CG malls europe - Commerz Real

CG malls europe - Commerz Real

CG malls europe - Commerz Real

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Commerz</strong> <strong>Real</strong> Estate Master FCP – SIF<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

AS AT DECEMBER 31, 2009<br />

2.1. Basis of preparation (continued)<br />

The preparation of financial statements in conformity with IFRS (as adopted by the EU) requires the use of certain critical<br />

accounting estimates. It also requires management to exercise its judgement in the process of applying the Fund’s<br />

accounting policies. Changes in assumptions may have a significant impact on the financial statements in the period the<br />

assumptions changed. Management believes that the underlying assumptions are appropriate. The areas involving a<br />

higher degree of judgement or complexity, or areas where assumptions and estimates are significant to the consolidated<br />

financial statements are disclosed in note 4.<br />

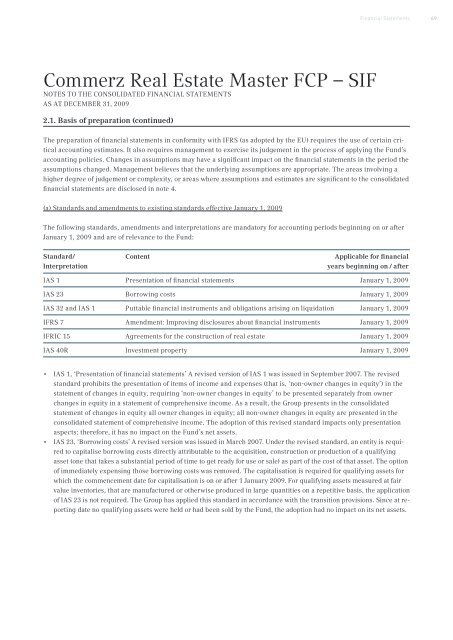

(a) Standards and amendments to existing standards effective January 1, 2009<br />

Financial Statements<br />

The following standards, amendments and interpretations are mandatory for accounting periods beginning on or after<br />

January 1, 2009 and are of relevance to the Fund:<br />

Standard/ Content Applicable for financial<br />

Interpretation years beginning on / after<br />

IAS 1 Presentation of financial statements January 1, 2009<br />

IAS 23 Borrowing costs January 1, 2009<br />

IAS 32 and IAS 1 Puttable financial instruments and obligations arising on liquidation January 1, 2009<br />

IFRS 7 Amendment: Improving disclosures about financial instruments January 1, 2009<br />

IFRIC 15 Agreements for the construction of real estate January 1, 2009<br />

IAS 40R Investment property January 1, 2009<br />

• IAS 1, ‘Presentation of financial statements’ A revised version of IAS 1 was issued in September 2007. The revised<br />

standard prohibits the presentation of items of income and expenses (that is, ‘non-owner changes in equity’) in the<br />

statement of changes in equity, requiring ‘non-owner changes in equity’ to be presented separately from owner<br />

changes in equity in a statement of comprehensive income. As a result, the Group presents in the consolidated<br />

statement of changes in equity all owner changes in equity; all non-owner changes in equity are presented in the<br />

consolidated statement of comprehensive income. The adoption of this revised standard impacts only presentation<br />

aspects; therefore, it has no impact on the Fund’s net assets.<br />

• IAS 23, ‘Borrowing costs’ A revised version was issued in March 2007. Under the revised standard, an entity is required<br />

to capitalise borrowing costs directly attributable to the acquisition, construction or production of a qualifying<br />

asset (one that takes a substantial period of time to get ready for use or sale) as part of the cost of that asset. The option<br />

of immediately expensing those borrowing costs was removed. The capitalisation is required for qualifying assets for<br />

which the commencement date for capitalisation is on or after 1 January 2009. For qualifying assets measured at fair<br />

value inventories, that are manufactured or otherwise produced in large quantities on a repetitive basis, the application<br />

of IAS 23 is not required. The Group has applied this standard in accordance with the transition provisions. Since at reporting<br />

date no qualifying assets were held or had been sold by the Fund, the adoption had no impact on its net assets.<br />

69