CG malls europe - Commerz Real

CG malls europe - Commerz Real

CG malls europe - Commerz Real

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

92<br />

<strong>Commerz</strong> <strong>Real</strong> Estate Master FCP – SIF<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

AS AT DECEMBER 31, 2009<br />

7. Prepayments<br />

The prepayments are made up of prepaid rents that are related to the rents for the months January 2010 (to be verified)<br />

amounting to EUR 2,537,085 and of prepaid expenses amounting to EUR 2,550,000. The prepaid expenses are mainly<br />

related to expenses in relation to the administration of the shopping <strong>malls</strong>, insurance costs, marketing costs as well as<br />

rents paid for January 2010.<br />

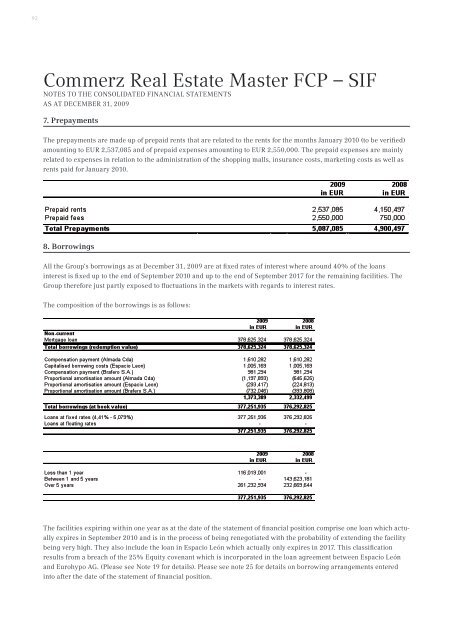

8. Borrowings<br />

All the Group‘s borrowings as at December 31, 2009 are at fixed rates of interest where around 40% of the loans<br />

interest is fixed up to the end of September 2010 and up to the end of September 2017 for the remaining facilities. The<br />

Group therefore just partly exposed to fluctuations in the markets with regards to interest rates.<br />

The composition of the borrowings is as follows:<br />

The facilities expiring within one year as at the date of the statement of financial position comprise one loan which actually<br />

expires in September 2010 and is in the process of being renegotiated with the probability of extending the facility<br />

being very high. They also include the loan in Espacio León which actually only expires in 2017. This classification<br />

results from a breach of the 25% Equity covenant which is incorporated in the loan agreement between Espacio León<br />

and Eurohypo AG. (Please see Note 19 for details). Please see note 25 for details on borrowing arrangements entered<br />

into after the date of the statement of financial position.