CG malls europe - Commerz Real

CG malls europe - Commerz Real

CG malls europe - Commerz Real

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

18<br />

As the figure above shows, many Western European countries show medium to high<br />

saturation in terms of shopping centre density (which is especially true for Austria, Ireland,<br />

Italy, the Netherlands and Norway) and slower growth prospects in the long term<br />

for consumer spending (mainly Ireland, the Netherlands, Portugal, and the UK). Compared<br />

to these core markets, emerging markets show a low to medium density of retail<br />

areas but also the highest growth expectations for long-term consumer spending. The<br />

average growth rate for the emerging markets for the next five years is 1.9%, compared<br />

to 1.3% for all core markets.<br />

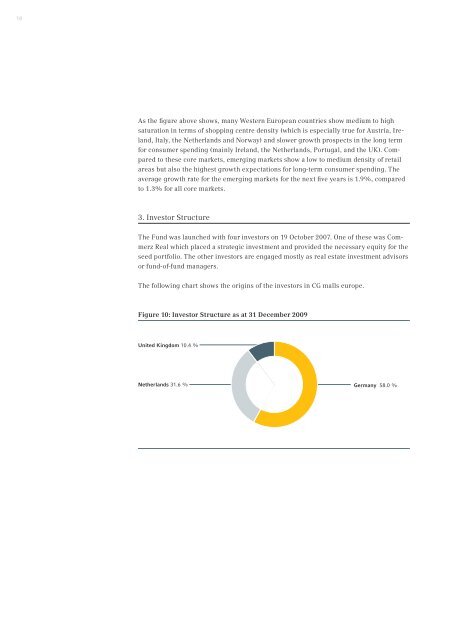

3. Investor Structure<br />

The Fund was launched with four investors on 19 October 2007. One of these was <strong>Commerz</strong><br />

<strong>Real</strong> which placed a strategic investment and provided the necessary equity for the<br />

seed portfolio. The other investors are engaged mostly as real estate investment advisors<br />

or fund-of-fund managers.<br />

The following chart shows the origins of the investors in <strong>CG</strong> <strong>malls</strong> <strong>europe</strong>.<br />

Figure 10: Investor Structure as at 31 December 2009<br />

United Kingdom 10.4 %<br />

Netherlands 31.6 %<br />

Germany 58.0 %