CG malls europe - Commerz Real

CG malls europe - Commerz Real

CG malls europe - Commerz Real

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Commerz</strong> <strong>Real</strong> Estate Master FCP – SIF<br />

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS<br />

AS AT DECEMBER 31, 2009<br />

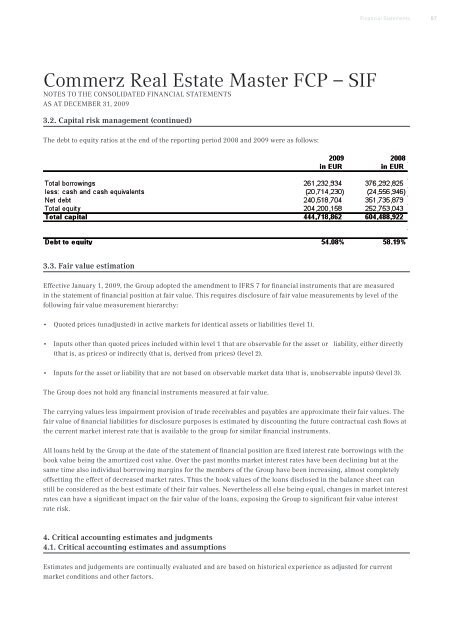

3.2. Capital risk management (continued)<br />

The debt to equity ratios at the end of the reporting period 2008 and 2009 were as follows:<br />

3.3. Fair value estimation<br />

Effective January 1, 2009, the Group adopted the amendment to IFRS 7 for financial instruments that are measured<br />

in the statement of financial position at fair value. This requires disclosure of fair value measurements by level of the<br />

following fair value measurement hierarchy:<br />

• Quoted prices (unadjusted) in active markets for identical assets or liabilities (level 1).<br />

• Inputs other than quoted prices included within level 1 that are observable for the asset or liability, either directly<br />

(that is, as prices) or indirectly (that is, derived from prices) (level 2).<br />

• Inputs for the asset or liability that are not based on observable market data (that is, unobservable inputs) (level 3).<br />

The Group does not hold any financial instruments measured at fair value.<br />

The carrying values less impairment provision of trade receivables and payables are approximate their fair values. The<br />

fair value of financial liabilities for disclosure purposes is estimated by discounting the future contractual cash flows at<br />

the current market interest rate that is available to the group for similar financial instruments.<br />

All loans held by the Group at the date of the statement of financial position are fixed interest rate borrowings with the<br />

book value being the amortized cost value. Over the past months market interest rates have been declining but at the<br />

same time also individual borrowing margins for the members of the Group have been increasing, almost completely<br />

offsetting the effect of decreased market rates. Thus the book values of the loans disclosed in the balance sheet can<br />

still be considered as the best estimate of their fair values. Nevertheless all else being equal, changes in market interest<br />

rates can have a significant impact on the fair value of the loans, exposing the Group to significant fair value interest<br />

rate risk.<br />

4. Critical accounting estimates and judgments<br />

4.1. Critical accounting estimates and assumptions<br />

Financial Statements<br />

Estimates and judgements are continually evaluated and are based on historical experience as adjusted for current<br />

market conditions and other factors.<br />

87