Südzucker International Finance B. V. Südzucker AG ... - Xetra

Südzucker International Finance B. V. Südzucker AG ... - Xetra

Südzucker International Finance B. V. Südzucker AG ... - Xetra

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

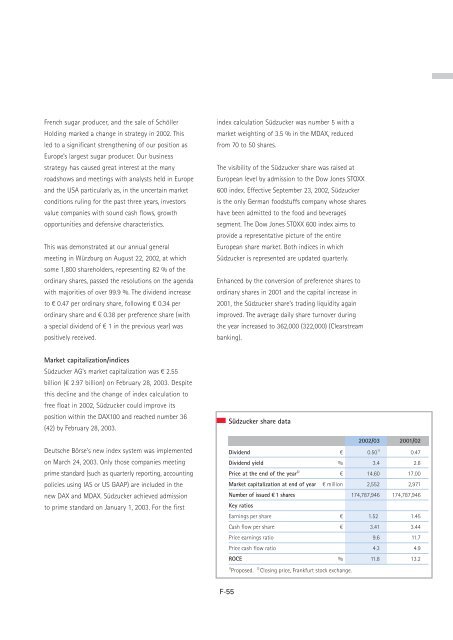

French sugar producer, and the sale of SchöllerHolding marked a change in strategy in 2002. Thisled to a significant strengthening of our position asEurope’s largest sugar producer. Our businessstrategy has caused great interest at the manyroadshows and meetings with analysts held in Europeand the USA particularly as, in the uncertain marketconditions ruling for the past three years, investorsvalue companies with sound cash flows, growthopportunities and defensive characteristics.This was demonstrated at our annual generalmeeting in Würzburg on August 22, 2002, at whichsome 1,800 shareholders, representing 82 % of theordinary shares, passed the resolutions on the agendawith majorities of over 99.9 %. The dividend increaseto D 0.47 per ordinary share, following D 0.34 perordinary share and D 0.38 per preference share (witha special dividend of D 1 in the previous year) waspositively received.index calculation <strong>Südzucker</strong> was number 5 with amarket weighting of 3.5 % in the MDAX, reducedfrom 70 to 50 shares.The visibility of the <strong>Südzucker</strong> share was raised atEuropean level by admission to the Dow Jones STOXX600 index. Effective September 23, 2002, <strong>Südzucker</strong>is the only German foodstuffs company whose shareshave been admitted to the food and beveragessegment. The Dow Jones STOXX 600 index aims toprovide a representative picture of the entireEuropean share market. Both indices in which<strong>Südzucker</strong> is represented are updated quarterly.Enhanced by the conversion of preference shares toordinary shares in 2001 and the capital increase in2001, the <strong>Südzucker</strong> share’s trading liquidity againimproved. The average daily share turnover duringthe year increased to 362,000 (322,000) (Clearstreambanking).Market capitalization/indices<strong>Südzucker</strong> <strong>AG</strong>'s market capitalization was D 2.55billion (D 2.97 billion) on February 28, 2003. Despitethis decline and the change of index calculation tofree float in 2002, <strong>Südzucker</strong> could improve itsposition within the DAX100 and reached number 36(42) by February 28, 2003.Deutsche Börse's new index system was implementedon March 24, 2003. Only those companies meetingprime standard (such as quarterly reporting, accountingpolicies using IAS or US GAAP) are included in thenew DAX and MDAX. <strong>Südzucker</strong> achieved admissionto prime standard on January 1, 2003. For the first<strong>Südzucker</strong> share data2002/03 2001/02Dividend D 0.50 1) 0.47Dividend yield % 3.4 2.8Price at the end of the year 2) D 14.60 17.00Market capitalization at end of year D million 2,552 2,971Number of issued H 1 shares 174,787,946 174,787,946Key ratiosEarnings per share D 1.52 1.45Cash flow per share D 3.41 3.44Price earnings ratio 9.6 11.7Price cash flow ratio 4.3 4.9ROCE % 11.8 13.21)Proposed. 2) Closing price, Frankfurt stock exchange.F-55