2013 Annual Budget - City of Bremerton

2013 Annual Budget - City of Bremerton

2013 Annual Budget - City of Bremerton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

save money. This year, the <strong>City</strong> refunded its general obligation bonds associated with the<br />

Norm Dick’s Government Center. This refunding (refinancing) will save the <strong>City</strong><br />

approximately $1,690,000 over the remaining life <strong>of</strong> the bond. (The <strong>City</strong> did not extend the<br />

remaining life <strong>of</strong> the bond, keeping the original 2034 maturity date.) This resulted in a direct<br />

savings to the <strong>2013</strong> general fund <strong>of</strong> over $135,000.<br />

<br />

<br />

<br />

<br />

<br />

During 2011, the <strong>City</strong> created two new funds, an Accumulated Leave Fund and Employment<br />

Security Fund, to address short term and long term liabilities associated with personnel. The<br />

<strong>City</strong> is self insured for unemployment benefits but has not in the past funded this liability.<br />

Also, the <strong>City</strong> has an obligation to cash out accumulated leave banks for those employees that<br />

leave <strong>City</strong> service. With the creation <strong>of</strong> these funds, the <strong>City</strong> is moving toward increasing<br />

fiscal stability by incorporating these costs into our annually budgeted personnel expenditures<br />

and having them centralized in a dedicated fund to minimize the impact to the operational<br />

budgets for each department. The <strong>2013</strong> budget continues this initiative.<br />

As with 2012 and in keeping with the conservative approach, capital and/or special projects<br />

that require grant funding have only been budgeted if the grant funding has already been<br />

awarded. Any projects that require new grants have not been identified in this budget. If the<br />

<strong>City</strong> applies for and receives grant funding for new projects/programs during <strong>2013</strong>, the <strong>City</strong><br />

will amend the budget at that time. By taking this approach, we can assure our citizens that<br />

full discussion can occur before we expend resources for items that we may not receive.<br />

To increase transparency regarding using on-going revenues to fund on-going expenditures,<br />

we separated capital into individual funds for each <strong>of</strong> our utilities with the 2012 <strong>Budget</strong> and<br />

will continue this practice with the <strong>2013</strong> <strong>Budget</strong>. By isolating out the capital from our ongoing<br />

operations and maintenance (O&M) costs, we can better identify our O&M costs to<br />

better analyze our revenue needs. In addition, the <strong>City</strong> is currently undergoing a<br />

comprehensive rate analysis <strong>of</strong> all three utilities. We are working with a Citizen Advisory<br />

Committee during this process and will be providing many opportunities for public input<br />

before any final decisions are made.<br />

As mentioned in the prior bullet, the <strong>City</strong> is currently undergoing a comprehensive rate<br />

analysis for its three utilities (Water, Wastewater, and Stormwater). Until this study is<br />

complete, there are no utility rate increases in the <strong>2013</strong> <strong>Budget</strong>. This study includes an<br />

analysis <strong>of</strong> how we do business (our costs) as well as our revenue needs to adequately fund not<br />

only our operations and maintenance, but also our future capital and system replacement<br />

needs. In preparation <strong>of</strong> and concurrent with the rate study, the Public Works Utility<br />

departments have done an exemplary job <strong>of</strong> analyzing and minimizing their cost <strong>of</strong> service<br />

delivery, which has been incorporated in this budget. Once the rate study is complete, any<br />

changes that may result from this study can be incorporated into the <strong>2013</strong> <strong>Budget</strong> through a<br />

budget amendment.<br />

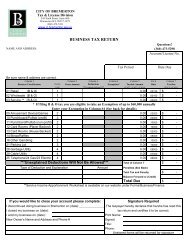

This budget proposes no changes to our current PILOT or commercial parking tax rates but<br />

does incorporate an increase to the B&O tax exemption rate to assist our small businesses.<br />

The Council, with Administration’s cooperation, has increased the B&O tax exemption level<br />

by $20,000, raising the level from $60,000 to $80,000 for annual gross income. In addition, it<br />

is intended that the B&O tax exemption level increase each year by $20,000 until the B&O tax<br />

is eliminated. The <strong>City</strong> acknowledges that at a rate <strong>of</strong> $20,000 annually for increases, the