CG malls europe - Commerz Real

CG malls europe - Commerz Real

CG malls europe - Commerz Real

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

102<br />

<strong>Commerz</strong> <strong>Real</strong> Estate Master FCP – SIF<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

AS AT DECEMBER 31, 2009<br />

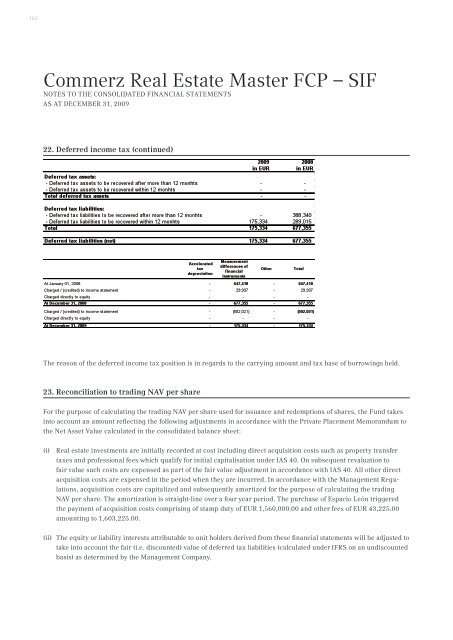

22. Deferred income tax (continued)<br />

The reason of the deferred income tax position is in regards to the carrying amount and tax base of borrowings held.<br />

23. Reconciliation to trading NAV per share<br />

For the purpose of calculating the trading NAV per share used for issuance and redemptions of shares, the Fund takes<br />

into account an amount reflecting the following adjustments in accordance with the Private Placement Memorandum to<br />

the Net Asset Value calculated in the consolidated balance sheet:<br />

(i) <strong>Real</strong> estate investments are initially recorded at cost including direct acquisition costs such as property transfer<br />

taxes and professional fees which qualify for initial capitalisation under IAS 40. On subsequent revaluation to<br />

fair value such costs are expensed as part of the fair value adjustment in accordance with IAS 40. All other direct<br />

acquisition costs are expensed in the period when they are incurred. In accordance with the Management Regulations,<br />

acquisition costs are capitalized and subsequently amortized for the purpose of calculating the trading<br />

NAV per share. The amortization is straight-line over a four year period. The purchase of Espacio León triggered<br />

the payment of acquisition costs comprising of stamp duty of EUR 1,560,000.00 and other fees of EUR 43,225.00<br />

amounting to 1,603,225.00.<br />

(ii) The equity or liability interests attributable to unit holders derived from these financial statements will be adjusted to<br />

take into account the fair (i.e. discounted) value of deferred tax liabilities (calculated under IFRS on an undiscounted<br />

basis) as determined by the Management Company.