CG malls europe - Commerz Real

CG malls europe - Commerz Real

CG malls europe - Commerz Real

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

84<br />

<strong>Commerz</strong> <strong>Real</strong> Estate Master FCP – SIF<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

AS AT DECEMBER 31, 2009<br />

3.1. Financial risk factors (continued)<br />

Such risks are subject to a quarterly or more frequent review. The Group has policies in place to ensure that rental contracts<br />

are made with customers with an appropriate credit history. Cash balances are held only with financial institutions<br />

with a Moody’s credit rating of A or better. The Group has policies that limit the amount of credit exposure to any<br />

financial institution. Limits on the level of credit risk by category and territory are approved quarterly by the Board of<br />

Directors. The utilisations of credit limits are regularly monitored.<br />

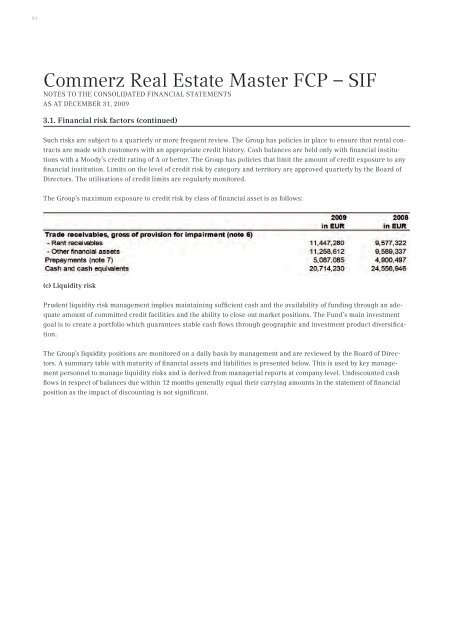

The Group’s maximum exposure to credit risk by class of financial asset is as follows:<br />

(c) Liquidity risk<br />

Prudent liquidity risk management implies maintaining sufficient cash and the availability of funding through an adequate<br />

amount of committed credit facilities and the ability to close out market positions. The Fund’s main investment<br />

goal is to create a portfolio which guarantees stable cash flows through geographic and investment product diversification.<br />

The Group’s liquidity positions are monitored on a daily basis by management and are reviewed by the Board of Directors.<br />

A summary table with maturity of financial assets and liabilities is presented below. This is used by key management<br />

personnel to manage liquidity risks and is derived from managerial reports at company level. Undiscounted cash<br />

flows in respect of balances due within 12 months generally equal their carrying amounts in the statement of financial<br />

position as the impact of discounting is not significant.