Annual Report - PT SMART Tbk

Annual Report - PT SMART Tbk

Annual Report - PT SMART Tbk

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

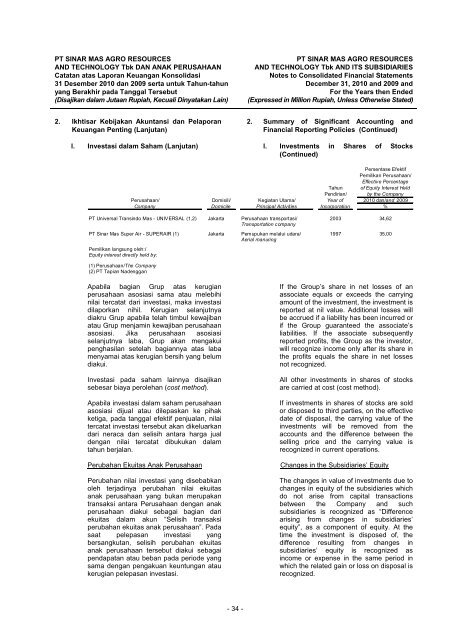

<strong>PT</strong> SINAR MAS AGRO RESOURCESAND TECHNOLOGY <strong>Tbk</strong> DAN ANAK PERUSAHAANCatatan atas Laporan Keuangan Konsolidasi31 Desember 2010 dan 2009 serta untuk Tahun-tahunyang Berakhir pada Tanggal Tersebut(Disajikan dalam Jutaan Rupiah, Kecuali Dinyatakan Lain)<strong>PT</strong> SINAR MAS AGRO RESOURCESAND TECHNOLOGY <strong>Tbk</strong> AND ITS SUBSIDIARIESNotes to Consolidated Financial StatementsDecember 31, 2010 and 2009 andFor the Years then Ended(Expressed in Million Rupiah, Unless Otherwise Stated)2. Ikhtisar Kebijakan Akuntansi dan PelaporanKeuangan Penting (Lanjutan)2. Summary of Significant Accounting andFinancial <strong>Report</strong>ing Policies (Continued)l. Investasi dalam Saham (Lanjutan) l. Investments in Shares of Stocks(Continued)Perusahaan/CompanyPersentase EfektifPemilikan Perusahaan/Effective PercentageTahun of Equity Interest HeldPendirian/ by the CompanyDomisili/ Kegiatan Utama/ Year of 2010 dan/and 2009Domicile Principal Activities Incorporation %<strong>PT</strong> Universal Transindo Mas - UNIVERSAL (1,2) Jakarta Perusahaan transportasi/ 2003 34,62Transportation company<strong>PT</strong> Sinar Mas Super Air - SUPERAIR (1) Jakarta Pemupukan melalui udara/ 1997 35,00Aerial manuringPemilikan langsung oleh:/Equity interest directly held by:(1) Perusahaan/The Company(2) <strong>PT</strong> Tapian NadengganApabila bagian Grup atas kerugianperusahaan asosiasi sama atau melebihinilai tercatat dari investasi, maka investasidilaporkan nihil. Kerugian selanjutnyadiakru Grup apabila telah timbul kewajibanatau Grup menjamin kewajiban perusahaanasosiasi. Jika perusahaan asosiasiselanjutnya laba, Grup akan mengakuipenghasilan setelah bagiannya atas labamenyamai atas kerugian bersih yang belumdiakui.Investasi pada saham lainnya disajikansebesar biaya perolehan (cost method).Apabila investasi dalam saham perusahaanasosiasi dijual atau dilepaskan ke pihakketiga, pada tanggal efektif penjualan, nilaitercatat investasi tersebut akan dikeluarkandari neraca dan selisih antara harga jualdengan nilai tercatat dibukukan dalamtahun berjalan.Perubahan Ekuitas Anak PerusahaanPerubahan nilai investasi yang disebabkanoleh terjadinya perubahan nilai ekuitasanak perusahaan yang bukan merupakantransaksi antara Perusahaan dengan anakperusahaan diakui sebagai bagian dariekuitas dalam akun “Selisih transaksiperubahan ekuitas anak perusahaan”. Padasaat pelepasan investasi yangbersangkutan, selisih perubahan ekuitasanak perusahaan tersebut diakui sebagaipendapatan atau beban pada periode yangsama dengan pengakuan keuntungan ataukerugian pelepasan investasi.If the Group’s share in net losses of anassociate equals or exceeds the carryingamount of the investment, the investment isreported at nil value. Additional losses willbe accrued if a liability has been incurred orif the Group guaranteed the associate’sliabilities. If the associate subsequentlyreported profits, the Group as the investor,will recognize income only after its share inthe profits equals the share in net lossesnot recognized.All other investments in shares of stocksare carried at cost (cost method).If investments in shares of stocks are soldor disposed to third parties, on the effectivedate of disposal, the carrying value of theinvestments will be removed from theaccounts and the difference between theselling price and the carrying value isrecognized in current operations.Changes in the Subsidiaries’ EquityThe changes in value of investments due tochanges in equity of the subsidiaries whichdo not arise from capital transactionsbetween the Company and suchsubsidiaries is recognized as “Differencearising from changes in subsidiaries’equity”, as a component of equity. At thetime the investment is disposed of, thedifference resulting from changes insubsidiaries’ equity is recognized asincome or expense in the same period inwhich the related gain or loss on disposal isrecognized.- 34 -