CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

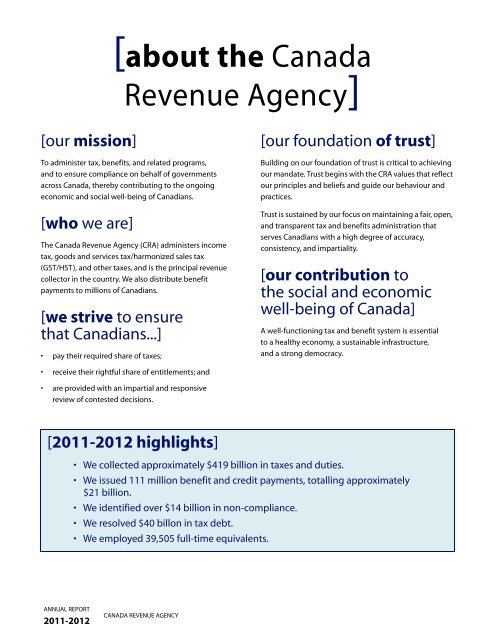

[our mission]<br />

ANNUAL REPORT<br />

<strong>2011</strong>-<strong>2012</strong><br />

[about the Canada<br />

Revenue Agency]<br />

To administer tax, benefits, and related programs,<br />

and <strong>to</strong> ensure compliance on behalf of governments<br />

across Canada, thereby contributing <strong>to</strong> the ongoing<br />

economic and social well-being of Canadians.<br />

[who we are]<br />

The Canada Revenue Agency (<strong>CRA</strong>) administers income<br />

tax, goods and services tax/harmonized sales tax<br />

(GST/HST), and other taxes, and is the principal revenue<br />

collec<strong>to</strong>r in the country. We also distribute benefit<br />

payments <strong>to</strong> millions of Canadians.<br />

[we strive <strong>to</strong> ensure<br />

that Canadians...]<br />

pay their required share of taxes;<br />

receive their rightful share of entitlements; and<br />

are provided with an impartial and responsive<br />

review of contested decisions.<br />

[<strong>2011</strong>-<strong>2012</strong> highlights]<br />

CANADA REVENUE AGENCY<br />

[our foundation of trust]<br />

Building on our foundation of trust is critical <strong>to</strong> achieving<br />

our mandate. Trust begins with the <strong>CRA</strong> values that reflect<br />

our principles and beliefs and guide our behaviour and<br />

practices.<br />

Trust is sustained by our focus on maintaining a fair, open,<br />

and transparent tax and benefits administration that<br />

serves Canadians with a high degree of accuracy,<br />

consistency, and impartiality.<br />

[our contribution <strong>to</strong><br />

the social and economic<br />

well-being of Canada]<br />

A well-functioning tax and benefit system is essential<br />

<strong>to</strong> a healthy economy, a sustainable infrastructure,<br />

and a strong democracy.<br />

We collected approximately $419 billion in taxes and <strong>du</strong>ties.<br />

We issued 111 million benefit and credit payments, <strong>to</strong>talling approximately<br />

$21 billion.<br />

We identified over $14 billion in non-compliance.<br />

We resolved $40 billon in tax debt.<br />

We employed 39,505 full-time equivalents.