2013 Annual Budget - City of Bremerton

2013 Annual Budget - City of Bremerton

2013 Annual Budget - City of Bremerton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

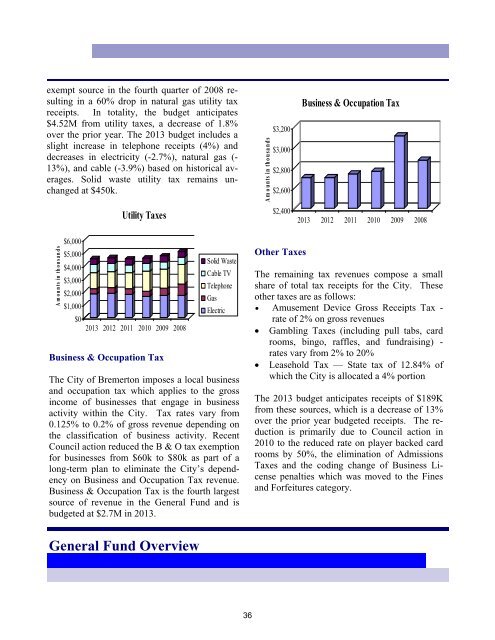

exempt source in the fourth quarter <strong>of</strong> 2008 resulting<br />

in a 60% drop in natural gas utility tax<br />

receipts. In totality, the budget anticipates<br />

$4.52M from utility taxes, a decrease <strong>of</strong> 1.8%<br />

over the prior year. The <strong>2013</strong> budget includes a<br />

slight increase in telephone receipts (4%) and<br />

decreases in electricity (-2.7%), natural gas (-<br />

13%), and cable (-3.9%) based on historical averages.<br />

Solid waste utility tax remains unchanged<br />

at $450k.<br />

Utility Taxes<br />

Am ounts in thousands<br />

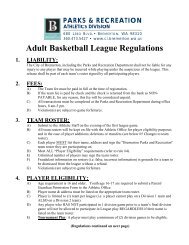

$3,200<br />

$3,000<br />

$2,800<br />

$2,600<br />

$2,400<br />

Business & Occupation Tax<br />

<strong>2013</strong> 2012 2011 2010 2009 2008<br />

Amounts in thousands<br />

$6,000<br />

$5,000<br />

$4,000<br />

$3,000<br />

$2,000<br />

$1,000<br />

$0<br />

<strong>2013</strong> 2012 2011 2010 2009 2008<br />

Business & Occupation Tax<br />

Solid Waste<br />

Cable TV<br />

Telephone<br />

The <strong>City</strong> <strong>of</strong> <strong>Bremerton</strong> imposes a local business<br />

and occupation tax which applies to the gross<br />

income <strong>of</strong> businesses that engage in business<br />

activity within the <strong>City</strong>. Tax rates vary from<br />

0.125% to 0.2% <strong>of</strong> gross revenue depending on<br />

the classification <strong>of</strong> business activity. Recent<br />

Council action reduced the B & O tax exemption<br />

for businesses from $60k to $80k as part <strong>of</strong> a<br />

long-term plan to eliminate the <strong>City</strong>’s dependency<br />

on Business and Occupation Tax revenue.<br />

Business & Occupation Tax is the fourth largest<br />

source <strong>of</strong> revenue in the General Fund and is<br />

budgeted at $2.7M in <strong>2013</strong>.<br />

Gas<br />

Electric<br />

Other Taxes<br />

The remaining tax revenues compose a small<br />

share <strong>of</strong> total tax receipts for the <strong>City</strong>. These<br />

other taxes are as follows:<br />

Amusement Device Gross Receipts Tax -<br />

rate <strong>of</strong> 2% on gross revenues<br />

Gambling Taxes (including pull tabs, card<br />

rooms, bingo, raffles, and fundraising) -<br />

rates vary from 2% to 20%<br />

Leasehold Tax — State tax <strong>of</strong> 12.84% <strong>of</strong><br />

which the <strong>City</strong> is allocated a 4% portion<br />

The <strong>2013</strong> budget anticipates receipts <strong>of</strong> $189K<br />

from these sources, which is a decrease <strong>of</strong> 13%<br />

over the prior year budgeted receipts. The reduction<br />

is primarily due to Council action in<br />

2010 to the reduced rate on player backed card<br />

rooms by 50%, the elimination <strong>of</strong> Admissions<br />

Taxes and the coding change <strong>of</strong> Business License<br />

penalties which was moved to the Fines<br />

and Forfeitures category.<br />

General Fund Overview<br />

36