Agri NW Jongboer - Senwes Tuisblad

Agri NW Jongboer - Senwes Tuisblad

Agri NW Jongboer - Senwes Tuisblad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

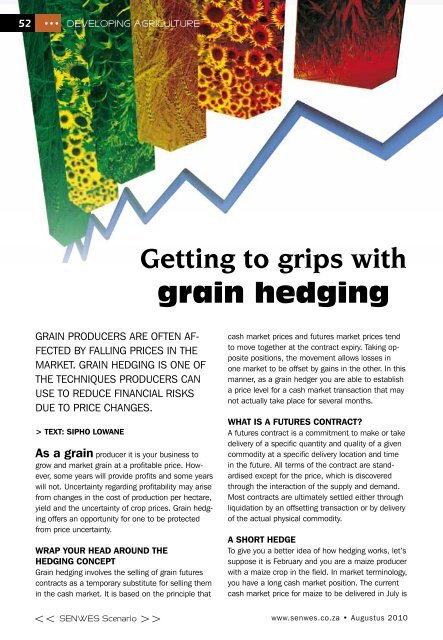

52 ••• DEvElopiNG aGricUlTUrE<br />

grAin producers Are oFten AF-<br />

Fected bY FAlling prices in the<br />

mArket. grAin hedging is one oF<br />

the techniques producers cAn<br />

use to reduce FinAnciAl risks<br />

due to price chAnges.<br />

> TExT: SIpHo loWanE<br />

as a grain producer it is your business to<br />

grow and market grain at a profitable price. however,<br />

some years will provide profits and some years<br />

will not. uncertainty regarding profitability may arise<br />

from changes in the cost of production per hectare,<br />

yield and the uncertainty of crop prices. grain hedging<br />

offers an opportunity for one to be protected<br />

from price uncertainty.<br />

Wrap your HEaD arounD THE<br />

HEDGInG ConCEpT<br />

grain hedging involves the selling of grain futures<br />

contracts as a temporary substitute for selling them<br />

in the cash market. it is based on the principle that<br />

><br />

Getting to grips with<br />

grain hedging<br />

cash market prices and futures market prices tend<br />

to move together at the contract expiry. taking opposite<br />

positions, the movement allows losses in<br />

one market to be offset by gains in the other. in this<br />

manner, as a grain hedger you are able to establish<br />

a price level for a cash market transaction that may<br />

not actually take place for several months.<br />

WHaT IS a FuTurES ConTraCT?<br />

A futures contract is a commitment to make or take<br />

delivery of a specific quantity and quality of a given<br />

commodity at a specific delivery location and time<br />

in the future. All terms of the contract are standardised<br />

except for the price, which is discovered<br />

through the interaction of the supply and demand.<br />

most contracts are ultimately settled either through<br />

liquidation by an offsetting transaction or by delivery<br />

of the actual physical commodity.<br />

a SHorT HEDGE<br />

to give you a better idea of how hedging works, let’s<br />

suppose it is February and you are a maize producer<br />

with a maize crop in the field. in market terminology,<br />

you have a long cash market position. the current<br />

cash market price for maize to be delivered in july is<br />

www.senwes.co.za • Augustus 2010