- Page 1 and 2: Annual Report 2011 Relazione interm

- Page 3 and 4: Statements of Comprehensive Income

- Page 5 and 6: Letter to the Shareholders To the S

- Page 7 and 8: Key Operating and Financial Data -

- Page 9 and 10: The trend of the key operating and

- Page 11 and 12: Liquidity margin: at December 31, 2

- Page 13 and 14: Consolidated Operating and Financia

- Page 15 and 16: Review of Operating and Financial P

- Page 17 and 18: The fixed-line area, with a contrac

- Page 19 and 20: - lower expenses of 246 million eur

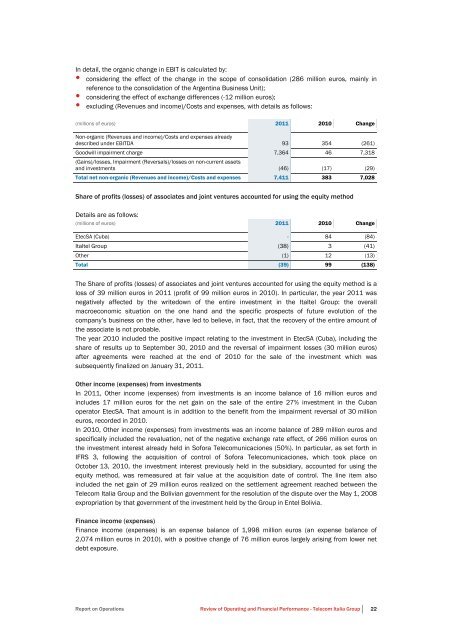

- Page 21: Business Unit (-329 million euros)

- Page 25 and 26: eflect the definitive fair value of

- Page 27 and 28: Capital expenditures on an accrual

- Page 29 and 30: Finance expenses, income taxes and

- Page 31 and 32: The financial risk management polic

- Page 33 and 34: On August 3, 2011, a bilateral stan

- Page 35 and 36: Research and Development As for “

- Page 37 and 38: Consolidated Financial Statements -

- Page 39 and 40: Consolidated Statements of Financia

- Page 41 and 42: Consolidated Statements of Cash Flo

- Page 43 and 44: Highlights - The Business Units of

- Page 45 and 46: The Business Units of the Telecom I

- Page 47 and 48: International Wholesale (millions o

- Page 49 and 50: compared to the same period of 2010

- Page 51 and 52: In detail: (millions of euros) 2011

- Page 53 and 54: Cubomusica GRATIS per 1 anno. Durin

- Page 55 and 56: In particular, for the unbundling c

- Page 57 and 58: International roaming On July 6, 20

- Page 59 and 60: For the telecommunications operator

- Page 61 and 62: Brazil The Telecom Italia Group ope

- Page 63 and 64: EBIT EBIT is 2,294 million reais, i

- Page 65 and 66: Argentina The Telecom Italia Group

- Page 67 and 68: Mobile telephony service: Telecom P

- Page 69 and 70: Again with regard to value-added se

- Page 71 and 72: Revenues Revenues amount to 238 mil

- Page 73 and 74:

Principal changes in the regulatory

- Page 75 and 76:

• it erroneously attributed the m

- Page 77 and 78:

European sales recorded a good tren

- Page 79 and 80:

Review of Operating and Financial P

- Page 81 and 82:

The reduction of 483 million euros

- Page 83 and 84:

(162 million euros, on the basis of

- Page 85 and 86:

Equity Equity amounts to 20,537 mil

- Page 87 and 88:

Dividends flow Dividends paid amoun

- Page 89 and 90:

Bonds Bonds at December 31, 2011 to

- Page 91 and 92:

Financial Statements - Telecom Ital

- Page 93 and 94:

Statements of Financial Position (m

- Page 95 and 96:

Additional Cash Flow Information (m

- Page 97 and 98:

Corporate Boards at December 31, 20

- Page 99 and 100:

