CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

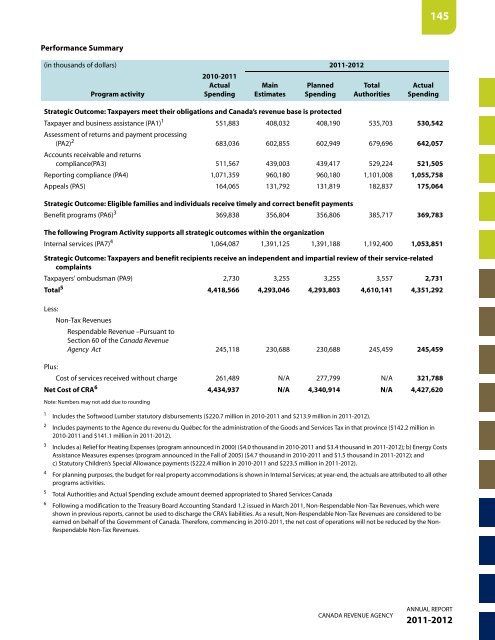

Performance Summary<br />

(in thousands of dollars) <strong>2011</strong>-<strong>2012</strong><br />

Program activity<br />

2010-<strong>2011</strong><br />

Actual<br />

Spending<br />

Main<br />

Estimates<br />

Planned<br />

Spending<br />

Total<br />

Authorities<br />

CANADA REVENUE AGENCY<br />

145<br />

Actual<br />

Spending<br />

Strategic Outcome: Taxpayers meet their obligations and Canada’s revenue base is protected<br />

Taxpayer and business assistance (PA1) 1<br />

551,883 408,032 408,190 535,703 530,542<br />

Assessment of returns and payment processing<br />

(PA2) 2<br />

Accounts receivable and returns<br />

683,036 602,855 602,949 679,696 642,057<br />

compliance(PA3) 511,567 439,003 439,417 529,224 521,505<br />

<strong>Report</strong>ing compliance (PA4) 1,071,359 960,180 960,180 1,101,008 1,055,758<br />

Appeals (PA5) 164,065 131,792 131,819 182,837 175,064<br />

Strategic Outcome: Eligible families and indivi<strong>du</strong>als receive timely and correct benefit payments<br />

Benefit programs (PA6) 3<br />

369,838 356,804 356,806 385,717 369,783<br />

The following Program Activity supports all strategic outcomes within the organization<br />

Internal services (PA7) 4<br />

1,064,087 1,391,125 1,391,188 1,192,400 1,053,851<br />

Strategic Outcome: Taxpayers and benefit recipients receive an independent and impartial review of their service-related<br />

complaints<br />

Taxpayers’ ombudsman (PA9) 2,730 3,255 3,255 3,557 2,731<br />

Total 5<br />

4,418,566 4,293,046 4,293,803 4,610,141 4,351,292<br />

Less:<br />

Non-Tax Revenues<br />

Respendable Revenue –Pursuant <strong>to</strong><br />

Section 60 of the Canada Revenue<br />

Agency Act 245,118 230,688 230,688 245,459 245,459<br />

Plus:<br />

Cost of services received without charge 261,489 N/A 277,799 N/A 321,788<br />

Net Cost of <strong>CRA</strong>6 4,434,937 N/A 4,340,914 N/A 4,427,620<br />

Note: Numbers may not add <strong>du</strong>e <strong>to</strong> rounding<br />

1<br />

Includes the Softwood Lumber statu<strong>to</strong>ry disbursements ($220.7 million in 2010-<strong>2011</strong> and $213.9 million in <strong>2011</strong>-<strong>2012</strong>).<br />

2 Includes payments <strong>to</strong> the <strong>Agence</strong> <strong>du</strong> revenu <strong>du</strong> Québec for the administration of the Goods and Services Tax in that province ($142.2 million in<br />

2010-<strong>2011</strong> and $141.1 million in <strong>2011</strong>-<strong>2012</strong>).<br />

3 Includes a) Relief for Heating Expenses (program announced in 2000) ($4.0 thousand in 2010-<strong>2011</strong> and $3.4 thousand in <strong>2011</strong>-<strong>2012</strong>); b) Energy Costs<br />

Assistance Measures expenses (program announced in the Fall of 2005) ($4.7 thousand in 2010-<strong>2011</strong> and $1.5 thousand in <strong>2011</strong>-<strong>2012</strong>); and<br />

c) Statu<strong>to</strong>ry Children’s Special Allowance payments ($222.4 million in 2010-<strong>2011</strong> and $223.5 million in <strong>2011</strong>-<strong>2012</strong>).<br />

4 For planning purposes, the budget for real property accommodations is shown in Internal Services; at year-end, the actuals are attributed <strong>to</strong> all other<br />

programs activities.<br />

5<br />

Total Authorities and Actual Spending exclude amount deemed appropriated <strong>to</strong> Shared Services Canada<br />

6 Following a modification <strong>to</strong> the Treasury Board Accounting Standard 1.2 issued in March <strong>2011</strong>, Non-Respendable Non-Tax Revenues, which were<br />

shown in previous reports, cannot be used <strong>to</strong> discharge the <strong>CRA</strong>’s liabilities. As a result, Non-Respendable Non-Tax Revenues are considered <strong>to</strong> be<br />

earned on behalf of the Government of Canada. Therefore, commencing in 2010-<strong>2011</strong>, the net cost of operations will not be re<strong>du</strong>ced by the Non-<br />

Respendable Non-Tax Revenues.<br />

ANNUAL REPORT<br />

<strong>2011</strong>-<strong>2012</strong>