PT BERAU COAL AND SUBSIDIARY - Bakrie & Brothers

PT BERAU COAL AND SUBSIDIARY - Bakrie & Brothers

PT BERAU COAL AND SUBSIDIARY - Bakrie & Brothers

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

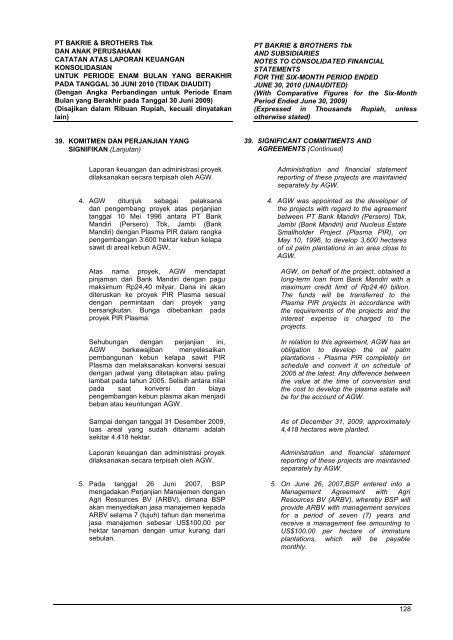

<strong>PT</strong> BAKRIE & BROTHERS TbkDAN ANAK PERUSAHAANCATATAN ATAS LAPORAN KEUANGANKONSOLIDASIANUNTUK PERIODE ENAM BULAN YANG BERAKHIRPADA TANGGAL 30 JUNI 2010 (TIDAK DIAUDIT)(Dengan Angka Perbandingan untuk Periode EnamBulan yang Berakhir pada Tanggal 30 Juni 2009)(Disajikan dalam Ribuan Rupiah, kecuali dinyatakanlain)<strong>PT</strong> BAKRIE & BROTHERS Tbk<strong>AND</strong> SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIALSTATEMENTSFOR THE SIX-MONTH PERIOD ENDEDJUNE 30, 2010 (UNAUDITED)(With Comparative Figures for the Six-MonthPeriod Ended June 30, 2009)(Expressed in Thousands Rupiah, unlessotherwise stated)39. KOMITMEN DAN PERJANJIAN YANGSIGNIFIKAN (Lanjutan)39. SIGNIFICANT COMMITMENTS <strong>AND</strong>AGREEMENTS (Continued)Laporan keuangan dan administrasi proyekdilaksanakan secara terpisah oleh AGW.4. AGW ditunjuk sebagai pelaksanadan pengembang proyek atas perjanjiantanggal 10 Mei 1996 antara <strong>PT</strong> BankMandiri (Persero) Tbk, Jambi (BankMandiri) dengan Plasma PIR dalam rangkapengembangan 3.600 hektar kebun kelapasawit di areal kebun AGW.Atas nama proyek, AGW mendapatpinjaman dari Bank Mandiri dengan pagumaksimum Rp24,40 milyar. Dana ini akanditeruskan ke proyek PIR Plasma sesuaidengan permintaan dari proyek yangbersangkutan. Bunga dibebankan padaproyek PIR Plasma.Sehubungan dengan perjanjian ini,AGW berkewajiban menyelesaikanpembangunan kebun kelapa sawit PIRPlasma dan melaksanakan konversi sesuaidengan jadwal yang ditetapkan atau palinglambat pada tahun 2005. Selisih antara nilaipada saat konversi dan biayapengembangan kebun plasma akan menjadibeban atau keuntungan AGW.Sampai dengan tanggal 31 Desember 2009,luas areal yang sudah ditanami adalahsekitar 4.418 hektar.Laporan keuangan dan administrasi proyekdilaksanakan secara terpisah oleh AGW.5. Pada tanggal 26 Juni 2007, BSPmengadakan Perjanjian Manajemen denganAgri Resources BV (ARBV), dimana BSPakan menyediakan jasa manajemen kepadaARBV selama 7 (tujuh) tahun dan menerimajasa manajemen sebesar US$100,00 perhektar tanaman dengan umur kurang darisebulan.Administration and financial statementreporting of these projects are maintainedseparately by AGW.4. AGW was appointed as the developer ofthe projects with regard to the agreementbetween <strong>PT</strong> Bank Mandiri (Persero) Tbk,Jambi (Bank Mandiri) and Nucleus EstateSmallholder Project (Plasma PIR), onMay 10, 1996, to develop 3,600 hectaresof oil palm plantations in an area close toAGW.AGW, on behalf of the project, obtained along-term loan from Bank Mandiri with amaximum credit limit of Rp24.40 billion.The funds will be transferred to thePlasma PIR projects in accordance withthe requirements of the projects and theinterest expense is charged to theprojects.In relation to this agreement, AGW has anobligation to develop the oil palmplantations - Plasma PIR completely onschedule and convert it on schedule of2005 at the latest. Any difference betweenthe value at the time of conversion andthe cost to develop the plasma estate willbe for the account of AGW.As of December 31, 2009, approximately4,418 hectares were planted.Administration and financial statementreporting of these projects are maintainedseparately by AGW.5. On June 26, 2007,BSP entered into aManagement Agreement with AgriResources BV (ARBV), whereby BSP willprovide ARBV with management servicesfor a period of seven (7) years andreceive a management fee amounting toUS$100.00 per hectare of immatureplantations, which will be payablemonthly.128