) Disajikan kembali setelah adanya reklasifikasi untuk tujuan perbandingan(2) Rasio kewajiban terhadap ekuitas = jumlah kewajiban / (ekuitas + hak minoritas atasaset bersih anak perusahaan)(3) Umur hutang = (rata-rata hutang usaha + rata-rata hutang lain-lain kepada pihakketiga) / beban pokok penjualan * 365 hari(4) Umur piutang = rata-rata piutang usaha / penjualan bersih * 365 hari(5) Perputaran persediaan = beban pokok penjualan / rata-rata persediaanNotes:(1) As restated after the reclassification for comparison purpose(2) Liabilities to equity = total liabilities / (equity + minority interest in net assets ofsubsidiaries)(3) Days payable = (average trade accounts payable + average other payables to thirdparties) / cost of goods sold * 365 days(4) Days receivable = average trade accounts receivable / net sales * 365 days(5) Inventory turnover = cost of goods sold / average inventories<strong>PT</strong> Sinar Mas Agro Resources and Technology <strong>Tbk</strong>.Laporan Tahunan 2010 AnNual <strong>Report</strong>9