CG malls europe - Commerz Real

CG malls europe - Commerz Real

CG malls europe - Commerz Real

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

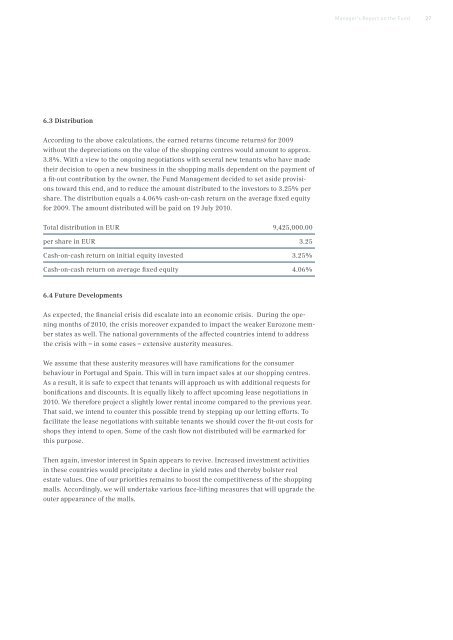

6.3 Distribution<br />

According to the above calculations, the earned returns (income returns) for 2009<br />

without the depreciations on the value of the shopping centres would amount to approx.<br />

3.8%. With a view to the ongoing negotiations with several new tenants who have made<br />

their decision to open a new business in the shopping <strong>malls</strong> dependent on the payment of<br />

a fit-out contribution by the owner, the Fund Management decided to set aside provisions<br />

toward this end, and to reduce the amount distributed to the investors to 3.25% per<br />

share. The distribution equals a 4.06% cash-on-cash return on the average fixed equity<br />

for 2009. The amount distributed will be paid on 19 July 2010.<br />

Total distribution in EUR 9,425,000.00<br />

per share in EUR 3.25<br />

Cash-on-cash return on initial equity invested 3.25%<br />

Cash-on-cash return on average fixed equity 4.06%<br />

6.4 Future Developments<br />

As expected, the financial crisis did escalate into an economic crisis. During the opening<br />

months of 2010, the crisis moreover expanded to impact the weaker Eurozone member<br />

states as well. The national governments of the affected countries intend to address<br />

the crisis with – in some cases – extensive austerity measures.<br />

We assume that these austerity measures will have ramifications for the consumer<br />

behaviour in Portugal and Spain. This will in turn impact sales at our shopping centres.<br />

As a result, it is safe to expect that tenants will approach us with additional requests for<br />

bonifications and discounts. It is equally likely to affect upcoming lease negotiations in<br />

2010. We therefore project a slightly lower rental income compared to the previous year.<br />

That said, we intend to counter this possible trend by stepping up our letting efforts. To<br />

facilitate the lease negotiations with suitable tenants we should cover the fit-out costs for<br />

shops they intend to open. Some of the cash flow not distributed will be earmarked for<br />

this purpose.<br />

Then again, investor interest in Spain appears to revive. Increased investment activities<br />

in these countries would precipitate a decline in yield rates and thereby bolster real<br />

estate values. One of our priorities remains to boost the competitiveness of the shopping<br />

<strong>malls</strong>. Accordingly, we will undertake various face-lifting measures that will upgrade the<br />

outer appearance of the <strong>malls</strong>.<br />

Manager‘s Report on the Fund<br />

27