CG malls europe - Commerz Real

CG malls europe - Commerz Real

CG malls europe - Commerz Real

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

56<br />

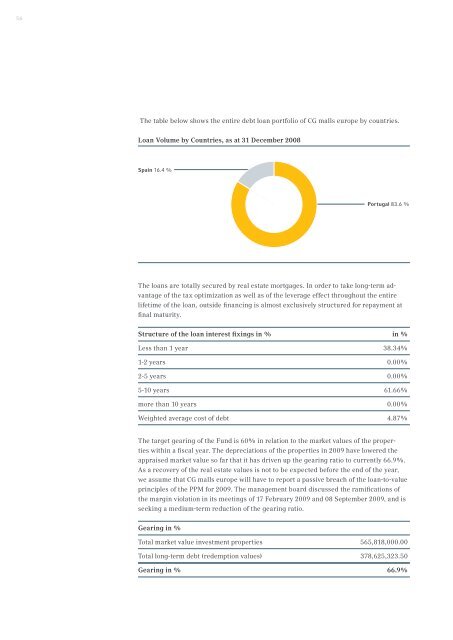

The table below shows the entire debt loan portfolio of <strong>CG</strong> <strong>malls</strong> <strong>europe</strong> by countries.<br />

Loan Volume by Countries, as at 31 December 2008<br />

Spain 16.4 %<br />

Portugal 83.6 %<br />

The loans are totally secured by real estate mortgages. In order to take long-term advantage<br />

of the tax optimization as well as of the leverage effect throughout the entire<br />

lifetime of the loan, outside financing is almost exclusively structured for repayment at<br />

final maturity.<br />

Structure of the loan interest fixings in % in %<br />

Less than 1 year 38.34%<br />

1-2 years 0.00%<br />

2-5 years 0.00%<br />

5-10 years 61.66%<br />

more than 10 years 0.00%<br />

Weighted average cost of debt 4.87%<br />

The target gearing of the Fund is 60% in relation to the market values of the properties<br />

within a fiscal year. The depreciations of the properties in 2009 have lowered the<br />

appraised market value so far that it has driven up the gearing ratio to currently 66.9%.<br />

As a recovery of the real estate values is not to be expected before the end of the year,<br />

we assume that <strong>CG</strong> <strong>malls</strong> <strong>europe</strong> will have to report a passive breach of the loan-to-value<br />

principles of the PPM for 2009. The management board discussed the ramifications of<br />

the margin violation in its meetings of 17 February 2009 and 08 September 2009, and is<br />

seeking a medium-term reduction of the gearing ratio.<br />

Gearing in %<br />

Total market value investment properties 565,818,000.00<br />

Total long-term debt (redemption values) 378,625,323.50<br />

Gearing in % 66.9%