CG malls europe - Commerz Real

CG malls europe - Commerz Real

CG malls europe - Commerz Real

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

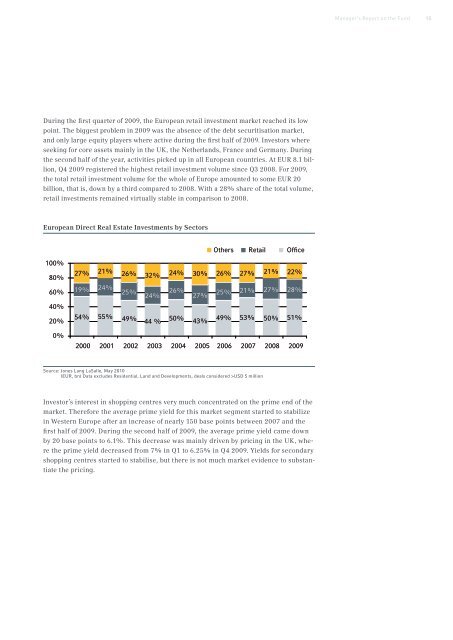

During the first quarter of 2009, the European retail investment market reached its low<br />

point. The biggest problem in 2009 was the absence of the debt securitisation market,<br />

and only large equity players where active during the first half of 2009. Investors where<br />

seeking for core assets mainly in the UK, the Netherlands, France and Germany. During<br />

the second half of the year, activities picked up in all European countries. At EUR 8.1 billion,<br />

Q4 2009 registered the highest retail investment volume since Q3 2008. For 2009,<br />

the total retail investment volume for the whole of Europe amounted to some EUR 20<br />

billion, that is, down by a third compared to 2008. With a 28% share of the total volume,<br />

retail investments remained virtually stable in comparison to 2008.<br />

European Direct <strong>Real</strong> Estate Investments by Sectors<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

27%<br />

19%<br />

54%<br />

21%<br />

24%<br />

55%<br />

26%<br />

25%<br />

49%<br />

32%<br />

24%<br />

44 %<br />

24%<br />

26%<br />

50%<br />

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009<br />

Source: Jones Lang LaSalle, May 2010<br />

30%<br />

27%<br />

43%<br />

Others Retail Office<br />

26%<br />

25%<br />

49%<br />

27%<br />

21%<br />

53%<br />

Source: Jones Lang LaSalle, May 2010<br />

(EUR, bn) Data excludes Residential, Land and Developments, deals considered >USD 5 million<br />

(EUR, bn) Data excludes Residential, Land and Developments,<br />

21%<br />

27%<br />

50%<br />

22%<br />

28%<br />

51%<br />

Investor’s<br />

deals<br />

interest<br />

considered<br />

in shopping<br />

>USD<br />

centres<br />

5 million<br />

very much concentrated on the prime end of the<br />

market. Therefore the average prime yield for this market segment started to stabilize<br />

in Western Europe after an increase of nearly 150 base points between 2007 and the<br />

first half of 2009. During the second half of 2009, the average prime yield came down<br />

by 20 base points to 6.1%. This decrease was mainly driven by pricing in the UK, where<br />

the prime yield decreased from 7% in Q1 to 6.25% in Q4 2009. Yields for secondary<br />

shopping centres started to stabilise, but there is not much market evidence to substantiate<br />

the pricing.<br />

Manager‘s Report on the Fund<br />

15