CG malls europe - Commerz Real

CG malls europe - Commerz Real

CG malls europe - Commerz Real

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

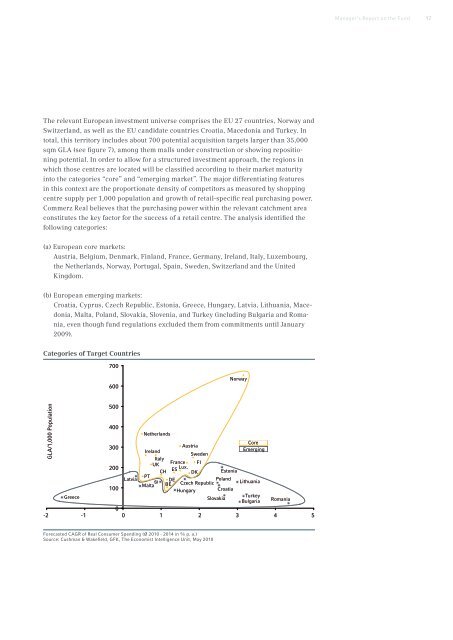

The relevant European investment universe comprises the EU 27 countries, Norway and<br />

Switzerland, as well as the EU candidate countries Croatia, Macedonia and Turkey. In<br />

total, this territory includes about 700 potential acquisition targets larger than 35,000<br />

sqm GLA (see figure 7), among them <strong>malls</strong> under construction or showing repositioning<br />

potential. In order to allow for a structured investment approach, the regions in<br />

which those centres are located will be classified according to their market maturity<br />

into the categories “core” and “emerging market”. The major differentiating features<br />

in this context are the proportionate density of competitors as measured by shopping<br />

centre supply per 1,000 population and growth of retail-specific real purchasing power.<br />

<strong>Commerz</strong> <strong>Real</strong> believes that the purchasing power within the relevant catchment area<br />

constitutes the key factor for the success of a retail centre. The analysis identified the<br />

following categories:<br />

(a) European core markets:<br />

Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, Luxembourg,<br />

the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland and the United<br />

Kingdom.<br />

(b) European emerging markets:<br />

Croatia, Cyprus, Czech Republic, Estonia, Greece, Hungary, Latvia, Lithuania, Macedonia,<br />

Malta, Poland, Slovakia, Slovenia, and Turkey (including Bulgaria and Romania,<br />

even though fund regulations excluded them from commitments until January<br />

2009).<br />

Categories of Target Countries<br />

GLA/1,000 Population<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

Netherlands<br />

Ireland<br />

100<br />

Latvia<br />

Malta<br />

Czech Republic<br />

Hungary<br />

Greece<br />

-2 -1<br />

0<br />

0 1 2 3 4 5<br />

Poland<br />

DE<br />

BE<br />

Croatia<br />

Lithuania<br />

Slovakia<br />

Turkey<br />

Bulgaria<br />

Romania<br />

Forecasted CAGR of <strong>Real</strong> Consumer Spending (Ø 2010 - 2014 in % p. a.)<br />

Source: Cushman & Wakefield, GFK, The Economist Intelligence Unit, May 2010<br />

PT<br />

Italy<br />

UK<br />

CH<br />

Austria<br />

Sweden<br />

France FI<br />

ES Lux.<br />

DK<br />

Estonia<br />

Norway<br />

Core<br />

Emerging<br />

Forecasted CAGR of <strong>Real</strong> Consumer Spending (Ø 2010 - 2014 in % p. a.)<br />

Source: Cushman & Wakefield, GFK, The Economist Intelligence Unit, May 2010<br />

Manager‘s Report on the Fund<br />

17