tradicionalmenteinovador - Brazil Buyers & Sellers

tradicionalmenteinovador - Brazil Buyers & Sellers

tradicionalmenteinovador - Brazil Buyers & Sellers

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

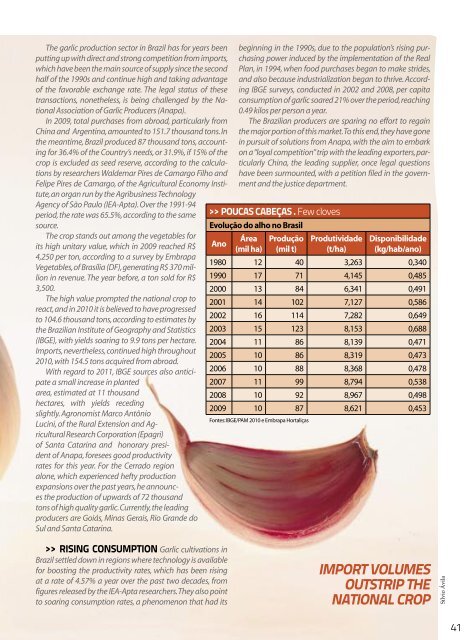

The garlic production sector in <strong>Brazil</strong> has for years been<br />

putting up with direct and strong competition from imports,<br />

which have been the main source of supply since the second<br />

half of the 1990s and continue high and taking advantage<br />

of the favorable exchange rate. The legal status of these<br />

transactions, nonetheless, is being challenged by the National<br />

Association of Garlic Producers (Anapa).<br />

In 2009, total purchases from abroad, particularly from<br />

China and Argentina, amounted to 151.7 thousand tons. In<br />

the meantime, <strong>Brazil</strong> produced 87 thousand tons, accounting<br />

for 36.4% of the Country’s needs, or 31.9%, if 15% of the<br />

crop is excluded as seed reserve, according to the calculations<br />

by researchers Waldemar Pires de Camargo Filho and<br />

Felipe Pires de Camargo, of the Agricultural Economy Institute,<br />

an organ run by the Agribusiness Technology<br />

Agency of São Paulo (IEA-Apta). Over the 1991-94<br />

period, the rate was 65.5%, according to the same<br />

source.<br />

The crop stands out among the vegetables for<br />

its high unitary value, which in 2009 reached R$ Ano<br />

4,250 per ton, according to a survey by Embrapa<br />

Vegetables, of Brasília (DF), generating R$ 370 million<br />

in revenue. The year before, a ton sold for R$<br />

3,500.<br />

The high value prompted the national crop to<br />

react, and in 2010 it is believed to have progressed<br />

to 104.6 thousand tons, according to estimates by<br />

the <strong>Brazil</strong>ian Institute of Geography and Statistics<br />

(IBGE), with yields soaring to 9.9 tons per hectare.<br />

Imports, nevertheless, continued high throughout<br />

2010, with 154.5 tons acquired from abroad.<br />

With regard to 2011, IBGE sources also anticipate<br />

a small increase in planted<br />

area, estimated at 11 thousand<br />

hectares, with yields receding<br />

slightly. Agronomist Marco Antônio<br />

Lucini, of the Rural Extension and Agricultural<br />

Research Corporation (Epagri)<br />

of Santa Catarina and honorary president<br />

of Anapa, foresees good productivity<br />

rates for this year. For the Cerrado region<br />

alone, which experienced hefty production<br />

expansions over the past years, he announces<br />

the production of upwards of 72 thousand<br />

tons of high quality garlic. Currently, the leading<br />

producers are Goiás, Minas Gerais, Rio Grande do<br />

Sul and Santa Catarina.<br />

beginning in the 1990s, due to the population’s rising purchasing<br />

power induced by the implementation of the Real<br />

Plan, in 1994, when food purchases began to make strides,<br />

and also because industrialization began to thrive. According<br />

IBGE surveys, conducted in 2002 and 2008, per capita<br />

consumption of garlic soared 21% over the period, reaching<br />

0.49 kilos per person a year.<br />

The <strong>Brazil</strong>ian producers are sparing no effort to regain<br />

the major portion of this market. To this end, they have gone<br />

in pursuit of solutions from Anapa, with the aim to embark<br />

on a “loyal competition” trip with the leading exporters, particularly<br />

China, the leading supplier, once legal questions<br />

have been surmounted, with a petition filed in the government<br />

and the justice department.<br />

>> POUCAS CABEÇAS . Few cloves<br />

Evolução do alho no Brasil<br />

Área<br />

(mil ha)<br />

Produção<br />

(mil t)<br />

Produtividade<br />

(t/ha)<br />

Disponibilidade<br />

(kg/hab/ano)<br />

1980 12 40 3,263 0,340<br />

1990 17 71 4,145 0,485<br />

2000 13 84 6,341 0,491<br />

2001 14 102 7,127 0,586<br />

2002 16 114 7,282 0,649<br />

2003 15 123 8,153 0,688<br />

2004 11 86 8,139 0,471<br />

2005 10 86 8,319 0,473<br />

2006 10 88 8,368 0,478<br />

2007 11 99 8,794 0,538<br />

2008 10 92 8,967 0,498<br />

2009 10 87 8,621 0,453<br />

Fontes: IBGE/PAM 2010 e Embrapa Hortaliças<br />

>> RISING CONSUMPTION Garlic cultivations in<br />

<strong>Brazil</strong> settled down in regions where technology is available<br />

for boosting the productivity rates, which has been rising<br />

at a rate of 4.57% a year over the past two decades, from<br />

figures released by the IEA-Apta researchers. They also point<br />

to soaring consumption rates, a phenomenon that had its<br />

IMPORT VOLUMES<br />

OUTSTRIP THE<br />

NATIONAL CROP<br />

Sílvio Ávila<br />

41