CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

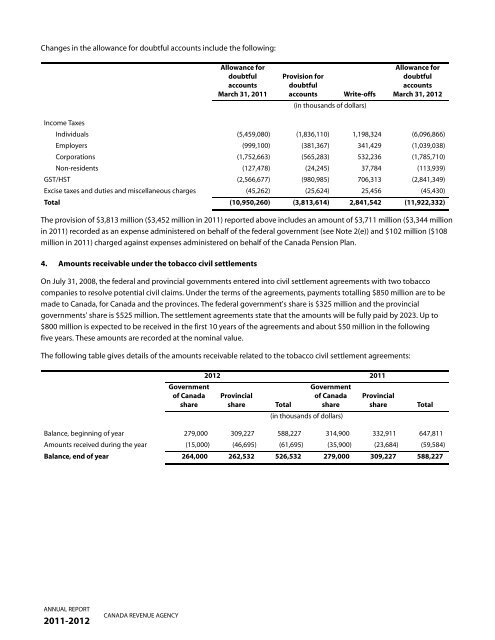

Changes in the allowance for doubtful accounts include the following:<br />

The provision of $3,813 million ($3,452 million in <strong>2011</strong>) reported above includes an amount of $3,711 million ($3,344 million<br />

in <strong>2011</strong>) recorded as an expense administered on behalf of the federal government (see Note 2(e)) and $102 million ($108<br />

million in <strong>2011</strong>) charged against expenses administered on behalf of the Canada Pension Plan.<br />

4. Amounts receivable under the <strong>to</strong>bacco civil settlements<br />

On July 31, 2008, the federal and provincial governments entered in<strong>to</strong> civil settlement agreements with two <strong>to</strong>bacco<br />

companies <strong>to</strong> resolve potential civil claims. Under the terms of the agreements, payments <strong>to</strong>talling $850 million are <strong>to</strong> be<br />

made <strong>to</strong> Canada, for Canada and the provinces. The federal government's share is $325 million and the provincial<br />

governments’ share is $525 million. The settlement agreements state that the amounts will be fully paid by 2023. Up <strong>to</strong><br />

$800 million is expected <strong>to</strong> be received in the first 10 years of the agreements and about $50 million in the following<br />

five years. These amounts are recorded at the nominal value.<br />

The following table gives details of the amounts receivable related <strong>to</strong> the <strong>to</strong>bacco civil settlement agreements:<br />

ANNUAL REPORT<br />

<strong>2011</strong>-<strong>2012</strong><br />

CANADA REVENUE AGENCY<br />

Allowance for<br />

doubtful<br />

accounts<br />

March 31, <strong>2011</strong><br />

Provision for<br />

doubtful<br />

accounts Write-offs<br />

(in thousands of dollars)<br />

Allowance for<br />

doubtful<br />

accounts<br />

March 31, <strong>2012</strong><br />

Income Taxes<br />

Indivi<strong>du</strong>als (5,459,080) (1,836,110) 1,198,324 (6,096,866)<br />

Employers (999,100) (381,367) 341,429 (1,039,038)<br />

Corporations (1,752,663) (565,283) 532,236 (1,785,710)<br />

Non-residents (127,478) (24,245) 37,784 (113,939)<br />

GST/HST (2,566,677) (980,985) 706,313 (2,841,349)<br />

Excise taxes and <strong>du</strong>ties and miscellaneous charges (45,262) (25,624) 25,456 (45,430)<br />

Total (10,950,260) (3,813,614) 2,841,542 (11,922,332)<br />

Government<br />

of Canada<br />

share<br />

<strong>2012</strong> <strong>2011</strong><br />

Provincial<br />

share Total<br />

Government<br />

of Canada<br />

share<br />

(in thousands of dollars)<br />

Provincial<br />

share Total<br />

Balance, beginning of year 279,000 309,227 588,227 314,900 332,911 647,811<br />

Amounts received <strong>du</strong>ring the year (15,000) (46,695) (61,695) (35,900) (23,684) (59,584)<br />

Balance, end of year 264,000 262,532 526,532 279,000 309,227 588,227