CG malls europe - Commerz Real

CG malls europe - Commerz Real

CG malls europe - Commerz Real

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

León PropCo received one long-term loan facility from Eurohypo Spain, amounting<br />

to EUR 61,980,000.00 for the financing of the purchase. León PropCo was capitalized<br />

with a total equity of EUR 11,450,238.95 in 2007 by its shareholder <strong>CG</strong> NL Holding<br />

B.V., which in turn received the required funds for this action by <strong>CG</strong>M Lux 3 S.à r.l.<br />

in the form of equity. In addition, León PropCo was provided with a shareholder loan<br />

over EUR 34,361,156.86 by <strong>CG</strong>M Lux 3 S.à r.l. which was converted into a PPL in April<br />

2010 and was increased by EUR 4,000,000.00 and hence subsequently amounts to<br />

EUR 38,361,156.86. The table below shows the financing sources of the company as at<br />

accounting date:<br />

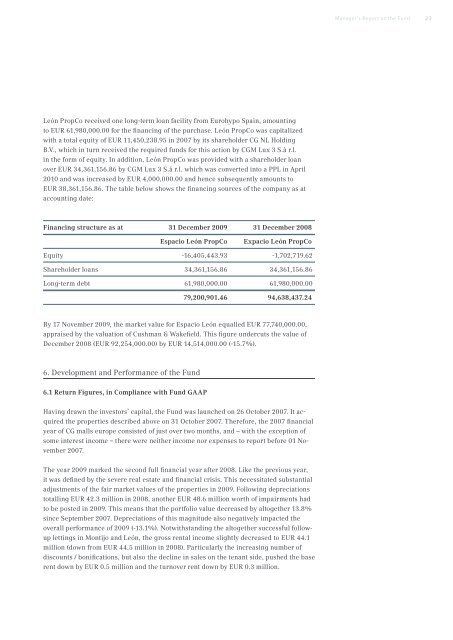

Financing structure as at 31 December 2009 31 December 2008<br />

Espacio León PropCo Expacio León PropCo<br />

Equity -16,405,443.93 -1,702,719.62<br />

Shareholder loans 34,361,156.86 34,361,156.86<br />

Long-term debt 61,980,000.00 61,980,000.00<br />

79,200,901.46 94,638,437.24<br />

By 17 November 2009, the market value for Espacio León equalled EUR 77,740,000.00,<br />

appraised by the valuation of Cushman & Wakefield. This figure undercuts the value of<br />

December 2008 (EUR 92,254,000.00) by EUR 14,514,000.00 (-15.7%).<br />

6. Development and Performance of the Fund<br />

6.1 Return Figures, in Compliance with Fund GAAP<br />

Having drawn the investors’ capital, the Fund was launched on 26 October 2007. It acquired<br />

the properties described above on 31 October 2007. Therefore, the 2007 financial<br />

year of <strong>CG</strong> <strong>malls</strong> <strong>europe</strong> consisted of just over two months, and – with the exception of<br />

some interest income – there were neither income nor expenses to report before 01 November<br />

2007.<br />

The year 2009 marked the second full financial year after 2008. Like the previous year,<br />

it was defined by the severe real estate and financial crisis. This necessitated substantial<br />

adjustments of the fair market values of the properties in 2009. Following depreciations<br />

totalling EUR 42.3 million in 2008, another EUR 48.6 million worth of impairments had<br />

to be posted in 2009. This means that the portfolio value decreased by altogether 13.8%<br />

since September 2007. Depreciations of this magnitude also negatively impacted the<br />

overall performance of 2009 (-13.1%). Notwithstanding the altogether successful followup<br />

lettings in Montijo and León, the gross rental income slightly decreased to EUR 44.1<br />

million (down from EUR 44.5 million in 2008). Particularly the increasing number of<br />

discounts / bonifications, but also the decline in sales on the tenant side, pushed the base<br />

rent down by EUR 0.5 million and the turnover rent down by EUR 0.3 million.<br />

Manager‘s Report on the Fund<br />

23