CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Discussion and analysis<br />

Analysis of net cost of operations<br />

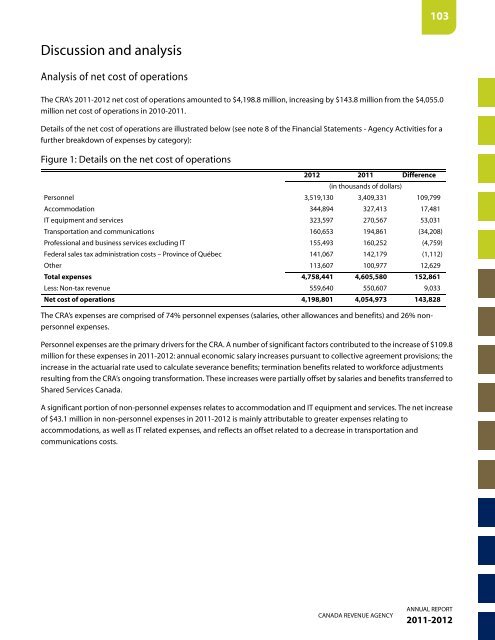

The <strong>CRA</strong>’s <strong>2011</strong>-<strong>2012</strong> net cost of operations amounted <strong>to</strong> $4,198.8 million, increasing by $143.8 million from the $4,055.0<br />

million net cost of operations in 2010-<strong>2011</strong>.<br />

Details of the net cost of operations are illustrated below (see note 8 of the Financial Statements - Agency Activities for a<br />

further breakdown of expenses by category):<br />

Figure 1: Details on the net cost of operations<br />

<strong>2012</strong> <strong>2011</strong><br />

(in thousands of dollars)<br />

Difference<br />

Personnel 3,519,130 3,409,331 109,799<br />

Accommodation 344,894 327,413 17,481<br />

IT equipment and services 323,597 270,567 53,031<br />

Transportation and communications 160,653 194,861 (34,208)<br />

Professional and business services excluding IT 155,493 160,252 (4,759)<br />

Federal sales tax administration costs – Province of Québec 141,067 142,179 (1,112)<br />

Other 113,607 100,977 12,629<br />

Total expenses 4,758,441 4,605,580 152,861<br />

Less: Non-tax revenue 559,640 550,607 9,033<br />

Net cost of operations 4,198,801 4,054,973 143,828<br />

The <strong>CRA</strong>’s expenses are comprised of 74% personnel expenses (salaries, other allowances and benefits) and 26% nonpersonnel<br />

expenses.<br />

Personnel expenses are the primary drivers for the <strong>CRA</strong>. A number of significant fac<strong>to</strong>rs contributed <strong>to</strong> the increase of $109.8<br />

million for these expenses in <strong>2011</strong>-<strong>2012</strong>: annual economic salary increases pursuant <strong>to</strong> collective agreement provisions; the<br />

increase in the actuarial rate used <strong>to</strong> calculate severance benefits; termination benefits related <strong>to</strong> workforce adjustments<br />

resulting from the <strong>CRA</strong>’s ongoing transformation. These increases were partially offset by salaries and benefits transferred <strong>to</strong><br />

Shared Services Canada.<br />

A significant portion of non-personnel expenses relates <strong>to</strong> accommodation and IT equipment and services. The net increase<br />

of $43.1 million in non-personnel expenses in <strong>2011</strong>-<strong>2012</strong> is mainly attributable <strong>to</strong> greater expenses relating <strong>to</strong><br />

accommodations, as well as IT related expenses, and reflects an offset related <strong>to</strong> a decrease in transportation and<br />

communications costs.<br />

CANADA REVENUE AGENCY<br />

103<br />

ANNUAL REPORT<br />

<strong>2011</strong>-<strong>2012</strong>