PT BERAU COAL AND SUBSIDIARY - Bakrie & Brothers

PT BERAU COAL AND SUBSIDIARY - Bakrie & Brothers

PT BERAU COAL AND SUBSIDIARY - Bakrie & Brothers

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

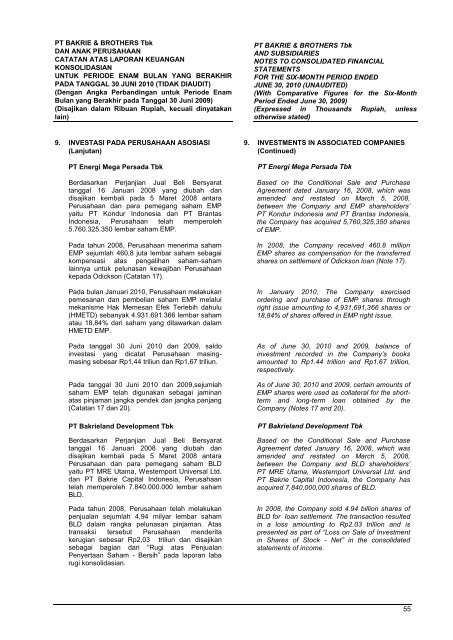

<strong>PT</strong> BAKRIE & BROTHERS TbkDAN ANAK PERUSAHAANCATATAN ATAS LAPORAN KEUANGANKONSOLIDASIANUNTUK PERIODE ENAM BULAN YANG BERAKHIRPADA TANGGAL 30 JUNI 2010 (TIDAK DIAUDIT)(Dengan Angka Perbandingan untuk Periode EnamBulan yang Berakhir pada Tanggal 30 Juni 2009)(Disajikan dalam Ribuan Rupiah, kecuali dinyatakanlain)<strong>PT</strong> BAKRIE & BROTHERS Tbk<strong>AND</strong> SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIALSTATEMENTSFOR THE SIX-MONTH PERIOD ENDEDJUNE 30, 2010 (UNAUDITED)(With Comparative Figures for the Six-MonthPeriod Ended June 30, 2009)(Expressed in Thousands Rupiah, unlessotherwise stated)9. INVESTASI PADA PERUSAHAAN ASOSIASI(Lanjutan)<strong>PT</strong> Energi Mega Persada TbkBerdasarkan Perjanjian Jual Beli Bersyarattanggal 16 Januari 2008 yang diubah dandisajikan kembali pada 5 Maret 2008 antaraPerusahaan dan para pemegang saham EMPyaitu <strong>PT</strong> Kondur Indonesia dan <strong>PT</strong> BrantasIndonesia, Perusahaan telah memperoleh5.760.325.350 lembar saham EMP.Pada tahun 2008, Perusahaan menerima sahamEMP sejumlah 460,8 juta lembar saham sebagaikompensasi atas pengalihan saham-sahamlainnya untuk pelunasan kewajiban Perusahaankepada Odickson (Catatan 17).Pada bulan Januari 2010, Perusahaan melakukanpemesanan dan pembelian saham EMP melaluimekanisme Hak Memesan Efek Terlebih dahulu(HMETD) sebanyak 4.931.691.366 lembar sahamatau 18,84% dari saham yang ditawarkan dalamHMETD EMP.Pada tanggal 30 Juni 2010 dan 2009, saldoinvestasi yang dicatat Perusahaan masingmasingsebesar Rp1,44 triliun dan Rp1,67 triliun.Pada tanggal 30 Juni 2010 dan 2009,sejumlahsaham EMP telah digunakan sebagai jaminanatas pinjaman jangka pendek dan jangka panjang(Catatan 17 dan 20).<strong>PT</strong> <strong>Bakrie</strong>land Development TbkBerdasarkan Perjanjian Jual Beli Bersyarattanggal 16 Januari 2008 yang diubah dandisajikan kembali pada 5 Maret 2008 antaraPerusahaan dan para pemegang saham BLDyaitu <strong>PT</strong> MRE Utama, Westernport Universal Ltd.dan <strong>PT</strong> <strong>Bakrie</strong> Capital Indonesia, Perusahaantelah memperoleh 7.840.000.000 lembar sahamBLD.Pada tahun 2008, Perusahaan telah melakukanpenjualan sejumlah 4,94 milyar lembar sahamBLD dalam rangka pelunasan pinjaman. Atastransaksi tersebut Perusahaan menderitakerugian sebesar Rp2,03 triliun dan disajikansebagai bagian dari “Rugi atas PenjualanPenyertaan Saham - Bersih” pada laporan labarugi konsolidasian.9. INVESTMENTS IN ASSOCIATED COMPANIES(Continued)<strong>PT</strong> Energi Mega Persada TbkBased on the Conditional Sale and PurchaseAgreement dated January 16, 2008, which wasamended and restated on March 5, 2008,between the Company and EMP shareholders’<strong>PT</strong> Kondur Indonesia and <strong>PT</strong> Brantas Indonesia,the Company has acquired 5,760,325,350 sharesof EMP.In 2008, the Company received 460.8 millionEMP shares as compensation for the transferredshares on settlement of Odickson loan (Note 17).In January 2010, The Company exercisedordering and purchase of EMP shares throughright issue amounting to 4,931,691,366 shares or18,84% of shares offered in EMP right issue.As of June 30, 2010 and 2009, balance ofinvestment recorded in the Company’s booksamounted to Rp1.44 trillion and Rp1.67 trillion,respectively.As of June 30, 2010 and 2009, certain amounts ofEMP shares were used as collateral for the shorttermand long-term loan obtained by theCompany (Notes 17 and 20).<strong>PT</strong> <strong>Bakrie</strong>land Development TbkBased on the Conditional Sale and PurchaseAgreement dated January 16, 2008, which wasamended and restated on March 5, 2008,between the Company and BLD shareholders’<strong>PT</strong> MRE Utama, Westernport Universal Ltd. and<strong>PT</strong> <strong>Bakrie</strong> Capital Indonesia, the Company hasacquired 7,840,000,000 shares of BLD.In 2008, the Company sold 4.94 billion shares ofBLD for loan settlement. The transaction resultedin a loss amounting to Rp2.03 trillion and ispresented as part of “Loss on Sale of Investmentin Shares of Stock - Net” in the consolidatedstatements of income.55