CG malls europe - Commerz Real

CG malls europe - Commerz Real

CG malls europe - Commerz Real

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

22<br />

5.2 Forum Montijo<br />

The acquisition, holding and financing structure used in the case of Forum Montijo<br />

closely resembles the one described for Almada Forum. Therefore, similarities will not<br />

be detailed again below.<br />

Forum Montijo is held by Brafero – Sociedade Imobiliària, S.A. (Brafero S.A.). The company<br />

has let the whole centre to Forum Montijo – Gestao de Centro Comercial, Sociedade<br />

Unipessoal, Lda. (Montijo Lda.) which acts as the operating company and grants use<br />

rights for the shops to the respective tenants.<br />

Montijo Lda. was purchased by <strong>CG</strong>M Lux 3 S.à r.l., and subsequently bought the shares<br />

of Brafero S.A. As Brafero S.A. is a capital company, the acquisition of 100% of the shares<br />

by Montijo Lda. did not trigger any transfer tax payments.<br />

<strong>CG</strong>M Lux 3 S.à r.l. was funded through a PPL from <strong>CG</strong>M Lux 1 S. à r.l. for the acquisition<br />

of Montijo Lda. which received an external loan from Eurohypo Portugal amounting to<br />

EUR 90,670,000.00 and a shareholder loan from <strong>CG</strong>M Lux 3 S. à r.l. amounting to<br />

EUR 69,473,566.83. These funds were used to acquire the shares of Brafero S.A., to<br />

cover expenses connected with the external financing and to grant an intra-group loan<br />

to Almada Lda.<br />

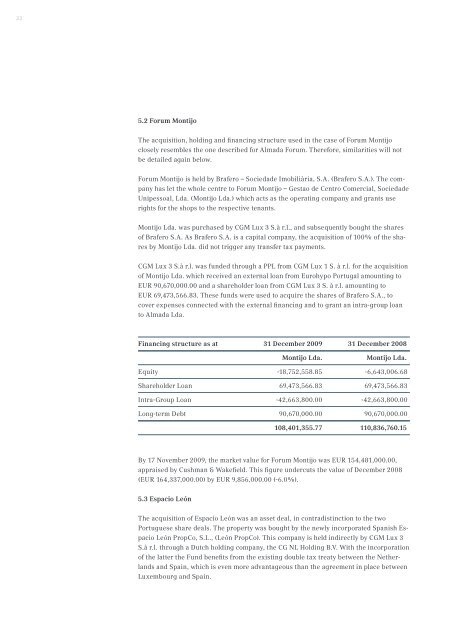

Financing structure as at 31 December 2009 31 December 2008<br />

Montijo Lda. Montijo Lda.<br />

Equity -18,752,558.85 -6,643,006.68<br />

Shareholder Loan 69,473,566.83 69,473,566.83<br />

Intra-Group Loan -42,663,800.00 -42,663,800.00<br />

Long-term Debt 90,670,000.00 90,670,000.00<br />

108,401,355.77 110,836,760.15<br />

By 17 November 2009, the market value for Forum Montijo was EUR 154,481,000.00,<br />

appraised by Cushman & Wakefield. This figure undercuts the value of December 2008<br />

(EUR 164,337,000.00) by EUR 9,856,000.00 (-6.0%).<br />

5.3 Espacio León<br />

The acquisition of Espacio León was an asset deal, in contradistinction to the two<br />

Portuguese share deals. The property was bought by the newly incorporated Spanish Espacio<br />

León PropCo, S.L., (León PropCo). This company is held indirectly by <strong>CG</strong>M Lux 3<br />

S.à r.l. through a Dutch holding company, the <strong>CG</strong> NL Holding B.V. With the incorporation<br />

of the latter the Fund benefits from the existing double tax treaty between the Netherlands<br />

and Spain, which is even more advantageous than the agreement in place between<br />

Luxembourg and Spain.