tradicionalmenteinovador - Brazil Buyers & Sellers

tradicionalmenteinovador - Brazil Buyers & Sellers

tradicionalmenteinovador - Brazil Buyers & Sellers

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

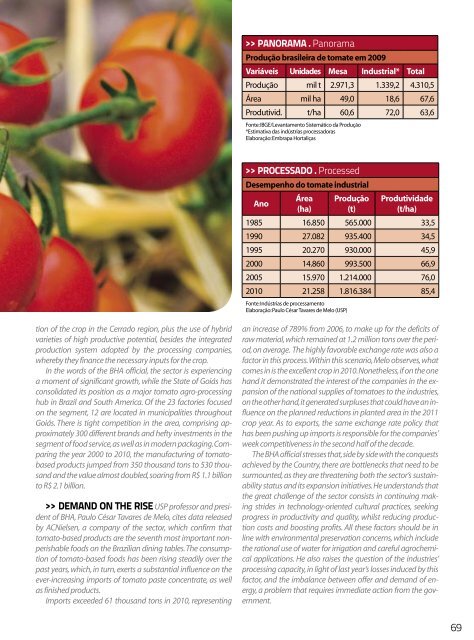

PANORAMA . Panorama<br />

Produção brasileira de tomate em 2009<br />

Variáveis Unidades Mesa Industrial* Total<br />

Produção mil t 2.971,3 1.339,2 4.310,5<br />

Área mil ha 49,0 18,6 67,6<br />

Produtivid. t/ha 60,6 72,0 63,6<br />

Fonte: IBGE/Levantamento Sistemático da Produção<br />

*Estimativa das indústrias processadoras<br />

Elaboração: Embrapa Hortaliças<br />

>> PROCESSADO . Processed<br />

Desempenho do tomate industrial<br />

Ano<br />

Área<br />

(ha)<br />

Produção<br />

(t)<br />

Produtividade<br />

(t/ha)<br />

1985 16.850 565.000 33,5<br />

1990 27.082 935.400 34,5<br />

1995 20.270 930.000 45,9<br />

2000 14.860 993.500 66,9<br />

2005 15.970 1.214.000 76,0<br />

2010 21.258 1.816.384 85,4<br />

Fonte: Indústrias de processamento<br />

Elaboração: Paulo César Tavares de Melo (USP)<br />

tion of the crop in the Cerrado region, plus the use of hybrid<br />

varieties of high productive potential, besides the integrated<br />

production system adopted by the processing companies,<br />

whereby they finance the necessary inputs for the crop.<br />

In the words of the BHA official, the sector is experiencing<br />

a moment of significant growth, while the State of Goiás has<br />

consolidated its position as a major tomato agro-processing<br />

hub in <strong>Brazil</strong> and South America. Of the 23 factories focused<br />

on the segment, 12 are located in municipalities throughout<br />

Goiás. There is tight competition in the area, comprising approximately<br />

300 different brands and hefty investments in the<br />

segment of food service, as well as in modern packaging. Comparing<br />

the year 2000 to 2010, the manufacturing of tomatobased<br />

products jumped from 350 thousand tons to 530 thousand<br />

and the value almost doubled, soaring from R$ 1.1 billion<br />

to R$ 2.1 billion.<br />

>> DEMAND ON THE RISE USP professor and president<br />

of BHA, Paulo César Tavares de Melo, cites data released<br />

by ACNielsen, a company of the sector, which confirm that<br />

tomato-based products are the seventh most important nonperishable<br />

foods on the <strong>Brazil</strong>ian dining tables. The consumption<br />

of tomato-based foods has been rising steadily over the<br />

past years, which, in turn, exerts a substantial influence on the<br />

ever-increasing imports of tomato paste concentrate, as well<br />

as finished products.<br />

Imports exceeded 61 thousand tons in 2010, representing<br />

an increase of 789% from 2006, to make up for the deficits of<br />

raw material, which remained at 1.2 million tons over the period,<br />

on average. The highly favorable exchange rate was also a<br />

factor in this process. Within this scenario, Melo observes, what<br />

comes in is the excellent crop in 2010. Nonetheless, if on the one<br />

hand it demonstrated the interest of the companies in the expansion<br />

of the national supplies of tomatoes to the industries,<br />

on the other hand, it generated surpluses that could have an influence<br />

on the planned reductions in planted area in the 2011<br />

crop year. As to exports, the same exchange rate policy that<br />

has been pushing up imports is responsible for the companies’<br />

week competitiveness in the second half of the decade.<br />

The BHA official stresses that, side by side with the conquests<br />

achieved by the Country, there are bottlenecks that need to be<br />

surmounted, as they are threatening both the sector’s sustainability<br />

status and its expansion initiatives. He understands that<br />

the great challenge of the sector consists in continuing making<br />

strides in technology-oriented cultural practices, seeking<br />

progress in productivity and quality, whilst reducing production<br />

costs and boosting profits. All these factors should be in<br />

line with environmental preservation concerns, which include<br />

the rational use of water for irrigation and careful agrochemical<br />

applications. He also raises the question of the industries’<br />

processing capacity, in light of last year’s losses induced by this<br />

factor, and the imbalance between offer and demand of energy,<br />

a problem that requires immediate action from the government.<br />

69