CG malls europe - Commerz Real

CG malls europe - Commerz Real

CG malls europe - Commerz Real

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

5.1 Almada Forum<br />

Almada Forum is held by Forum Almada – Gestao de Centro Comercial, Sociedade<br />

Unipessoal, Lda. II & Comandita (Almada Cda.). The company has let the entire mall to<br />

Forum Almada – Gestao de Centro Comercial, Sociedade Unipessoal, Lda. (Almada Lda.)<br />

which acts as the operating company and grants use rights for the shops to the respective<br />

tenants.<br />

Almada Lda. was bought by <strong>CG</strong>M Lux 2 S.à r.l., and Almada Lda. subsequently acquired<br />

a 70% interest in Almada Cda. The remaining 30% interest was acquired by <strong>CG</strong>M Lux 3<br />

S.à r.l. As Almada Cda. is a private company, the 70/30-split was necessary to avoid the<br />

payment of a transfer tax.<br />

The current structure of the Almada investment – as well as the overall structure – was<br />

designed with a view to tax efficiency. Therefore the companies were funded both<br />

through external and internal loans. In this specific case, Almada Lda. received three<br />

different types of loan facilities to finance the acquisition of its 70% interest in Almada<br />

Cda.: a EUR 35,800,000 loan facility from Eurohypo Portugal, a EUR 42,663,800 intragroup<br />

loan from Forum Montijo – Gestao de Centro Comercial, Sociedade Unipessoal,<br />

Lda. (Montijo Lda.), the operating company for Forum Montijo, and a EUR 96,844,069.52<br />

shareholder loan from <strong>CG</strong>M Lux 2 S.à r.l. <strong>CG</strong>M Lux 3 S.à r.l. financed the 30% interest in<br />

Almada Cda. through the PPL received from <strong>CG</strong>M Lux 1 S.à r.l.<br />

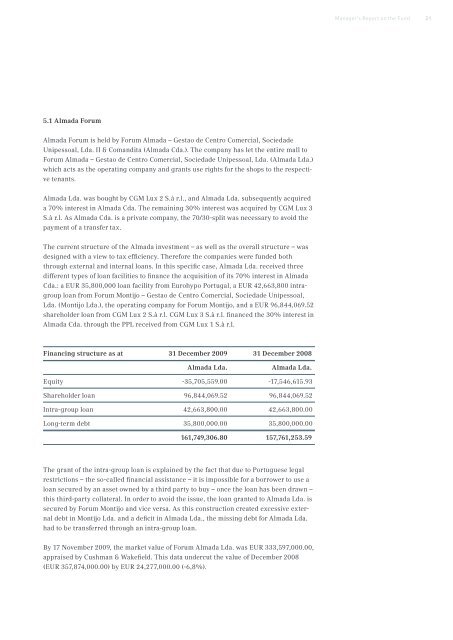

Financing structure as at 31 December 2009 31 December 2008<br />

Almada Lda. Almada Lda.<br />

Equity -35,705,559.00 -17,546,615.93<br />

Shareholder loan 96,844,069.52 96,844,069.52<br />

Intra-group loan 42,663,800.00 42,663,800.00<br />

Long-term debt 35,800,000.00 35,800,000.00<br />

161,749,306.80 157,761,253.59<br />

The grant of the intra-group loan is explained by the fact that due to Portuguese legal<br />

restrictions – the so-called financial assistance – it is impossible for a borrower to use a<br />

loan secured by an asset owned by a third party to buy – once the loan has been drawn –<br />

this third-party collateral. In order to avoid the issue, the loan granted to Almada Lda. is<br />

secured by Forum Montijo and vice versa. As this construction created excessive external<br />

debt in Montijo Lda. and a deficit in Almada Lda., the missing debt for Almada Lda.<br />

had to be transferred through an intra-group loan.<br />

By 17 November 2009, the market value of Forum Almada Lda. was EUR 333,597,000.00,<br />

appraised by Cushman & Wakefield. This data undercut the value of December 2008<br />

(EUR 357,874,000.00) by EUR 24,277,000.00 (-6,8%).<br />

Manager‘s Report on the Fund<br />

21