The liquidity of trading partners is the soundness of enterprise during creatingcontacts. Degree of liquidity is related with other areas of management of enterpriseand therefore for the reliable evaluation of the success of business there must be atleast consideration even profitability, as well as other indicators of enterprise’smanagement 7 .Aim of liquidity’s indicators is formulated a potential ability of enterprise topay debts at the moment. Solvency ratios derived enterprise’s liquidity from ratiobetween current assets as the group the most liquid assets and short-term debt asobligations paid in the near future 8 .Payment solvency and Slovak agricultural enterprisesEnterprises have inadequately secured the sale of products, protection againstunwanted price’s movements, production quality and also disposal with costs. This arereasons the primary payment insolvency for enterprise’s subject. A secondary insolvencyconsists in the overdue accounts in specified time and value for customers 9 .The agrosector in present time must respond to declines in sale prices ofvegetable and animal products, sales are decreasing and gets worse liquidity of agrifoodenterprises 10 .At the enterprise’s survival needs there is a need of real money and not only yield onpaper, which is presented in double-entry bookkeeping. Permanent payment ability andliquidity became a short-term enterprise’s aim. The basis for their management is just thecash flow statement 11 .Financial measures from the European funds to support agriculture can beobtained only by producing successful projects oriented on support of productiveagriculture and support of sustainable rural development. Risk is connected with theirdesign 12 .Payments from the CAPSlovakia has the possibility of taking non-refundable financial means from theEU structural funds, from the 1st of January 2004. Time mismatch between demand offinance and actual payout of subsidies from state causes considerable problems tofarmers. Downward payment of subsidies means that money for farmers on this year,7 KOŠČO, T. et al. 2006. Podnikové financie. Nitra: SPU, 2006, 147 s., ISBN 80-8069-725-68 GRÜNWALD, R et al. 1992.Finanční analýzy a plánovaní. Praha: Nad zlato, 1992. 110 s., ISBN 80-900383-8-7,9 SERENČÉŠ, P. 2005. Faktory podnikovej úspešnosti v podmienkach európskeho agrárneho trhu. In: Zborníkz vedeckého seminára, Nitra: SPU, 2005, 44-47 s., ISBN 80-8069-615-2,10 VEREŠPEJOVÁ, A. 2009. Slovenskí farmári, už vás melie hospodárska kríza. In: Farmár, č. 9, 2009, 8-11s., ISSN 1337-740X,11 FICZOVÁ, I. 2000. Vykazovanie Cash flow. In: Finančný manažér, roč. 1, 2000, č. 1, s. 15-19, ISSN 1335-5813,12 KOŠČO, T. – TÓTH, M. 2005. Východiská a pozície poisťovacieho trhu na území Slovenskej a Rakúskejspolkovej republiky. In Zborník z vedeckého seminára s medzinárodnou účasťou (CD) "Faktory podnikovejúspešnosti v podmienkach európskeho agrárneho trhu". Nitra : SPU, 2005, 305-311s., ISBN 80-8069-615-2,159

