- Page 1 and 2:

1 DISTRICT OF MISSION Regular Counc

- Page 3 and 4:

Regular Council Agenda June 15, 200

- Page 5 and 6:

5 From: Jacquie [gagnon00@telus.net

- Page 7 and 8:

co 3 5 PVC/ c6Ncil 300 CONC 340 CUP

- Page 9 and 10:

Memo 9 FILE: PRO.DEV.ZON/PRO.DEV.DE

- Page 11 and 12:

Memo 1 1 FILE: PRO.DEV.ZON R09-004

- Page 13 and 14:

13 Road Construction As shown on Pl

- Page 15 and 16:

15 PLAN Lot layout DRAFT PLAN OF SU

- Page 17 and 18:

17 DRAFT PLAN OF SUBDIVISION OF LOT

- Page 19 and 20:

mi.s.sTsRicoT nOF ON THE FRASER FIL

- Page 21 and 22:

APPENDIX 1 FILE: PRO.WAT.SPI PAGE 3

- Page 23 and 24:

lsslon MDISTRICT OF ON THE FRASER C

- Page 25 and 26:

25 DATE PREPARED: 14 May 2009 TO: F

- Page 27 and 28:

27 District of Mission IlahaeDairy

- Page 29 and 30:

mis.sTs.i.conoF ON THE FRASER , /e-

- Page 31 and 32:

APPENDIX 4 LOT 2 LOT 1 idUPP 1,1111

- Page 33 and 34:

33 Site Description The subject pro

- Page 35 and 36:

35 Appendix 1 ENGINEERING DEPARTMEN

- Page 37 and 38:

7.1 O F rn o • • co -0 o C.) 0

- Page 39 and 40:

I 39 ADDRESS 33955 CHEW, AVE DRAFT

- Page 41 and 42:

41 Neighbourhood Context The propos

- Page 43:

43 Appendix. B Site Plans PAgGE 4 O

- Page 49 and 50:

49 OHERRY AVE. 113.35 LOT 6 465.95

- Page 51 and 52:

Streetscape r, C) V,__-I. 11111: A1

- Page 53 and 54:

53 DISTRICT OF MISSION INFRASTRUCTU

- Page 55 and 56:

55 6. Following a review with Counc

- Page 57 and 58:

57 committees. There is a mixture o

- Page 59 and 60:

59 That principle is that the work

- Page 61 and 62:

M iD DIS TRICT S TsiOnO F ON THE FR

- Page 63 and 64:

11111111/111111111111111111110, Abb

- Page 65 and 66:

65 UMC Report No. 32 -2009 Page 3 o

- Page 67 and 68:

67 UMC Report No. 32 -2009 Page 5 o

- Page 69 and 70:

City of Abbotsford / District of Mi

- Page 71 and 72:

City of Abbotsford ! District of Mi

- Page 73 and 74:

Item No. 09-2 Project Mill Lake Pro

- Page 75 and 76:

Item No. 09-4 Project Gladwin, Beva

- Page 77 and 78:

Item No. 09-6 Project Nornsh Transm

- Page 79 and 80:

79 APPENDIX B HISTORICAL PEAK DAY D

- Page 81 and 82:

2006 Joint Water System Demand (MLD

- Page 83 and 84:

2007 JoInt Water System Demand (MLD

- Page 85 and 86:

2008 Joint Water System Demand (MLD

- Page 87 and 88:

District of Mission, British Columb

- Page 89 and 90:

89 2008 Annual Report District of M

- Page 91 and 92:

91 Table of Contents Introduction a

- Page 93 and 94:

Municipal Forest — 50th Year Anni

- Page 95 and 96:

Municipal Forest — 50th Year Anni

- Page 97 and 98:

97 Celebrating Municipal Forest - 5

- Page 99 and 100:

Municipal Forest — 50 th Year Ann

- Page 101 and 102:

101 Municipal Forest — 50 th Year

- Page 103 and 104:

103 Municipal Forest — 50' h Year

- Page 105 and 106:

Municipal Forest — 50th Year Anni

- Page 107 and 108:

Municipal Forest — 50 Th Year Ann

- Page 109 and 110:

