CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

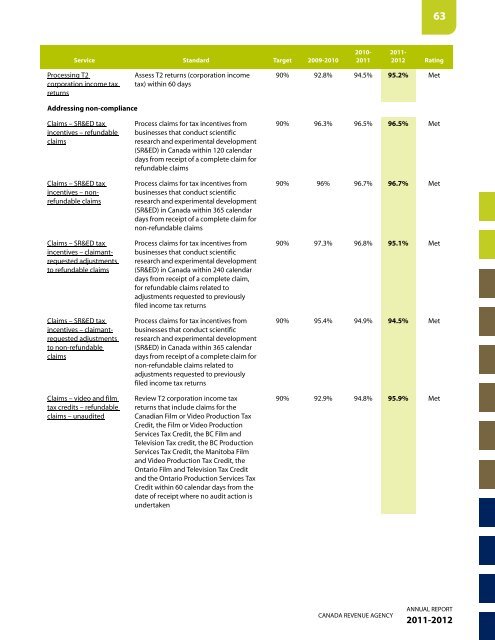

Service Standard Target 2009-2010<br />

Processing T2<br />

corporation income tax<br />

returns<br />

Addressing non-compliance<br />

Claims – SR&ED tax<br />

incentives – refundable<br />

claims<br />

Claims – SR&ED tax<br />

incentives – nonrefundable<br />

claims<br />

Claims – SR&ED tax<br />

incentives – claimantrequested<br />

adjustments<br />

<strong>to</strong> refundable claims<br />

Claims – SR&ED tax<br />

incentives – claimantrequested<br />

adjustments<br />

<strong>to</strong> non-refundable<br />

claims<br />

Claims – video and film<br />

tax credits – refundable<br />

claims – unaudited<br />

Assess T2 returns (corporation income<br />

tax) within 60 days<br />

Process claims for tax incentives from<br />

businesses that con<strong>du</strong>ct scientific<br />

research and experimental development<br />

(SR&ED) in Canada within 120 calendar<br />

days from receipt of a complete claim for<br />

refundable claims<br />

Process claims for tax incentives from<br />

businesses that con<strong>du</strong>ct scientific<br />

research and experimental development<br />

(SR&ED) in Canada within 365 calendar<br />

days from receipt of a complete claim for<br />

non-refundable claims<br />

Process claims for tax incentives from<br />

businesses that con<strong>du</strong>ct scientific<br />

research and experimental development<br />

(SR&ED) in Canada within 240 calendar<br />

days from receipt of a complete claim,<br />

for refundable claims related <strong>to</strong><br />

adjustments requested <strong>to</strong> previously<br />

filed income tax returns<br />

Process claims for tax incentives from<br />

businesses that con<strong>du</strong>ct scientific<br />

research and experimental development<br />

(SR&ED) in Canada within 365 calendar<br />

days from receipt of a complete claim for<br />

non-refundable claims related <strong>to</strong><br />

adjustments requested <strong>to</strong> previously<br />

filed income tax returns<br />

Review T2 corporation income tax<br />

returns that include claims for the<br />

Canadian Film or Video Pro<strong>du</strong>ction Tax<br />

Credit, the Film or Video Pro<strong>du</strong>ction<br />

Services Tax Credit, the BC Film and<br />

Television Tax credit, the BC Pro<strong>du</strong>ction<br />

Services Tax Credit, the Mani<strong>to</strong>ba Film<br />

and Video Pro<strong>du</strong>ction Tax Credit, the<br />

Ontario Film and Television Tax Credit<br />

and the Ontario Pro<strong>du</strong>ction Services Tax<br />

Credit within 60 calendar days from the<br />

date of receipt where no audit action is<br />

undertaken<br />

2010-<br />

<strong>2011</strong><br />

90% 92.8% 94.5% 95.2% Met<br />

90% 96.3% 96.5% 96.5% Met<br />

90% 96% 96.7% 96.7% Met<br />

90% 97.3% 96.8% 95.1% Met<br />

90% 95.4% 94.9% 94.5% Met<br />

90% 92.9% 94.8% 95.9% Met<br />

CANADA REVENUE AGENCY<br />

63<br />

<strong>2011</strong>-<br />

<strong>2012</strong> Rating<br />

ANNUAL REPORT<br />

<strong>2011</strong>-<strong>2012</strong>