CG malls europe - Commerz Real

CG malls europe - Commerz Real

CG malls europe - Commerz Real

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

100<br />

<strong>Commerz</strong> <strong>Real</strong> Estate Master FCP – SIF<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

AS AT DECEMBER 31, 2009<br />

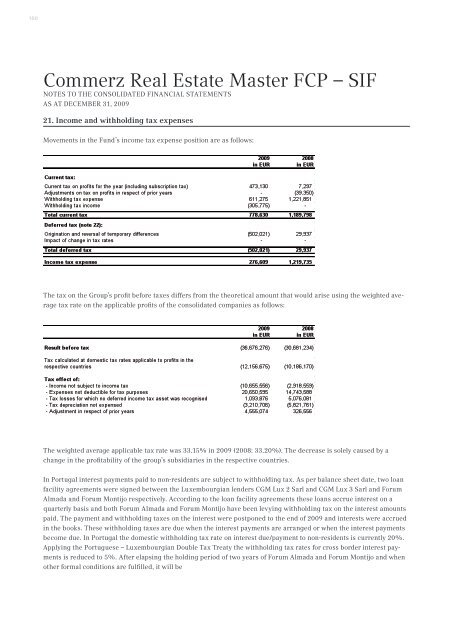

21. Income and withholding tax expenses<br />

Movements in the Fund’s income tax expense position are as follows:<br />

The tax on the Group’s profit before taxes differs from the theoretical amount that would arise using the weighted average<br />

tax rate on the applicable profits of the consolidated companies as follows:<br />

The weighted average applicable tax rate was 33.15% in 2009 (2008: 33.20%). The decrease is solely caused by a<br />

change in the profitability of the group’s subsidiaries in the respective countries.<br />

In Portugal interest payments paid to non-residents are subject to withholding tax. As per balance sheet date, two loan<br />

facility agreements were signed between the Luxembourgian lenders <strong>CG</strong>M Lux 2 Sarl and <strong>CG</strong>M Lux 3 Sarl and Forum<br />

Almada and Forum Montijo respectively. According to the loan facility agreements these loans accrue interest on a<br />

quarterly basis and both Forum Almada and Forum Montijo have been levying withholding tax on the interest amounts<br />

paid. The payment and withholding taxes on the interest were postponed to the end of 2009 and interests were accrued<br />

in the books. These withholding taxes are due when the interest payments are arranged or when the interest payments<br />

become due. In Portugal the domestic withholding tax rate on interest due/payment to non-residents is currently 20%.<br />

Applying the Portuguese – Luxembourgian Double Tax Treaty the withholding tax rates for cross border interest payments<br />

is reduced to 5%. After elapsing the holding period of two years of Forum Almada and Forum Montijo and when<br />

other formal conditions are fulfilled, it will be