CG malls europe - Commerz Real

CG malls europe - Commerz Real

CG malls europe - Commerz Real

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

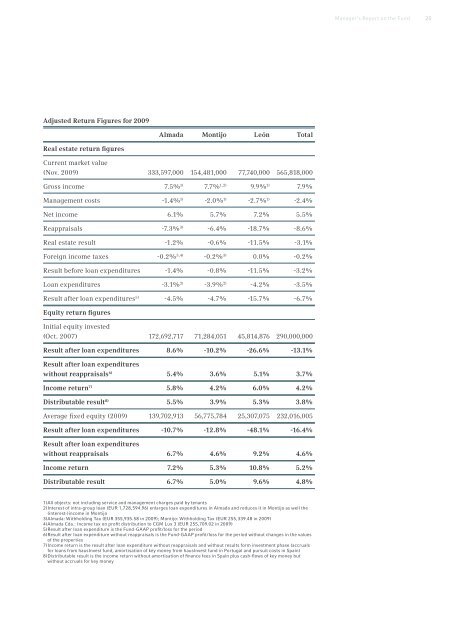

Adjusted Return Figures for 2009<br />

<strong>Real</strong> estate return figures<br />

Almada Montijo León Total<br />

Current market value<br />

(Nov. 2009) 333,597,000 154,481,000 77,740,000 565,818,000<br />

Gross income 7.5% 1) 7.7% 1,2) 9.9% 1) 7.9%<br />

Management costs -1.4% 1) -2.0% 1) -2.7% 1) -2.4%<br />

Net income 6.1% 5.7% 7.2% 5.5%<br />

Reappraisals -7.3% 3) -6.4% -18.7% -8.6%<br />

<strong>Real</strong> estate result -1.2% -0.6% -11.5% -3.1%<br />

Foreign income taxes -0.2% 3,4) -0.2% 3) 0.0% -0.2%<br />

Result before loan expenditures -1.4% -0.8% -11.5% -3.2%<br />

Loan expenditures -3.1% 2) -3.9% 2) -4.2% -3.5%<br />

Result after loan expenditures 5) -4.5% -4.7% -15.7% -6.7%<br />

Equity return figures<br />

Initial equity invested<br />

(Oct. 2007) 172,692,717 71,284,051 45,814,876 290,000,000<br />

Result after loan expenditures 8.6% -10.2% -26.6% -13.1%<br />

Result after loan expenditures<br />

without reappraisals 6) 5.4% 3.6% 5.1% 3.7%<br />

Income return 7) 5.8% 4.2% 6.0% 4.2%<br />

Distributable result 8) 5.5% 3.9% 5.3% 3.8%<br />

Average fixed equity (2009) 139,702,913 56,775,784 25,307,075 232,016,005<br />

Result after loan expenditures -10.7% -12.8% -48.1% -16.4%<br />

Result after loan expenditures<br />

without reappraisals 6.7% 4.6% 9.2% 4.6%<br />

Income return 7.2% 5.3% 10.8% 5.2%<br />

Distributable result 6.7% 5.0% 9.6% 4.8%<br />

1) All objects: not including service and management charges paid by tenants<br />

2) Interest of intra-group loan (EUR 1,728,594.96) enlarges loan expenditures in Almada and reduces it in Montijo as well the<br />

(interest-)income in Montijo<br />

3) Almada: Withholding Tax (EUR 355,935.58 in 2009); Montijo: Withholding Tax (EUR 255,339.48 in 2009)<br />

4) Almada Cda.: Income tax on profit distribution to <strong>CG</strong>M Lux 3 (EUR 255,709.02 in 2009)<br />

5) Result after loan expenditure is the Fund-GAAP profit/loss for the period<br />

6) Result after loan expenditure without reappraisals is the Fund-GAAP profit/loss for the period without changes in the values<br />

of the properties<br />

7) Income return is the result after loan expenditure without reappraisals and without results form investment phase (accruals<br />

for loans from hausInvest fund, amortisation of key money from hausInvest fund in Portugal and pursuit costs in Spain)<br />

8) Distributable result is the income return without amortisation of finance fees in Spain plus cash-flows of key money but<br />

without accruals for key money<br />

Manager‘s Report on the Fund<br />

25