CG malls europe - Commerz Real

CG malls europe - Commerz Real

CG malls europe - Commerz Real

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

98<br />

<strong>Commerz</strong> <strong>Real</strong> Estate Master FCP – SIF<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

AS AT DECEMBER 31, 2009<br />

19. Consolidated entities (continued)<br />

During 2009, the Group breached a 25% Equity covenant which is incorporated in the loan agreement between Espacio<br />

León Propco S.L. and Eurohypo AG. Despite the covenant breach the lender did not request accelerated repayment of<br />

the loan.<br />

During two consecutive years the equity of Espacio León Propco., S.L. has fallen below 50% of the amount of its nominal<br />

share capital. Pursuant to Spanish Law, this would constitute a cause of mandatory dissolution. However, Royal<br />

Decree Law 10/2008 (the RD) established that, for the purposes of mandatory dissolution, any losses due to, amongst<br />

others, deterioration of the value of fixed assets shall not be considered, allowing for a 2-year suspension on the mandatory<br />

dissolution. This 2-year suspension would have seized on December 31, 2009 but was extended until December 31,<br />

2011 in March 2010 (please refer to Note 25 for further details). As the losses which were encountered by Espacio León<br />

since the acquisition of the investment property were mainly due to deterioration of the value of the property Royal<br />

Decree Law is applicable to Espacio León until December 31, 2011.<br />

20. Related party transactions<br />

Pursuant to the Private Placement Memorandum dated July 13, 2007 the Fund has appointed <strong>Commerz</strong> <strong>Real</strong> AG as<br />

Investment Advisor with the responsibility to prepare the purchase and sale of commercial real estate properties for the<br />

Fund and advise the Fund with respect to asset management.<br />

(a) Management Fee<br />

The Management Company is entitled to receive a Management Fee in an amount of 0.50% per annum of the Gross Asset<br />

Value of the Fund, with rebates being granted to Investors depending on the Aggregate Investment Amount of such<br />

Investor and to Investors subscribing for Units at the Initial Closing or acquiring Units before June 30, 2008 (see below).<br />

The reduced Management Fee percentage is determined by reference to a fee waterfall, with the applicable percentage<br />

decreasing as the Aggregate Investment Amount increases.<br />

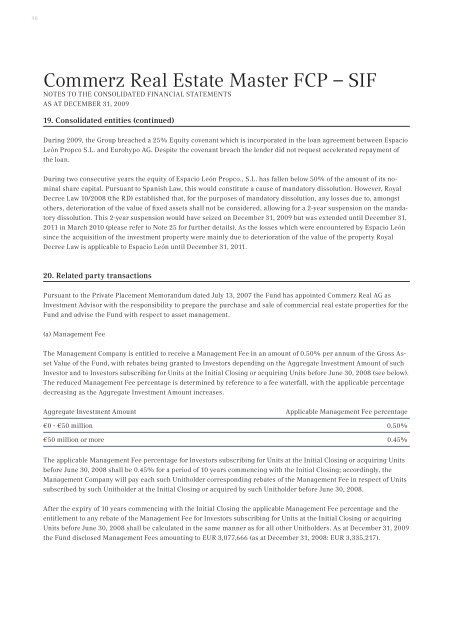

Aggregate Investment Amount Applicable Management Fee percentage<br />

€0 - €50 million 0.50%<br />

€50 million or more 0.45%<br />

The applicable Management Fee percentage for Investors subscribing for Units at the Initial Closing or acquiring Units<br />

before June 30, 2008 shall be 0.45% for a period of 10 years commencing with the Initial Closing; accordingly, the<br />

Management Company will pay each such Unitholder corresponding rebates of the Management Fee in respect of Units<br />

subscribed by such Unitholder at the Initial Closing or acquired by such Unitholder before June 30, 2008.<br />

After the expiry of 10 years commencing with the Initial Closing the applicable Management Fee percentage and the<br />

entitlement to any rebate of the Management Fee for Investors subscribing for Units at the Initial Closing or acquiring<br />

Units before June 30, 2008 shall be calculated in the same manner as for all other Unitholders. As at December 31, 2009<br />

the Fund disclosed Management Fees amounting to EUR 3,077,666 (as at December 31, 2008: EUR 3,335,217).