CG malls europe - Commerz Real

CG malls europe - Commerz Real

CG malls europe - Commerz Real

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Commerz</strong> <strong>Real</strong> Estate Master FCP – SIF<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

AS AT DECEMBER 31, 2009<br />

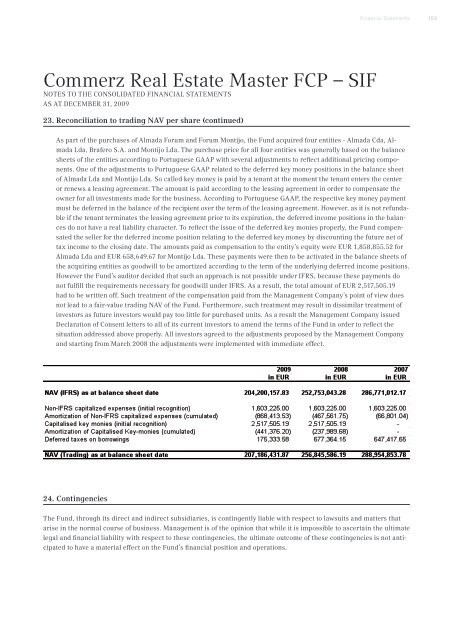

23. Reconciliation to trading NAV per share (continued)<br />

As part of the purchases of Almada Forum and Forum Montijo, the Fund acquired four entities - Almada Cda, Al-<br />

mada Lda, Brafero S.A. and Montijo Lda. The purchase price for all four entities was generally based on the balance<br />

sheets of the entities according to Portuguese GAAP with several adjustments to reflect additional pricing compo-<br />

nents. One of the adjustments to Portuguese GAAP related to the deferred key money positions in the balance sheet<br />

of Almada Lda and Montijo Lda. So called key money is paid by a tenant at the moment the tenant enters the center<br />

or renews a leasing agreement. The amount is paid according to the leasing agreement in order to compensate the<br />

owner for all investments made for the business. According to Portuguese GAAP, the respective key money payment<br />

must be deferred in the balance of the recipient over the term of the leasing agreement. However, as it is not refunda-<br />

ble if the tenant terminates the leasing agreement prior to its expiration, the deferred income positions in the balan-<br />

ces do not have a real liability character. To reflect the issue of the deferred key monies properly, the Fund compen-<br />

sated the seller for the deferred income position relating to the deferred key money by discounting the future net of<br />

tax income to the closing date. The amounts paid as compensation to the entity’s equity were EUR 1,858,855.52 for<br />

Almada Lda and EUR 658,649.67 for Montijo Lda. These payments were then to be activated in the balance sheets of<br />

the acquiring entities as goodwill to be amortized according to the term of the underlying deferred income positions.<br />

However the Fund’s auditor decided that such an approach is not possible under IFRS, because these payments do<br />

not fulfill the requirements necessary for goodwill under IFRS. As a result, the total amount of EUR 2,517,505.19<br />

had to be written off. Such treatment of the compensation paid from the Management Company’s point of view does<br />

not lead to a fair-value trading NAV of the Fund. Furthermore, such treatment may result in dissimilar treatment of<br />

investors as future investors would pay too little for purchased units. As a result the Management Company issued<br />

Declaration of Consent letters to all of its current investors to amend the terms of the Fund in order to reflect the<br />

situation addressed above properly. All investors agreed to the adjustments proposed by the Management Company<br />

and starting from March 2008 the adjustments were implemented with immediate effect.<br />

24. Contingencies<br />

The Fund, through its direct and indirect subsidiaries, is contingently liable with respect to lawsuits and matters that<br />

arise in the normal course of business. Management is of the opinion that while it is impossible to ascertain the ultimate<br />

legal and financial liability with respect to these contingencies, the ultimate outcome of these contingencies is not anti-<br />

cipated to have a material effect on the Fund’s financial position and operations.<br />

Financial Statements<br />

103