Macro-Organization Group at Decembe

- Page 101 and 102:

other sources of information, the p

- Page 103 and 104:

Relative performance by Tim Partici

- Page 105 and 106:

Related Party Transactions In accor

- Page 107 and 108:

the Dow Jones Sustainability World

- Page 109 and 110:

Economic value generated and distri

- Page 111 and 112:

Type of customer care customer Over

- Page 113 and 114:

Involvement initiatives For the fif

- Page 115 and 116:

Vehicles Telecom Italia S.p.A. 2011

- Page 117 and 118:

• cogeneration/trigeneration: 5 l

- Page 119 and 120:

• an increase in emissions attrib

- Page 121 and 122:

channels have been registered as "D

- Page 123 and 124:

• Network and service platform in

- Page 125 and 126:

• E-learning and evolved teaching

- Page 127 and 128:

Tim Brasil Group (units) 12.31.2011

- Page 129 and 130:

Development The 2010 Group performa

- Page 131 and 132:

Internal communication The main act

- Page 133 and 134:

introduced on this subject. The agr

- Page 135 and 136:

On August 2, 2011 the second phase

- Page 137 and 138:

The Risk Management department mana

- Page 139 and 140:

Net financial debt is calculated as

- Page 141 and 142:

Bundle. Commercial offer including

- Page 143 and 144:

HFC (Hydrofluorocarbons). Hydrofluo

- Page 145 and 146:

Shared Access. Methods of shared ac

- Page 147 and 148:

Consolidated Financial Statements a

- Page 149 and 150:

Note 34 - Other income (expenses) f

- Page 151 and 152:

Equity and Liabilities (millions of

- Page 153 and 154:

Consolidated Statements of Comprehe

- Page 155 and 156:

Consolidated Statements of Cash Flo

- Page 157 and 158:

Note 1 - Form, content and other ge

- Page 159 and 160:

• Argentina: includes fixed (Tele

- Page 161 and 162:

Note 2 - Accounting policies Going

- Page 163 and 164:

case of loss of control of a subsid

- Page 165 and 166:

Impairment of intangible and tangib

- Page 167 and 168:

• held to maturity (originally mo

- Page 169 and 170:

Inventories Inventories are measure

- Page 171 and 172:

Revenues are recognized to the exte

- Page 173 and 174:

Use of estimates The preparation of

- Page 175 and 176:

Note 3 - Business combinations Acqu

- Page 177 and 178:

Acquisition of control of Sofora Te

- Page 179 and 180:

Note 4 - Goodwill Goodwill shows th

- Page 181 and 182:

Core Domestic International Wholesa

- Page 183 and 184:

Changes in key variables needed to

- Page 185 and 186:

Concessions, licenses, trademarks a

- Page 187 and 188:

Note 6 - Tangible assets (owned and

- Page 189 and 190:

Gross carrying amount, accumulated

- Page 191 and 192:

Gross carrying amount, accumulated

- Page 193 and 194:

Aggregate data for 2011 and 2010, p

- Page 195 and 196:

Note 9 - Financial assets (non-curr

- Page 197 and 198:

Note 10 - Miscellaneous receivables

- Page 199 and 200:

The temporary differences which mak

- Page 201 and 202:

In addition to this effect, the inc

- Page 203 and 204:

Note 13 - Trade and miscellaneous r

- Page 205 and 206:

Note 14 - Equity Equity includes: (

- Page 207 and 208:

• the reduction of share capital

- Page 209 and 210:

• to mandate the board of directo

- Page 211 and 212:

Gross financial debt according to t

- Page 213 and 214:

The following table lists the bonds

- Page 215 and 216:

Nortel Inversora S.A. Preferred Ser

- Page 217 and 218:

Such obligation, required by nation

- Page 219 and 220:

Revolving Credit Facility The follo

- Page 221 and 222:

Note 17 - Financial risk management

- Page 223 and 224:

of market parameters, even though t

- Page 225 and 226:

In order to limit the risk of the n

- Page 227 and 228:

