2013 Annual Budget - City of Bremerton

2013 Annual Budget - City of Bremerton

2013 Annual Budget - City of Bremerton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Due to ongoing economic conditions a collection<br />

rate <strong>of</strong> 95% has been used to estimate revenue, a<br />

1% increase from prior year. With voter approval<br />

<strong>of</strong> I-747, cities are limited to revenue increases<br />

<strong>of</strong> the lesser <strong>of</strong> inflation or one percent<br />

plus new construction each year. In years in<br />

which the inflation rate is less than one percent<br />

there is a hardship provision that allows the <strong>City</strong>,<br />

if tax vote room is available, to assess up to a one<br />

percent increase. The current year inflation rate<br />

is expected to be above one percent and the<br />

budget includes a levy increase <strong>of</strong> one percent.<br />

In addition, the EMS tax levy <strong>of</strong> fifty cents<br />

($0.50) per thousand dollars ($1,000) <strong>of</strong> assessed<br />

valuation, has been levied with estimated revenue<br />

<strong>of</strong> $1.2M. Due to a projected decrease in<br />

assessed valuation for taxes levied for collection<br />

in 2012, and the maximum rate <strong>of</strong> fifty cents per<br />

thousand dollars, anticipated collections, including<br />

delinquencies, will decrease by $114k. The<br />

following tables recap the <strong>City</strong>’s recent property<br />

tax levy information along with <strong>2013</strong> estimates.<br />

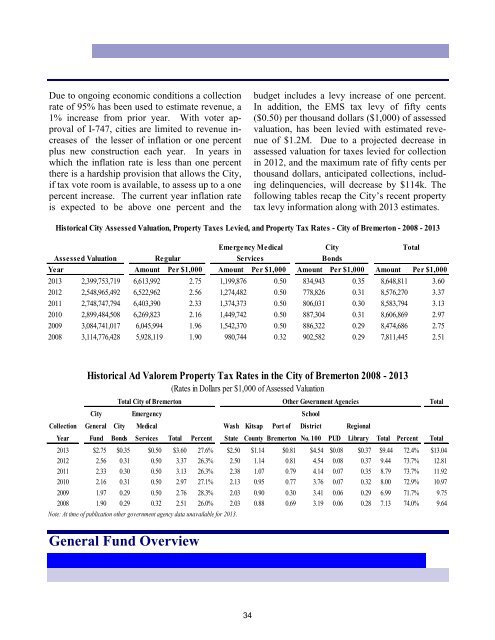

Historical <strong>City</strong> Assessed Valuation, Property Taxes Levied, and Property Tax Rates - <strong>City</strong> <strong>of</strong> <strong>Bremerton</strong> - 2008 - <strong>2013</strong><br />

Emergency Medical<br />

<strong>City</strong><br />

Total<br />

Assessed Valuation<br />

Regular<br />

Services<br />

Bonds<br />

Year Amount Per $1,000 Amount Per $1,000 Amount Per $1,000 Amount Per $1,000<br />

<strong>2013</strong> 2,399,753,719 6,613,992 2.75 1,199,876 0.50 834,943 0.35 8,648,811 3.60<br />

2012 2,548,965,492 6,522,962 2.56 1,274,482 0.50 778,826 0.31 8,576,270 3.37<br />

2011 2,748,747,794 6,403,390 2.33 1,374,373 0.50 806,031 0.30 8,583,794 3.13<br />

2010 2,899,484,508 6,269,823 2.16 1,449,742 0.50 887,304 0.31 8,606,869 2.97<br />

2009 3,084,741,017 6,045,994 1.96 1,542,370 0.50 886,322 0.29 8,474,686 2.75<br />

2008 3,114,776,428 5,928,119 1.90 980,744 0.32 902,582 0.29 7,811,445 2.51<br />

Historical Ad Valorem Property Tax Rates in the <strong>City</strong> <strong>of</strong> <strong>Bremerton</strong> 2008 - <strong>2013</strong><br />

(Rates in Dollars per $1,000 <strong>of</strong> Assessed Valuation<br />

Total <strong>City</strong> <strong>of</strong> <strong>Bremerton</strong><br />

Other Government Agencies<br />

Total<br />

<strong>City</strong> Emergency School<br />

Collection General <strong>City</strong> Medical Wash Kitsap Port <strong>of</strong> District Regional<br />

Year Fund Bonds Services Total Percent State County <strong>Bremerton</strong> No. 100 PUD Library Total Percent Total<br />

<strong>2013</strong> $2.75 $0.35 $0.50 $3.60 27.6% $2.50 $1.14 $0.81 $4.54 $0.08 $0.37 $9.44 72.4% $13.04<br />

2012 2.56 0.31 0.50 3.37 26.3% 2.50 1.14 0.81 4.54 0.08 0.37 9.44 73.7% 12.81<br />

2011 2.33 0.30 0.50 3.13 26.3% 2.38 1.07 0.79 4.14 0.07 0.35 8.79 73.7% 11.92<br />

2010 2.16 0.31 0.50 2.97 27.1% 2.13 0.95 0.77 3.76 0.07 0.32 8.00 72.9% 10.97<br />

2009 1.97 0.29 0.50 2.76 28.3% 2.03 0.90 0.30 3.41 0.06 0.29 6.99 71.7% 9.75<br />

2008 1.90 0.29 0.32 2.51 26.0% 2.03 0.88 0.69 3.19 0.06 0.28 7.13 74.0% 9.64<br />

Note: At time <strong>of</strong> publication other government agency data unavailable for <strong>2013</strong>.<br />

General Fund Overview<br />

34