CG malls europe - Commerz Real

CG malls europe - Commerz Real

CG malls europe - Commerz Real

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Commerz</strong> <strong>Real</strong> Estate Master FCP – SIF<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

AS AT DECEMBER 31, 2009<br />

21. Income and withholding tax expenses (continued)<br />

possible for <strong>CG</strong>M Lux 2 and <strong>CG</strong>M Lux 3 to apply for the Interest & Royalties Directive (“I&R Directive”) withholding tax<br />

rates for Portugal effecting a partial refund of the withholding tax. Under the I&R Directive in principle no withholding<br />

tax is levied. Portugal implemented a transitory regulation in connection to the withholding tax rates that approach step<br />

by step to the I&R Directive. The withholding tax rates according to that transitory regime are:<br />

(i) 10% until June 2009<br />

(ii) 5% from July 2009 until June 30, 2013<br />

(iii) Nil after 1 July 2013.<br />

Furthermore, in case certain conditions are met it will be possible for <strong>CG</strong>M Lux 2 and <strong>CG</strong>M Lux 3 after elapse of the two<br />

year holding period to apply for the refund of:<br />

(i) 5% of the interest due until June 30, 2009<br />

(ii) 10% of the interest due between July 1, 2009 and October 31, 2009<br />

In order to take advantage of this option, the Management has decided to amend both loan facility agreements to allow<br />

for a two year holding period of the interest payments of both companies.<br />

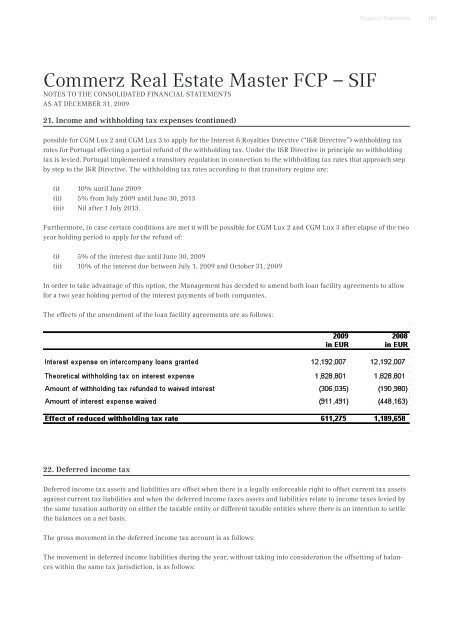

The effects of the amendment of the loan facility agreements are as follows:<br />

22. Deferred income tax<br />

Deferred income tax assets and liabilities are offset when there is a legally enforceable right to offset current tax assets<br />

against current tax liabilities and when the deferred income taxes assets and liabilities relate to income taxes levied by<br />

the same taxation authority on either the taxable entity or different taxable entities where there is an intention to settle<br />

the balances on a net basis.<br />

The gross movement in the deferred income tax account is as follows:<br />

Financial Statements<br />

The movement in deferred income liabilities during the year, without taking into consideration the offsetting of balances<br />

within the same tax jurisdiction, is as follows:<br />

101