Note 18 -Derivatives Derivative fin

- Page 229 and 230:

Note 19 - Supplementary disclosures

- Page 231 and 232:

Comparison between carrying amount

- Page 233 and 234:

Carrying amount for each class of f

- Page 235 and 236:

Fair value hierarchy level for each

- Page 237 and 238:

Note 20 - Employee benefits Employe

- Page 239 and 240:

The effect on the income statement,

- Page 241 and 242:

Note 22 - Miscellaneous payables an

- Page 243 and 244:

Note 24 - Contingent liabilities, o

- Page 245 and 246:

On December 16, 2011 Telecom Italia

- Page 247 and 248:

In a judgement on November 2, 2011,

- Page 249 and 250:

Greece -DELAN During 2009, the comp

- Page 251 and 252:

c) Commitments and guarantees Guara

- Page 253 and 254:

Note 27 - Acquisition of goods and

- Page 255 and 256:

Note 29 - Other operating expenses

- Page 257 and 258:

Note 32 - Gains (losses) on disposa

- Page 259 and 260:

Note 34 - Other income (expenses) f

- Page 261 and 262:

Finance expenses Finance expenses d

- Page 263 and 264:

Note 36 - Profit (loss) for the yea

- Page 265 and 266:

Future potential changes in share c

- Page 267 and 268:

Note 38 - Segment reporting a) Repo

- Page 269 and 270:

Headcount by Operating Segment (num

- Page 271 and 272:

The effects on the individual line

- Page 273 and 274:

Transactions with associates and jo

- Page 275 and 276:

Transactions with companies control

- Page 277 and 278:

Transactions with other related par

- Page 279 and 280:

(millions of euros) 12/31/2011 12/3

- Page 281 and 282:

In the 2011, the contributions paid

- Page 283 and 284:

Description of other Telecom Italia

- Page 285 and 286:

Calculation of fair value measureme

- Page 287 and 288:

Note 41 - Significant non-recurring

- Page 289 and 290:

Note 42 - Positions or transactions

- Page 291 and 292:

c) Operating leases Revenue related

- Page 293 and 294:

Note 44 - Events subsequent to Dece

- Page 295 and 296:

Name Head office Currency Share cap

- Page 297 and 298:

Name Head office Currency Share cap

- Page 299 and 300:

Certification of the Consolidated F

- Page 301 and 302:

Consolidated Financial Statements T

- Page 303 and 304:

Contents Telecom Italia S.p.A. Sepa

- Page 305 and 306:

Statements of Financial Position As

- Page 307 and 308:

Separate Income Statements (euros)

- Page 309 and 310:

Statements of Changes in Equity Sta

- Page 311 and 312:

Additional Cash Flow Information (t

- Page 313 and 314:

Profit (loss) before tax from conti

- Page 315 and 316:

• the capitalized costs can be me

- Page 317 and 318:

Intangible and tangible assets with

- Page 319 and 320:

Financial liabilities hedged by der

- Page 321 and 322:

Starting from January 1, 2007, Ital

- Page 323 and 324:

Finance income and expenses Finance

- Page 325 and 326:

• IFRIC 19 (Extinguishing Financi

- Page 327 and 328:

The cost of capital used for the es

- Page 329 and 330:

Type of license The net carrying am

- Page 331 and 332:

Note 5 - Tangible assets (owned and

- Page 333 and 334:

12/31/2010 Accumulated impairment l

- Page 335 and 336:

Note 6 - Investments Investments de

- Page 337 and 338:

(thousands of euros) Carrying amoun

- Page 339 and 340:

5,620 thousand euros for receivable

- Page 341 and 342:

Note 8 - Miscellaneous receivables

- Page 343 and 344:

The temporary differences which mak

- Page 345 and 346:

Note 10 - Inventories Inventories a

- Page 347 and 348:

Trade receivables amount to 4,162,0

- Page 349 and 350:

Note 12 - Equity Equity is composed

- Page 351 and 352:

Share capital carries a restriction

- Page 353 and 354:

