CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

CRA Annual Report to Parliament 2011-2012 (PDF - Agence du ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>to</strong> 2.3% of Gross Domestic Pro<strong>du</strong>ct in 2009, which was<br />

down from 2.9% in 1992.<br />

This type of non-compliance is complex, so it is important<br />

for revenue administrations <strong>to</strong> share details about<br />

different approaches and experiences, successful or not, in<br />

dealing with these issues. The <strong>CRA</strong> continues <strong>to</strong> work with<br />

Canadian and international partners through research,<br />

information-sharing, communication, e<strong>du</strong>cation, and<br />

compliance activities <strong>to</strong> re<strong>du</strong>ce participation in the<br />

underground economy.<br />

The <strong>CRA</strong> led the task group that pro<strong>du</strong>ced the ‘Re<strong>du</strong>cing<br />

opportunities for tax non-compliance in the underground<br />

economy’ report for the OECD Forum on Tax<br />

Administration. The report was prepared <strong>to</strong> help revenue<br />

administrations advance their thinking and practices<br />

about identifying and handling risks related <strong>to</strong> the<br />

underground economy and electronic payment systems,<br />

and <strong>to</strong> promote discussion and knowledge-sharing on<br />

these important issues.<br />

In <strong>2011</strong>-<strong>2012</strong>, we<br />

audited 10,627<br />

underground<br />

economy files.<br />

80% of the files<br />

audited resulted in<br />

a tax assessment.<br />

These audits<br />

identified<br />

$513 million of<br />

unreported income<br />

with an associated<br />

fiscal impact of $260 million.<br />

[enforcement]<br />

The Enforcement program undertakes audits and criminal<br />

investigations of those suspected of deriving income from<br />

criminal activities and of those who evade taxes.<br />

5 For more information about Statistics Canada's report,<br />

Estimating the Underground Economy in Canada, 1992-2009,<br />

go <strong>to</strong> www.statcan.gc.ca/dai-quo/index-eng.htm.<br />

ANNUAL REPORT<br />

<strong>2011</strong>-<strong>2012</strong><br />

CANADA REVENUE AGENCY<br />

The <strong>CRA</strong> addresses these cases of deliberate fraud and in<br />

some instances refers cases <strong>to</strong> the Public Prosecution<br />

Service of Canada. Taxpayers may face penalties, court<br />

fines, and up <strong>to</strong> five years in prison.<br />

In <strong>2011</strong>-<strong>2012</strong>, the program con<strong>du</strong>cted 819 enforcement<br />

audits that resulted in finding $67.4 million of additional<br />

taxes owing. A <strong>to</strong>tal of 137 taxpayers were convicted of tax<br />

evasion or fraud, and 24 indivi<strong>du</strong>als received prison<br />

sentences.<br />

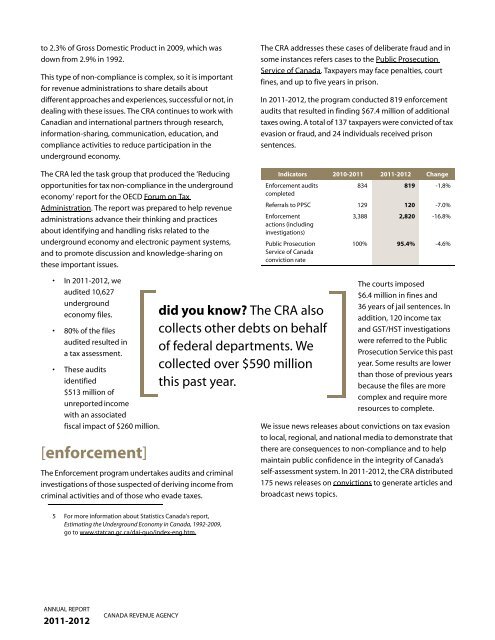

Indica<strong>to</strong>rs 2010-<strong>2011</strong> <strong>2011</strong>-<strong>2012</strong> Change<br />

Enforcement audits<br />

completed<br />

834 819 -1.8%<br />

Referrals <strong>to</strong> PPSC 129 120 -7.0%<br />

Enforcement<br />

actions (including<br />

investigations)<br />

3,388 2,820 -16.8%<br />

Public Prosecution<br />

Service of Canada<br />

conviction rate<br />

did you know? The <strong>CRA</strong> also<br />

collects other debts on behalf<br />

of federal departments. We<br />

collected over $590 million<br />

this past year.<br />

100% 95.4% -4.6%<br />

The courts imposed<br />

$6.4 million in fines and<br />

36 years of jail sentences. In<br />

addition, 120 income tax<br />

and GST/HST investigations<br />

were referred <strong>to</strong> the Public<br />

Prosecution Service this past<br />

year. Some results are lower<br />

than those of previous years<br />

because the files are more<br />

complex and require more<br />

resources <strong>to</strong> complete.<br />

We issue news releases about convictions on tax evasion<br />

<strong>to</strong> local, regional, and national media <strong>to</strong> demonstrate that<br />

there are consequences <strong>to</strong> non-compliance and <strong>to</strong> help<br />

maintain public confidence in the integrity of Canada’s<br />

self-assessment system. In <strong>2011</strong>-<strong>2012</strong>, the <strong>CRA</strong> distributed<br />

175 news releases on convictions <strong>to</strong> generate articles and<br />

broadcast news <strong>to</strong>pics.