PT BERAU COAL AND SUBSIDIARY - Bakrie & Brothers

PT BERAU COAL AND SUBSIDIARY - Bakrie & Brothers

PT BERAU COAL AND SUBSIDIARY - Bakrie & Brothers

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

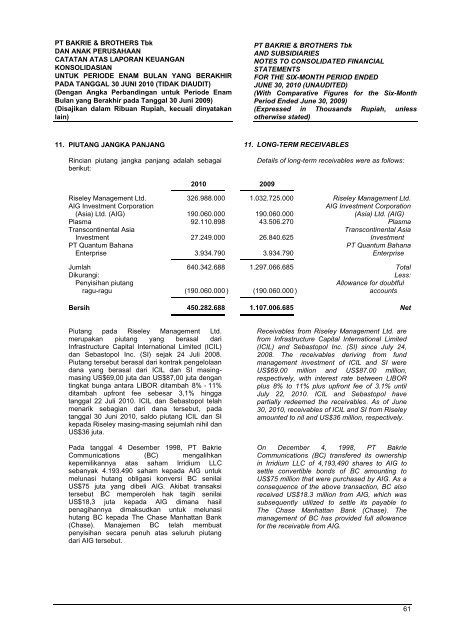

<strong>PT</strong> BAKRIE & BROTHERS TbkDAN ANAK PERUSAHAANCATATAN ATAS LAPORAN KEUANGANKONSOLIDASIANUNTUK PERIODE ENAM BULAN YANG BERAKHIRPADA TANGGAL 30 JUNI 2010 (TIDAK DIAUDIT)(Dengan Angka Perbandingan untuk Periode EnamBulan yang Berakhir pada Tanggal 30 Juni 2009)(Disajikan dalam Ribuan Rupiah, kecuali dinyatakanlain)<strong>PT</strong> BAKRIE & BROTHERS Tbk<strong>AND</strong> SUBSIDIARIESNOTES TO CONSOLIDATED FINANCIALSTATEMENTSFOR THE SIX-MONTH PERIOD ENDEDJUNE 30, 2010 (UNAUDITED)(With Comparative Figures for the Six-MonthPeriod Ended June 30, 2009)(Expressed in Thousands Rupiah, unlessotherwise stated)11. PIUTANG JANGKA PANJANG 11. LONG-TERM RECEIVABLESRincian piutang jangka panjang adalah sebagaiberikut:Details of long-term receivables were as follows:2010 2009Riseley Management Ltd. 326.988.000 1.032.725.000 Riseley Management Ltd.AIG Investment CorporationAIG Investment Corporation(Asia) Ltd. (AIG) 190.060.000 190.060.000 (Asia) Ltd. (AIG)Plasma 92.110.898 43.506.270 PlasmaTranscontinental AsiaTranscontinental AsiaInvestment 27.249.000 26.840.625 Investment<strong>PT</strong> Quantum Bahana<strong>PT</strong> Quantum BahanaEnterprise 3.934.790 3.934.790 EnterpriseJumlah 640.342.688 1.297.066.685 TotalDikurangi:Less:Penyisihan piutangAllowance for doubtfulragu-ragu (190.060.000 ) (190.060.000 ) accountsBersih 450.282.688 1.107.006.685 NetPiutang pada Riseley Management Ltd.merupakan piutang yang berasal dariInfrastructure Capital International Limited (ICIL)dan Sebastopol Inc. (SI) sejak 24 Juli 2008.Piutang tersebut berasal dari kontrak pengelolaandana yang berasal dari ICIL dan SI masingmasingUS$69,00 juta dan US$87,00 juta dengantingkat bunga antara LIBOR ditambah 8% - 11%ditambah upfront fee sebesar 3,1% hinggatanggal 22 Juli 2010. ICIL dan Sebastopol telahmenarik sebagian dari dana tersebut, padatanggal 30 Juni 2010, saldo piutang ICIL dan SIkepada Riseley masing-masing sejumlah nihil danUS$36 juta.Pada tanggal 4 Desember 1998, <strong>PT</strong> <strong>Bakrie</strong>Communications (BC) mengalihkankepemilikannya atas saham Irridium LLCsebanyak 4.193.490 saham kepada AIG untukmelunasi hutang obligasi konversi BC senilaiUS$75 juta yang dibeli AIG. Akibat transaksitersebut BC memperoleh hak tagih senilaiUS$18,3 juta kepada AIG dimana hasilpenagihannya dimaksudkan untuk melunasihutang BC kepada The Chase Manhattan Bank(Chase). Manajemen BC telah membuatpenyisihan secara penuh atas seluruh piutangdari AIG tersebut.Receivables from Riseley Management Ltd. arefrom Infrastructure Capital International Limited(ICIL) and Sebastopol Inc. (SI) since July 24,2008. The receivables deriving from fundmanagement investment of ICIL and SI wereUS$69.00 million and US$87.00 million,respectively, with interest rate between LIBORplus 8% to 11% plus upfront fee of 3.1% untilJuly 22, 2010. ICIL and Sebastopol havepartially redeemed the receivables. As of June30, 2010, receivables of ICIL and SI from Riseleyamounted to nil and US$36 million, respectively.On December 4, 1998, <strong>PT</strong> <strong>Bakrie</strong>Communications (BC) transfered its ownershipin Irridium LLC of 4,193,490 shares to AIG tosettle convertible bonds of BC amounting toUS$75 million that were purchased by AIG. As aconsequence of the above transaction, BC alsoreceived US$18.3 million from AIG, which wassubsequently utilized to settle its payable toThe Chase Manhattan Bank (Chase). Themanagement of BC has provided full allowancefor the receivable from AIG.61