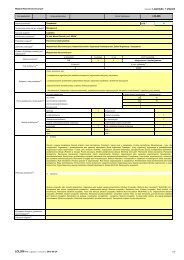

they receive until December and in the worse case Agricultural Paying Agency isauthorized to transfer money until June next year, when is late for agriculture because ofseasonality. Banks actively support projects financed from the EU structural funds toresolve this issue and cover a yearlong demand of finance in agricultural basic industry.Banks provide to farmers bridge loans on frontload support, which can be obtainedmainly through direct payments from EU funds and state budget 13 .One of the priorities of the CAP for the 21st century is that payments from theCAP distributed fairly and insists that the distribution was fair for farmers in the old andnew Member States, too. The team of authors agreed on the fact that all farmers of theEU should be given a direct payments based on area acreage which is financing of EUand they refuse any additional financing, which would undermine fair economiccompetition in the EU single market 14.Material and methodsThe aim of the paper is to calculate liquidity ratios in order to assess influenceof cash flows from the Common Agricultural Policy on liquidity of Slovak tradingcompanies in agriculture in the period 2000-2009.Liquidity indicators, as part of an analysis overall financial situation of entity,allow to formulate ability of an entity to pay obligations on time. In this paper, therewere used ratio indicators of liquidity formulated in the book by Zalai et al. (1998) 15 :The financial-economic analysis of enterprise.L1 cash ratio (liquidity 1st degree) = short term financial assetscurrent liabilitiesL2 current ratio (liquidity 2nd degree) = short term financial assets + short-term debtcurrent liabilitiesL3 total liquidity (liquidity 3rd degree) = short term financial assets + short-term debt + stockcurrent liabilitiesWe have set aside for purposes of calculating only trade companies, so jointstock companies and limited liability companies (code in database 55) from a databaseof agricultural enterprises of the Slovak Republic. Their quantity was 722 beforeapplying the statistical measurement.The region of SR was not taken into account in the calculation. The data aretaken globally for the whole of Slovakia in the period 2000-2009, so 10 years, with anemphasis on assessing whether the financial flows from the CAP contributed toimproving the liquidity or liquidity deteriorated.13BALOGHOVÁ, B. – RÁBEK, T. 2006. Bankový úver ako dôležitá zložka cudzích zdrojov. In:Medzinárodné vedecké dni 2006 „Konkurencieschopnosť v EÚ – výzva pre krajiny V4“. [Zborník na CDROM]. Nitra: SPU, 2006, 1009-1015 s., ISBN 80-8069-704-3,14 SERENČÉŠ et al. 2010. Financie v poľnohospodárstve, 1.vyd. Nitra: SPU, 167- 168 s., ISBN 978-80-552-0438-3,15 ZALAI, K. et al. 1998.: Finančno-ekonomická analýza podniku. Bratislava: SPRINT, ISBN 80-88848-18-0,160

- Page 1 and 2:

5/54Zeszyty NaukoweSzko³y G³ówne

- Page 3 and 4:

RADA PROGRAMOWABogdan Klepacki (SGG

- Page 5 and 6:

Rizovová Beáta, Gašparíkov Vero

- Page 7 and 8:

Według średniego wariantu szacunk

- Page 9 and 10:

Kluczowa dla zrozumienia możliwoś

- Page 11 and 12:

Deklaracji w zakresie praw politycz

- Page 13 and 14:

ezpieczeństwa żywnościowego powi

- Page 15 and 16:

zbóż drastyczne wzrosły z dużym

- Page 17 and 18:

11. Międzynarodowy Pakt Praw Gospo

- Page 19 and 20:

Figure 1. Structure of sales area s

- Page 21 and 22:

Figure 3. Structure of retail sales

- Page 23 and 24:

etail sector is also particularly i

- Page 25 and 26:

• modernity - the introduction of

- Page 27 and 28:

time, place and form. Trade respons

- Page 29 and 30:

The retailer must sometimes very qu

- Page 31 and 32:

equipped with a pretty clear sign t

- Page 33 and 34:

them. Also, very often the wrong wa

- Page 35 and 36:

liquidated. Currently, fruit and ve

- Page 37 and 38:

5 (54) 2011Jarosław GołębiewskiZ

- Page 39 and 40:

nowe formy zawierania transakcji, o

- Page 41 and 42:

koszty połączeń internetowych or

- Page 43 and 44:

on ewoluować z poziomu taktycznego

- Page 45 and 46:

Rysunek 1. Model 3iUczciwość mark

- Page 47 and 48:

produkcji, system informacyjny, sys

- Page 49 and 50:

hiperkonkurencja, problemy środowi

- Page 51 and 52:

5 (54) 2011Ing. Katarína Kleinová

- Page 53 and 54:

Why is it important to have a good

- Page 55 and 56:

oles in international relations, tr

- Page 57 and 58:

Scheme 2 Do you think that the inha

- Page 59 and 60:

REFERENCES[1] GfK USA. 2011. The An

- Page 61 and 62:

potrzeba przetrwanie skutków globa

- Page 63 and 64:

Rysunek 2. Liczba zakładów ubezpi

- Page 65 and 66:

Wzrastający udział w rynku stanow

- Page 67 and 68:

W 2002 r. poprzez placówki bankowe

- Page 69 and 70:

Portugalii, czy Włoch, gdzie udzia

- Page 71 and 72:

companies from the Polish Financial

- Page 73 and 74:

The increase in advertising expendi

- Page 75 and 76:

memo ability ads an advertisement b

- Page 77 and 78:

the sales can be find out from the

- Page 79 and 80:

