Annual Report - PT SMART Tbk

Annual Report - PT SMART Tbk

Annual Report - PT SMART Tbk

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

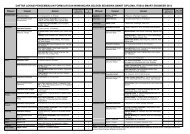

<strong>PT</strong> SINAR MAS AGRO RESOURCESAND TECHNOLOGY <strong>Tbk</strong> DAN ANAK PERUSAHAANCatatan atas Laporan Keuangan Konsolidasi31 Desember 2010 dan 2009 serta untuk Tahun-tahunyang Berakhir pada Tanggal Tersebut(Disajikan dalam Jutaan Rupiah, Kecuali Dinyatakan Lain)<strong>PT</strong> SINAR MAS AGRO RESOURCESAND TECHNOLOGY <strong>Tbk</strong> AND ITS SUBSIDIARIESNotes to Consolidated Financial StatementsDecember 31, 2010 and 2009 andFor the Years then Ended(Expressed in Million Rupiah, Unless Otherwise Stated)2. Ikhtisar Kebijakan Akuntansi dan PelaporanKeuangan Penting (Lanjutan)2. Summary of Significant Accounting andFinancial <strong>Report</strong>ing Policies (Continued)l. Investasi dalam Saham l. Investments in Shares of StocksInvestasi pada perusahaan asosiasidengan kepemilikan Perusahaan baiklangsung maupun tidak langsung melaluianak perusahaan dengan hak suara antara20% sampai dengan 50% maupun kurangdari 20% hak suara, namun Perusahaanmemiliki pengaruh signifikan, dicatatdengan menggunakan metode ekuitas.Dengan metode ekuitas, biaya perolehaninvestasi pada perusahaan asosiasiditambah atau dikurangi dengan bagiankepemilikan Perusahaan atau anakperusahaan atas laba atau rugi perusahaanasosiasi sejak tanggal perolehan danperubahan hak kepemilikan proporsionalPerusahaan pada perusahaan asosiasiyang timbul dari perubahan dalam ekuitasperusahaan asosiasi yang belumdiperhitungkan ke dalam laporan laba rugikonsolidasi.Perubahan tersebut di atas meliputiperubahan yang timbul sebagai akibat dariperbedaan dalam penjabaran valuta asingdan penyesuaian selisih yang timbul daripenggabungan usaha yang disajikansebagai “Selisih transaksi perubahanekuitas perusahaan asosiasi” pada bagianekuitas pada neraca konsolidasi. Distribusilaba (kecuali dividen saham) yang diterimadari investee mengurangi nilai tercatat(carrying amount) investasi. Bagian ataslaba atau rugi bersih perusahaan asosiasi,disesuaikan dengan jumlah amortisasisecara garis lurus selama 20 (dua puluh)tahun atas selisih antara biaya perolehaninvestasi pada perusahaan asosiasi danbagian pemilikan Perusahaan atau anakperusahaan atas nilai wajar aset bersihpada tanggal perolehan (goodwill) sertapenyusutan selisih antara harga wajardengan bagian pemilikan Perusahaan atasnilai buku aset sesuai dengan sisa taksiranumur aset yang bersangkutan.Perusahaan-perusahaan asosiasi tersebutmeliputi:Investments in which the Company hasownership interest, directly or indirectlythrough a subsidiary, of 20% to 50%, orless than 20% but the Company hassignificant influence are accounted forusing the equity method. Under the equitymethod, the cost of investment is increasedor decreased by the Company's orsubsidiaries' share in net earnings orlosses of the associate from the date ofacquisition, and changes in the Company'sproportionate interest in the associatesarising from changes in the associates'equity that have not been included in theconsolidated statements of income.Such changes include those arising fromforeign exchange translation differencesand adjustment of differences arising frombusiness combinations, which arepresented as “Difference arising fromchanges in equity of associates” in theequity section of the consolidated balancesheets. Profit distributions (except stockdividends) received from an investeereduce the carrying amount of theinvestment. Equity in net earnings (Iosses)of associates is adjusted for the straightlineamortization, over a period of twenty(20) years, of the difference between thecost of such investment and the Company'sor subsidiaries' proportionate share in theunderlying fair value of the net assets at thedate of acquisition (goodwill) anddepreciation of the difference between thefair values and the Company's share in thebook value of the net assets based on theestimated remaining useful lives of theassets. The associated companies are asfollows:Perusahaan/CompanyPersentase EfektifPemilikan Perusahaan/Effective PercentageTahun of Equity Interest HeldPendirian/ by the CompanyDomisili/ Kegiatan Utama/ Year of 2010 dan/and 2009Domicile Principal Activities Incorporation %<strong>PT</strong> Hortimart Agrogemilang - HORTIMART (2) Malang Pembibitan tanaman/ 1990 39,10Production and sale of seeds<strong>PT</strong> Trans Indojaya Mas - TRANSINDO (1,2) Jakarta Perusahaan transportasi/ 1988 34,62Transportation company- 33 -