The following statement provides ad

- Page 355 and 356:

With regard to additional capital i

- Page 357 and 358:

Note 13 - Financial liabilities (no

- Page 359 and 360:

The main components of financial li

- Page 361 and 362:

elating to items classified as curr

- Page 363 and 364:

• the loan contract signed by Tel

- Page 365 and 366:

Note 14 - Net financial debt As req

- Page 367 and 368:

Total Financial liabilities (at the

- Page 369 and 370:

Financial liabilities - Maturities

- Page 371 and 372:

Currency of denomination Notional a

- Page 373 and 374:

Carrying amount for each class of f

- Page 375 and 376:

Fair value hierarchy level for each

- Page 377 and 378:

Comparison between carrying amount

- Page 379 and 380:

Gains and losses by IAS 39 category

- Page 381 and 382:

Under IAS 19, employee severance in

- Page 383 and 384:

Note 19 - Provisions Provisions dec

- Page 385 and 386:

Note 21 - Trade and miscellaneous p

- Page 387 and 388:

Note 22 - Contingent liabilities, o

- Page 389 and 390:

outcome is considered probable. As

- Page 391 and 392:

Federazione Anti Pirateria Audiovis

- Page 393 and 394:

offers, contractual profile changes

- Page 395 and 396:

Note 23 - Revenues Revenues decreas

- Page 397 and 398:

Note 26 - Employee benefits expense

- Page 399 and 400:

Note 30 - Depreciation and amortiza

- Page 401 and 402:

Note 34 - Finance income and Financ

- Page 403 and 404:

Note 35 - Related party transaction

- Page 405 and 406:

STATEMENT OF FINANCIAL POSITION LIN

- Page 407 and 408:

Transactions with subsidiaries The

- Page 409 and 410:

Total income (expenses) from invest

- Page 411 and 412:

(thousands of euros) 12/31/2011 12/

- Page 413 and 414:

STATEMENT OF CASH FLOWS LINE ITEMS

- Page 415 and 416:

STATEMENT OF FINANCIAL POSITION LIN

- Page 417 and 418:

STATEMENT OF FINANCIAL POSITION LIN

- Page 419 and 420:

STATEMENT OF FINANCIAL POSITION LIN

- Page 421 and 422:

Remuneration to key managers In 201

- Page 423 and 424:

The beneficiaries were identified i

- Page 425 and 426:

Parameters used to determine fair v

- Page 427 and 428:

Note 37 - Significant non-recurring

- Page 429 and 430:

Expense related Telecom Italia has

- Page 431 and 432:

Note 41 - List of investments in su

- Page 433 and 434:

Certification of the Separate Finan

- Page 435 and 436:

Telecom Italia S.p.A. Separate Fina

- Page 437 and 438:

Report of the Board of Statutory Au

- Page 439 and 440:

The Board of Auditors has overseen

- Page 441 and 442:

amendments Agreed procedures and de

- Page 443 and 444:

PricewaterhouseCoopers S.p.A. commu

- Page 445 and 446:

On 7 July 2011, after the alignment

- Page 447 and 448:

met the Chairman of the Conselho Fi

- Page 449 and 450:

Regarding the provisions of article

- Page 451 and 452:

18. No significant facts that shoul

- Page 453 and 454:

non-compliances imputable to the ex

- Page 455 and 456:

corporate bodies, and in particular

- Page 457 and 458:

amount equal to 2% of the par value

- Page 459 and 460:

curricula vitae are attached) as Di

- Page 461 and 462:

at least twenty-five days before th

- Page 463 and 464:

Authorization to increase share cap

- Page 465 and 466:

and this is confirmed in a report p

- Page 467 and 468:

5.6 - For five years starting from

- Page 469 and 470:

Proposed Resolution The Shareholder

- Page 471 and 472:

9.8 - In appointing directors who f

- Page 473 and 474:

only one slate. 17.10 - The Board o

- Page 475 and 476:

17.17 - At the first renewal of the