Municipal Forest — 50th Year Anni

- Page 111 and 112: 111 Municipal Forest — 5O Year An

- Page 113 and 114: Municipal Forest — 50th Year Anni

- Page 115 and 116: Municipal Forest — 50th Year Anni

- Page 117 and 118: Municipal Forest — 50 Th Year Ann

- Page 119 and 120: Municipal Forest — 50 th Year Ann

- Page 121 and 122: Municipal Forest — 50th Year Anni

- Page 123 and 124: Municipal Forest — 50th Year Anni

- Page 125 and 126: Municipal Forest — 5dh Year Anniv

- Page 127 and 128: Municipal Forest — 50 th Year Ann

- Page 129 and 130: Municipal Forest — 50th Year Anni

- Page 131 and 132: 131 Municipal Forest — 50th Year

- Page 133 and 134: Financial Statements 133 SCHEDULE 1

- Page 135 and 136: Financial Statements 135 SCHEDULE 2

- Page 137 and 138: Municipal Forest - 50th Year Annive

- Page 139 and 140: Financial Statements 139 SCHEDULE 4

- Page 141 and 142: Financial Statements 141 SCHEDULE 5

- Page 143 and 144: Municipal Forest - 50th Year Annive

- Page 145 and 146: 145 Financial Statements Consolidat

- Page 147 and 148: 147 SCHEDULE 8 Consolidated Expendi

- Page 149 and 150: Financial Statements 149 SCHEDULE 9

- Page 151 and 152: Financial Statements 151 SCHEDULE 9

- Page 153 and 154: 153

- Page 155 and 156: Municipal Forest - 50th Year Annive

- Page 157 and 158: Municipal Forest - 50th Year Annive

- Page 159 and 160: 159 Municipal Forest - 50th Year An

- Page 161: Municipal Forest - 50th Year Annive

- Page 165 and 166: 165 Celebrating Municipal Forest -

- Page 167 and 168: Celebrating Municipal Forest - 50 Y

- Page 169 and 170: Celebrating Municipal Forest - 50 Y

- Page 171 and 172: Celebrating Municipal Forest - 50 Y

- Page 173 and 174: Celebrating Municipal Forest - 50 Y

- Page 175 and 176: 175 LOCATION and MAP OF MISSION The

- Page 177 and 178: 177 Caitlyn Rhododendron — Missio

- Page 179 and 180: 179 BDO April 16, 2009 Members of C

- Page 181 and 182: 181 District of Mission — 2008 Au

- Page 183 and 184: 183 District of Mission — 2008 Au

- Page 185 and 186: 185 Possible Aggregate Misstatement

- Page 187 and 188: 187 District of Mission — 2008 Au

- Page 189 and 190: 189 District of Mission — 2008 Au

- Page 191 and 192: 191 District of Mission — 2008 Au

- Page 193 and 194: 193 District of Mission — 2008 Au

- Page 195 and 196: 195 Appendix C — Audit Planning L

- Page 197 and 198: 197 District of Mission — 2008 Au

- Page 199 and 200: 199 District of Mission — 2008 Au

- Page 201 and 202: 201 District of Mission — 2008 Au

- Page 203 and 204: 203 • Indicators of Financial Con

- Page 205 and 206: 205 District of Mission - 2008 Audi

- Page 207 and 208: 207 lsslon MDISTRICT OF ON THE FRAS

- Page 209 and 210: 3 209 that it would be beneficial t

- Page 211 and 212: 5 211 3. Assisting Public instituti

- Page 213 and 214:

7 213 housing committee met with la

- Page 215 and 216:

9 215 The purpose of this committee

- Page 217 and 218:

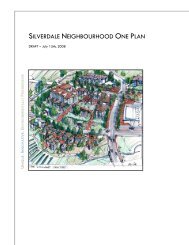

217 11 ToP participatory planning a

- Page 219 and 220:

219 DISTRICT OF 1S S ion --44* ON T

- Page 221 and 222:

221 Corporate Administration INFORM

- Page 223 and 224:

223 iii. for which the total number

- Page 225 and 226:

225 provocation, to cause injury or

- Page 227 and 228:

227 SUMMARY TABLE OF BYLAW REQUIREM

- Page 229 and 230:

District of Mission Memo 229 File C

- Page 231 and 232:

II 2 33429 33470 33475 5342 8334 53

- Page 233 and 234:

, tU C. IN U STAVE — SOUTH OF DEW

- Page 235 and 236:

: I P 12,41-1 C T fl 01- 4'22: •-

- Page 237 and 238:

LOT 27 LOT `6 I I NOTES: 1. LOTS FR

- Page 239 and 240:

2 3 6( DRAFT PLAN OF SUBDIVISION OF

- Page 241 and 242:

BANNISTER DR. 35 I " .4' 35 36 if i

- Page 243 and 244:

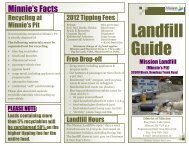

243 2 Uncovered Loads July 2007 to

- Page 245 and 246:

245 From: Jennifer Russell Sent: Mo

- Page 247 and 248:

247 From: Jennifer Russell Sent: Mo

- Page 249 and 250:

06/03/2009 08:52 6048264319 MMSI WA

- Page 251 and 252:

06/03/2009 08:52 6048264319 MMSI WA

- Page 253 and 254:

06/03/2009 08:52 6048264319 MMSI WA

- Page 255 and 256:

06/03/2009 08:52 6048264319 MMSI WA

- Page 257 and 258:

257 MINUTES of the SPECIAL MEETING

- Page 259 and 260:

259 MINUTES of the REGULAR MEETING

- Page 261 and 262:

261 Regular Council Meeting Page 3

- Page 263 and 264:

263 Regular Council Meeting Page 5

- Page 265 and 266:

265 Regular Council Meeting Page 7

- Page 267 and 268:

267 Regular Council Meeting Page 9

- Page 269 and 270:

269 Regular Council Meeting Page 11

- Page 271 and 272:

271 Regular Council Meeting Page 13

- Page 273 and 274:

273 Regular Council Meeting Page 15

- Page 275 and 276:

275 MINUTES of the SPECIAL MEETING

- Page 277 and 278:

277 Special Council Meeting Page 3

- Page 279 and 280:

279 ITN 13L.sr Placc H BROWNFIELD R

- Page 281 and 282:

281 BROWNFIELD RENEWAL FUNDING PROG

- Page 283 and 284:

283 BROWNFIELD RENEWAL FUNDING PROG

- Page 285 and 286:

285 BROWNFIELD RENEWAL FUNDING PROG

- Page 287 and 288:

287 BROWNFIELD RENEWAL FUNDING PROG

- Page 289 and 290:

289 Mayor and Council of Mission Fi

- Page 291 and 292:

291 Fee Structure Proposal Proposal

- Page 293 and 294:

293 From: Jennifer Russell Sent: We