5 (54) 2011Ľubica Kubicová, Zdenk

- Page 81 and 82:

Graph 1: Consumption of Milk and Da

- Page 83 and 84:

Graph 3: Consumption of Yoghurt per

- Page 85 and 86:

On the basis of the income elastici

- Page 87 and 88:

Producers of Activia Sweet Strawber

- Page 89 and 90:

ConclusionWhen the new product come

- Page 91 and 92:

them in the best possible way with

- Page 93 and 94:

"The integration of business practi

- Page 95 and 96:

DJSI indexes belong to the world's

- Page 97 and 98:

space for staff training in this ar

- Page 99 and 100:

Policy to the community:11. Does yo

- Page 101 and 102:

SummarySocial responsibility and et

- Page 103 and 104:

prowadzi do zwiększenia bieżącej

- Page 105 and 106:

ozwijające się wskazują na wyst

- Page 107 and 108:

wykorzystanych w dalszej części o

- Page 109 and 110: Tabl. 1. Wyniki oszacowania paramet

- Page 111 and 112: 8 16,4 83,6 24,1 75,910 22,1 77,9 2

- Page 113 and 114: Z kolei, uwzględniając współczy

- Page 115 and 116: Literatura1. Diamond P.: National d

- Page 117 and 118: - przemysł spożywczy,- handel i d

- Page 119 and 120: żywnościowego nie należy bowiem

- Page 121 and 122: wpływ na swoje towary. Rolnik musi

- Page 123 and 124: produktów i usług do konsumentów

- Page 125 and 126: Specyfika marketingu w agrobiznesie

- Page 127 and 128: maksymalizację zysku, na pragnieni

- Page 129 and 130: dóbr i usług wybranym klientom w

- Page 131 and 132: 14. Pilarczyk B., Nestorowicz R., M

- Page 133 and 134: Fibres from sunflower stems are use

- Page 135 and 136: the incoming world economic crisis,

- Page 137 and 138: Tab 4 Break-event points of sunflow

- Page 139 and 140: 5 (54) 2011Beáta Rizovová, Veroni

- Page 141 and 142: CostsImportance ofmedia withincommu

- Page 143 and 144: 4 TABLE 3. TOP 10 ADVERTISERS AND T

- Page 145 and 146: Own surveyFor processing the proble

- Page 147 and 148: Following chart 3 give a review of

- Page 149 and 150: Information about authorsIng. Veron

- Page 151 and 152: 27 also agreed to further cut direc

- Page 153 and 154: In new EU budget perspective for th

- Page 155 and 156: Table 2 shows agrarian commodities

- Page 157 and 158: Contact AddressIng. Patrik Rovný,

- Page 159: welcomed by agrarian producers with

- Page 163 and 164: Table 1 Structure of agricultural e

- Page 165 and 166: the year 2004 the change in the lev

- Page 167 and 168: 3 Total liquidity (L3)Analysis of l

- Page 169 and 170: make effort for its development and

- Page 171 and 172: 5 (54) 2011Dušan ŠimoForeign trad

- Page 173 and 174: the sales network of food chains an

- Page 175 and 176: Table 3 shows the significantly inc

- Page 177 and 178: 5 (54) 2011Dariusz StrzębickiSelli

- Page 179 and 180: • monetary value of agricultural

- Page 181 and 182: Figure 2. The website of the citrus

- Page 183 and 184: service, to reduce promotional cost

- Page 185 and 186: • USDA Never Ever Three - means t

- Page 187 and 188: quality. The products offered on th

- Page 189 and 190: Many of these electronic commerce B

- Page 191 and 192: commodities the market also offers

- Page 193 and 194: • thanks to the electronic market

- Page 195 and 196: delivery points. The warehouses are

- Page 197 and 198: 10. Stone J.: Local farmers sell pr

- Page 199 and 200: - Means to finance the start of com

- Page 201 and 202: of investment in EUR is 132 776 and

- Page 203 and 204: Table no. 3 Overview of suitable fi

- Page 205 and 206: Slovakia lags behind not only the c

- Page 207 and 208: The main sources of information in

- Page 209 and 210: 5 (54) 2011Marián TóthImpact of C

- Page 211 and 212:

ResultsTaking into account the comp

- Page 213 and 214:

possible and the importance of subs

- Page 215 and 216:

Figure 3Profit/hectare of agricultu