CG malls europe - Commerz Real

CG malls europe - Commerz Real

CG malls europe - Commerz Real

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The vacancy rate is reported in relation to the let floor space (sqm) and to the rental<br />

income (base rent) to be realised. Since Multi Development, the developer and purchaser<br />

of the <strong>malls</strong>, is paying rent guarantees, additional vacancy rates were posted which<br />

would result from a termination of the rent guarantee. In Montijo, rent guarantee payments<br />

were made for a vacant space and for a let space (to offset the difference between<br />

the contractually agreed rent and the rent actually paid by the tenant) as at 31 December<br />

2009. In Léon, rent guarantee payments were made for five vacant retail units and<br />

for seven let units as at 31 December 2009. Difficult as it was, the year 2009 did see the<br />

successful extension of 17.5% of all portfolio leases (in terms of rental income). Almada<br />

accounted for 7.5%, Montijo for 37.5% and León for 20.3% of these lease renewals.<br />

Regrettably, it proved impossible to re-let all of the floor space. The number of rent<br />

discounts granted to tenants also went up in 2009. Tenants requested rent-free period<br />

less often than they did discounts / bonifications on the existing rent level. In Almada,<br />

we granted rent-free periods to a total of 6 tenants and discounts / bonifications to a total<br />

of 50 tenants in 2009. In Montijo, we granted rent-free periods to 9 tenants and discounts<br />

/ bonifications to 26 tenants in 2009. In León, finally, we granted rent-free periods to 5<br />

tenants and discounts / bonifications to 25 tenants in 2009.<br />

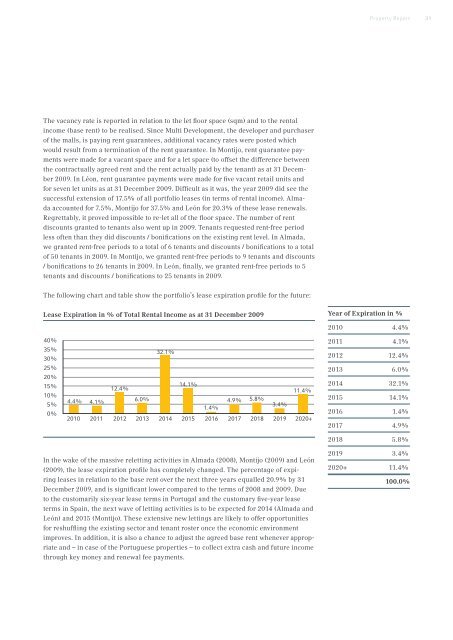

The following chart and table show the portfolio’s lease expiration profile for the future:<br />

Lease Expiration in % of total rental income<br />

Lease Expiration in % of Total Rental Income as at 31 December 2009<br />

40%<br />

35%<br />

30%<br />

25%<br />

20%<br />

32.1%<br />

15%<br />

10%<br />

5%<br />

4.4% 4.1%<br />

12.4%<br />

6.0%<br />

14.1%<br />

1.4%<br />

4.9% 5.8%<br />

3.4%<br />

11.4%<br />

0%<br />

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020+<br />

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019+<br />

In the wake of the massive reletting activities in Almada (2008), Montijo (2009) and León<br />

(2009), the lease expiration profile has completely changed. The percentage of expiring<br />

leases in relation to the base rent over the next three years equalled 20.9% by 31<br />

December 2009, and is significant lower compared to the terms of 2008 and 2009. Due<br />

to the customarily six-year lease terms in Portugal and the customary five-year lease<br />

terms in Spain, the next wave of letting activities is to be expected for 2014 (Almada and<br />

León) and 2015 (Montijo). These extensive new lettings are likely to offer opportunities<br />

for reshuffling the existing sector and tenant roster once the economic environment<br />

improves. In addition, it is also a chance to adjust the agreed base rent whenever appropriate<br />

and – in case of the Portuguese properties – to collect extra cash and future income<br />

through key money and renewal fee payments.<br />

Property Report<br />

Year of Expiration in %<br />

2010 4.4%<br />

2011 4.1%<br />

2012 12.4%<br />

2013 6.0%<br />

2014 32.1%<br />

2015 14.1%<br />

2016 1.4%<br />

2017 4.9%<br />

2018 5.8%<br />

2019 3.4%<br />

2020+ 11.4%<br />

100.0%<br />

31