PT BERAU COAL AND SUBSIDIARY - Bakrie & Brothers

PT BERAU COAL AND SUBSIDIARY - Bakrie & Brothers

PT BERAU COAL AND SUBSIDIARY - Bakrie & Brothers

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

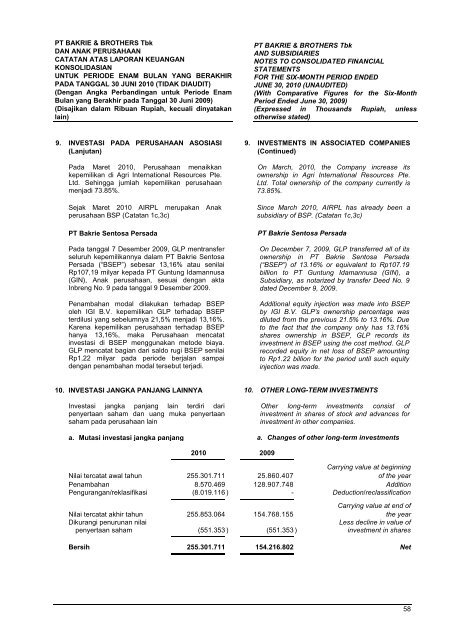

<strong>PT</strong> BAKRIE & BROTHERS TbkDAN ANAK PERUSAHAANCATATAN ATAS LAPORAN KEUANGANKONSOLIDASIANUNTUK PERIODE ENAM BULAN YANG BERAKHIRPADA TANGGAL 30 JUNI 2010 (TIDAK DIAUDIT)(Dengan Angka Perbandingan untuk Periode EnamBulan yang Berakhir pada Tanggal 30 Juni 2009)(Disajikan dalam Ribuan Rupiah, kecuali dinyatakanlain)<strong>PT</strong> BAKRIE & BROTHERS Tbk<strong>AND</strong> SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIALSTATEMENTSFOR THE SIX-MONTH PERIOD ENDEDJUNE 30, 2010 (UNAUDITED)(With Comparative Figures for the Six-MonthPeriod Ended June 30, 2009)(Expressed in Thousands Rupiah, unlessotherwise stated)9. INVESTASI PADA PERUSAHAAN ASOSIASI(Lanjutan)Pada Maret 2010, Perusahaan menaikkankepemilikan di Agri International Resources Pte.Ltd. Sehingga jumlah kepemilikan perusahaanmenjadi 73.85%.Sejak Maret 2010 AIRPL merupakan Anakperusahaan BSP (Catatan 1c,3c)<strong>PT</strong> <strong>Bakrie</strong> Sentosa PersadaPada tanggal 7 Desember 2009, GLP mentransferseluruh kepemilikannya dalam <strong>PT</strong> <strong>Bakrie</strong> SentosaPersada (“BSEP”) sebesar 13,16% atau senilaiRp107,19 milyar kepada <strong>PT</strong> Guntung Idamannusa(GIN), Anak perusahaan, sesuai dengan aktaInbreng No. 9 pada tanggal 9 Desember 2009.Penambahan modal dilakukan terhadap BSEPoleh IGI B.V. kepemilikan GLP terhadap BSEPterdilusi yang sebelumnya 21,5% menjadi 13,16%.Karena kepemilikan perusahaan terhadap BSEPhanya 13,16%, maka Perusahaan mencatatinvestasi di BSEP menggunakan metode biaya.GLP mencatat bagian dari saldo rugi BSEP senilaiRp1,22 milyar pada periode berjalan sampaidengan penambahan modal tersebut terjadi.9. INVESTMENTS IN ASSOCIATED COMPANIES(Continued)On March, 2010, the Company increase itsownership in Agri International Resources Pte.Ltd. Total ownership of the company currently is73.85%.Since March 2010, AIRPL has already been asubsidiary of BSP. (Catatan 1c,3c)<strong>PT</strong> <strong>Bakrie</strong> Sentosa PersadaOn December 7, 2009, GLP transferred all of itsownership in <strong>PT</strong> <strong>Bakrie</strong> Sentosa Persada(“BSEP”) of 13.16% or equivalent to Rp107.19billion to <strong>PT</strong> Guntung Idamannusa (GIN), aSubsidiary, as notarized by transfer Deed No. 9dated December 9, 2009.Additional equity injection was made into BSEPby IGI B.V. GLP’s ownership percentage wasdiluted from the previous 21.5% to 13.16%. Dueto the fact that the company only has 13.16%shares ownership in BSEP, GLP records itsinvestment in BSEP using the cost method. GLPrecorded equity in net loss of BSEP amountingto Rp1.22 billion for the period until such equityinjection was made.10. INVESTASI JANGKA PANJANG LAINNYA 10. OTHER LONG-TERM INVESTMENTSInvestasi jangka panjang lain terdiri daripenyertaan saham dan uang muka penyertaansaham pada perusahaan lainOther long-term investments consist ofinvestment in shares of stock and advances forinvestment in other companies.a. Mutasi investasi jangka panjang a. Changes of other long-term investments2010 2009Carrying value at beginningNilai tercatat awal tahun 255.301.711 25.860.407 of the yearPenambahan 8.570.469 128.907.748 AdditionPengurangan/reklasifikasi (8.019.116 ) - Deduction/reclassificationCarrying value at end ofNilai tercatat akhir tahun 255.853.064 154.768.155 the yearDikurangi penurunan nilaiLess decline in value ofpenyertaan saham (551.353 ) (551.353 ) investment in sharesBersih 255.301.711 154.216.802 Net58