Südzucker International Finance B. V. Südzucker AG ... - Xetra

Südzucker International Finance B. V. Südzucker AG ... - Xetra

Südzucker International Finance B. V. Südzucker AG ... - Xetra

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

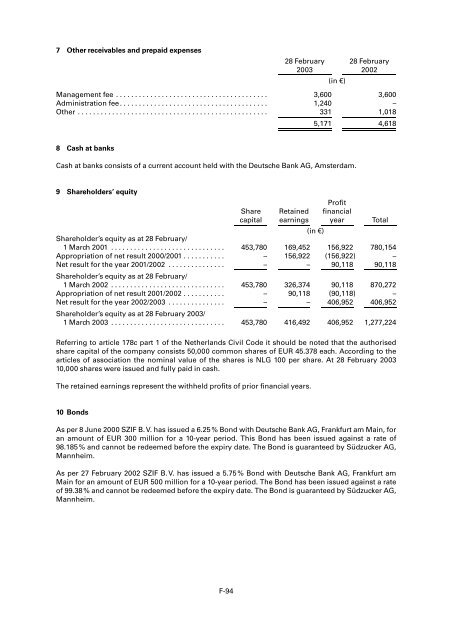

7 Other receivables and prepaid expenses28 February2003(in 5)28 February2002Management fee . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,600 3,600Administration fee . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,240 –Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 331 1,0185,171 4,6188 Cash at banksCash at banks consists of a current account held with the Deutsche Bank <strong>AG</strong>, Amsterdam.9 Shareholders’ equitySharecapitalRetainedearningsProfitfinancialyearTotal(in 5)Shareholder’s equity as at 28 February/1 March 2001 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 453,780 169,452 156,922 780,154Appropriation of net result 2000/2001 . . . . . . . . . . . – 156,922 (156,922) –Net result for the year 2001/2002 . . . . . . . . . . . . . . . – – 90,118 90,118Shareholder’s equity as at 28 February/1 March 2002 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 453,780 326,374 90,118 870,272Appropriation of net result 2001/2002 . . . . . . . . . . . – 90,118 (90,118) –Net result for the year 2002/2003 . . . . . . . . . . . . . . . – – 406,952 406,952Shareholder’s equity as at 28 February 2003/1 March 2003 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 453,780 416,492 406,952 1,277,224Referring to article 178c part 1 of the Netherlands Civil Code it should be noted that the authorisedshare capital of the company consists 50,000 common shares of EUR 45.378 each. According to thearticles of association the nominal value of the shares is NLG 100 per share. At 28 February 200310,000 shares were issued and fully paid in cash.The retained earnings represent the withheld profits of prior financial years.10 BondsAs per 8 June 2000 SZIF B. V. has issued a 6.25 % Bond with Deutsche Bank <strong>AG</strong>, Frankfurt am Main, foran amount of EUR 300 million for a 10-year period. This Bond has been issued against a rate of98.185% and cannot be redeemed before the expiry date. The Bond is guaranteed by <strong>Südzucker</strong> <strong>AG</strong>,Mannheim.As per 27 February 2002 SZIF B. V. has issued a 5.75% Bond with Deutsche Bank <strong>AG</strong>, Frankfurt amMain for an amount of EUR 500 million for a 10-year period. The Bond has been issued against a rateof 99.38% and cannot be redeemed before the expiry date. The Bond is guaranteed by <strong>Südzucker</strong> <strong>AG</strong>,Mannheim.F-94