Südzucker International Finance B. V. Südzucker AG ... - Xetra

Südzucker International Finance B. V. Südzucker AG ... - Xetra

Südzucker International Finance B. V. Südzucker AG ... - Xetra

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

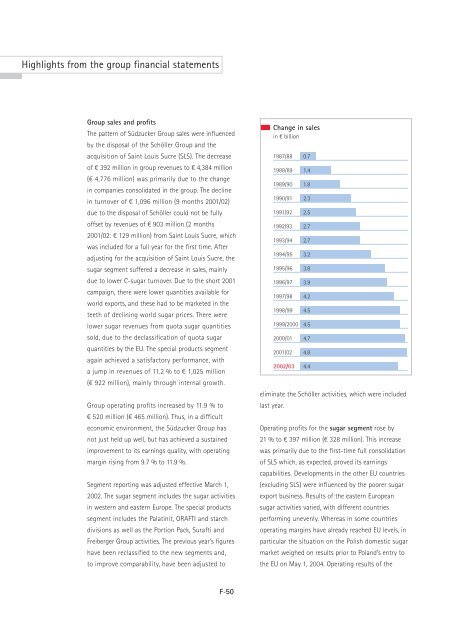

Highlights from the group financial statementsGroup sales and profitsThe pattern of <strong>Südzucker</strong> Group sales were influencedby the disposal of the Schöller Group and theacquisition of Saint Louis Sucre (SLS). The decreaseof D 392 million in group revenues to D 4,384 million(D 4,776 million) was primarily due to the changein companies consolidated in the group. The declinein turnover of D 1,096 million (9 months 2001/02)due to the disposal of Schöller could not be fullyoffset by revenues of D 903 million (2 months2001/02: D 129 million) from Saint Louis Sucre, whichwas included for a full year for the first time. Afteradjusting for the acquisition of Saint Louis Sucre, thesugar segment suffered a decrease in sales, mainlydue to lower C-sugar turnover. Due to the short 2001campaign, there were lower quantities available forworld exports, and these had to be marketed in theteeth of declining world sugar prices. There werelower sugar revenues from quota sugar quantitiessold, due to the declassification of quota sugarquantities by the EU. The special products segmentagain achieved a satisfactory performance, witha jump in revenues of 11.2 % to D 1,025 million(D 922 million), mainly through internal growth.Group operating profits increased by 11.9 % toD 520 million (D 465 million). Thus, in a difficulteconomic environment, the <strong>Südzucker</strong> Group hasnot just held up well, but has achieved a sustainedimprovement to its earnings quality, with operatingmargin rising from 9.7 % to 11.9 %.Segment reporting was adjusted effective March 1,2002. The sugar segment includes the sugar activitiesin western and eastern Europe. The special productssegment includes the Palatinit, ORAFTI and starchdivisions as well as the Portion Pack, Surafti andFreiberger Group activities. The previous year’s figureshave been reclassified to the new segments and,to improve comparability, have been adjusted toChange in salesin D billion1987/88 0.71988/89 1.41989/901990/911.82.31991/92 2.51992/93 2.71993/94 2.71994/95 3.21995/96 3.81996/97 3.91997/98 4.21998/99 4.51999/20002000/014.54.72001/02 4.82002/034.4eliminate the Schöller activities, which were includedlast year.Operating profits for the sugar segment rose by21 % to D 397 million (D 328 million). This increasewas primarily due to the first-time full consolidationof SLS which, as expected, proved its earningscapabilities. Developments in the other EU countries(excluding SLS) were influenced by the poorer sugarexport business. Results of the eastern Europeansugar activities varied, with different countriesperforming unevenly. Whereas in some countriesoperating margins have already reached EU levels, inparticular the situation on the Polish domestic sugarmarket weighed on results prior to Poland’s entry tothe EU on May 1, 2004. Operating results of theF-50